On May 16, 2025, CANTOR FITZGERALD, L. P. (Trades, Portfolio), a prominent investment firm, executed a significant transaction involving Newmark Group Inc (NMRK, Financial). The firm acquired 43,137,846 shares of Newmark Group Inc at a price of $11.58 per share, marking a new holding in its portfolio. This acquisition represents a strategic move by the firm, reflecting its confidence in the potential growth and value creation of Newmark Group Inc.

About CANTOR FITZGERALD, L. P. (Trades, Portfolio)

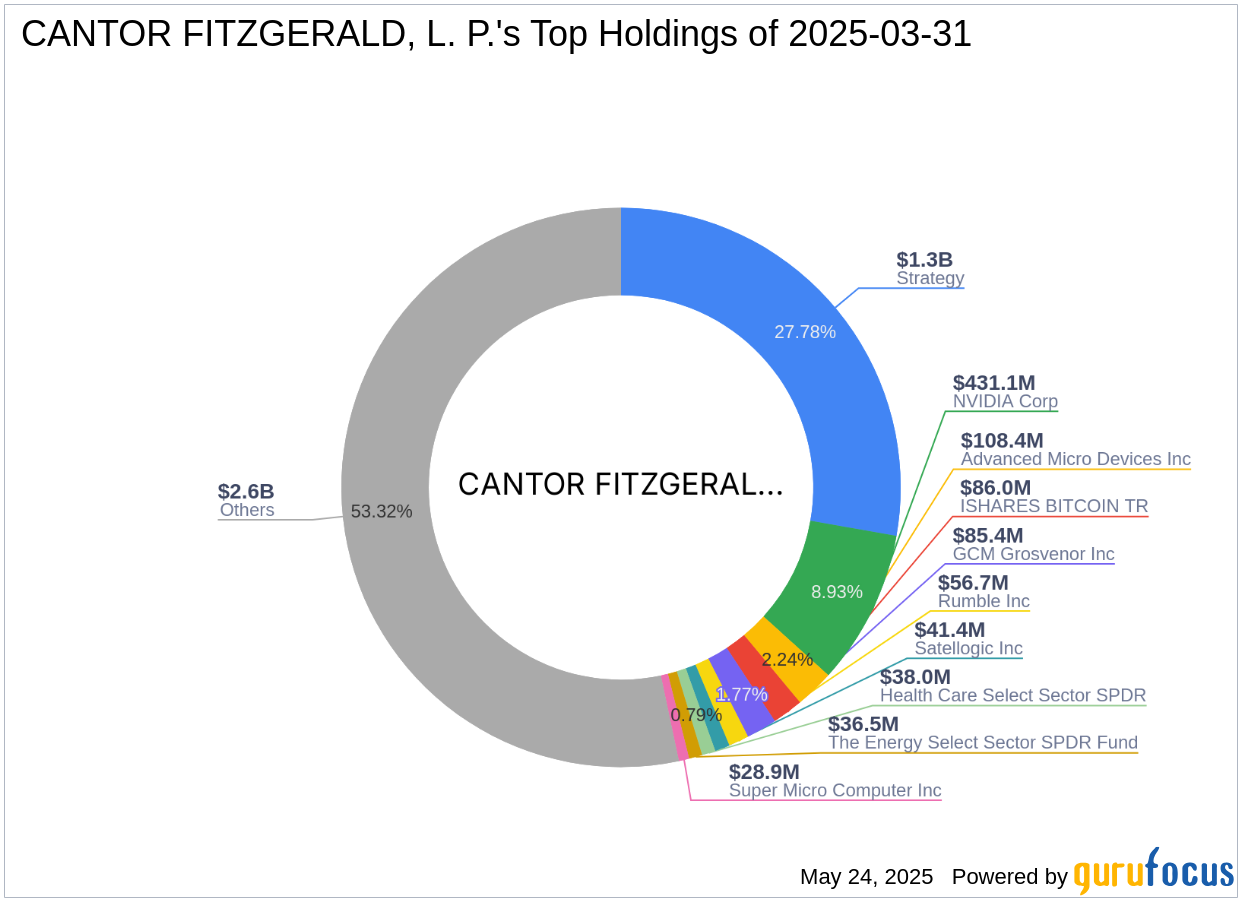

CANTOR FITZGERALD, L. P. (Trades, Portfolio) is headquartered at 110 East 59th Street, New York, NY 10022, and is renowned for its strategic investments in the technology and financial services sectors. The firm manages an equity portfolio valued at $4.83 billion, with top holdings in companies such as Advanced Micro Devices Inc (AMD, Financial) and NVIDIA Corp (NVDA, Financial). This diverse portfolio underscores the firm's commitment to investing in high-growth sectors and companies with robust market potential.

Overview of Newmark Group Inc

Newmark Group Inc is a commercial real estate advisory firm that offers a wide range of services, including leasing, corporate advisory, and investment sales. The company, which went public on December 15, 2017, has a market capitalization of $1.82 billion and is currently trading at $10.48 per share. Newmark Group Inc provides a diverse array of integrated services and products designed to meet the full needs of both real estate investors/owners and occupiers, making it a significant player in the real estate industry.

Financial Metrics and Valuation of Newmark Group Inc

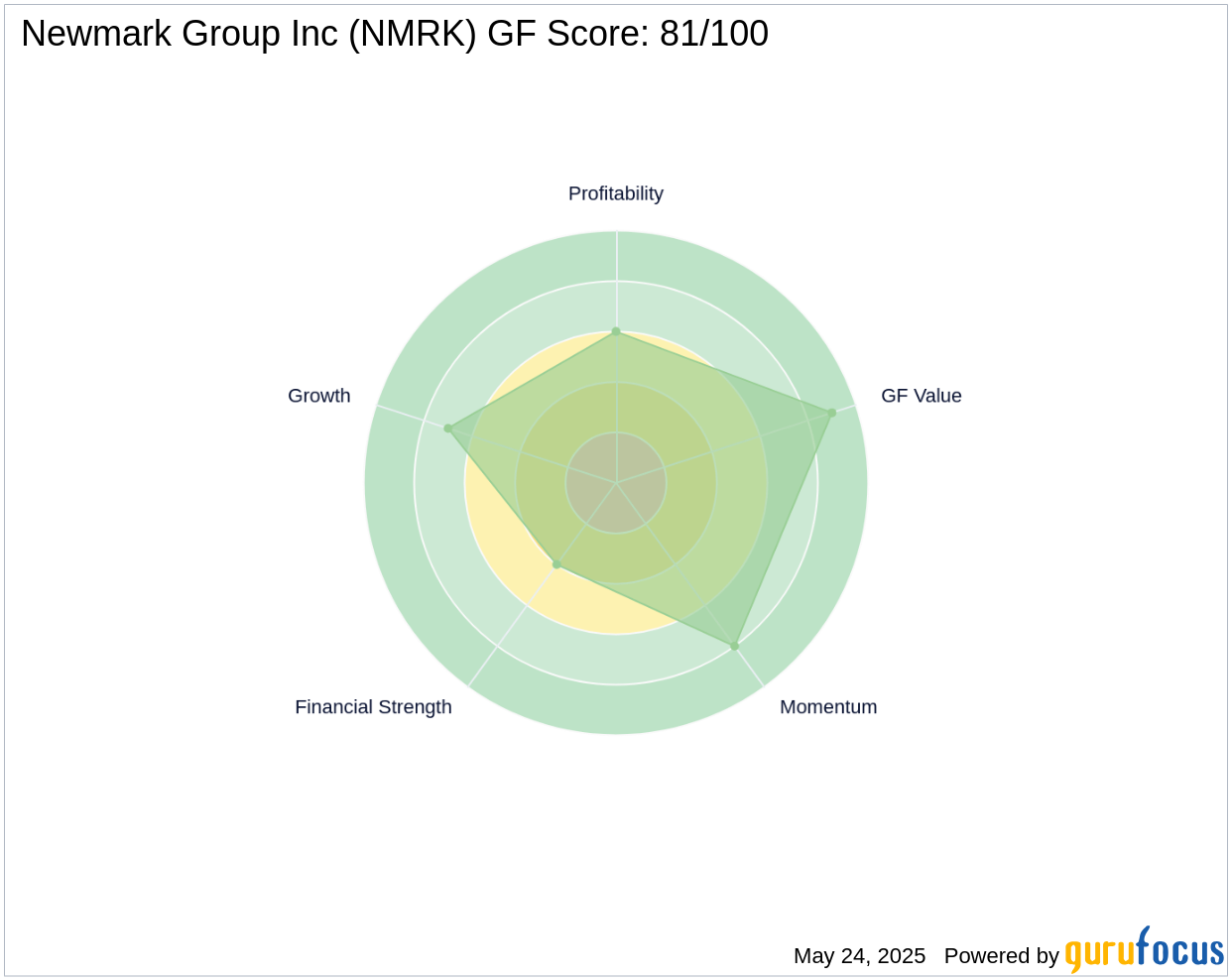

Newmark Group Inc is considered fairly valued with a GF Value of $11.48, and a Price to GF Value ratio of 0.91. The company has a PE ratio of 26.87 and a GF Score of 81/100, indicating good outperformance potential. These metrics suggest that Newmark Group Inc is positioned well for future growth, despite current market challenges.

Impact of the Transaction on CANTOR FITZGERALD's Portfolio

The acquisition of Newmark Group Inc shares represents 9.37% of CANTOR FITZGERALD's portfolio, with the firm holding 22.40% of its total shares in the company. This strategic move reflects the firm's confidence in Newmark Group Inc's potential for growth and value creation. By investing in Newmark Group Inc, CANTOR FITZGERALD is aligning its portfolio with a company that has a strong foothold in the real estate advisory sector.

Performance and Growth Prospects of Newmark Group Inc

Despite a year-to-date price decline of 16.43%, Newmark Group Inc shows a growth rank of 7/10 and a profitability rank of 6/10. The company's revenue growth over the past three years stands at 1.30%, with a focus on expanding its real estate services and capital markets segments. These growth prospects highlight the company's potential to rebound and deliver value to its shareholders.

Other Notable Investors in Newmark Group Inc

Leucadia National is the largest holder of Newmark Group Inc shares, while renowned investor Joel Greenblatt (Trades, Portfolio) also holds a position in the company. The involvement of these investors underscores the potential value and strategic importance of Newmark Group Inc in the real estate industry. Their participation further validates the firm's decision to invest in Newmark Group Inc, highlighting the company's promising future.

Transaction Analysis

The acquisition of Newmark Group Inc shares by CANTOR FITZGERALD, L. P. (Trades, Portfolio) is a significant addition to the firm's portfolio, representing a strategic investment in a company with strong growth potential. This transaction not only enhances the firm's portfolio diversification but also aligns with its investment philosophy of targeting high-growth sectors. As Newmark Group Inc continues to expand its services and strengthen its market position, this investment is poised to deliver substantial returns for CANTOR FITZGERALD in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: