Summary:

- Copart (CPRT, Financial) shares dropped significantly by 15.93% this past week following a revenue miss.

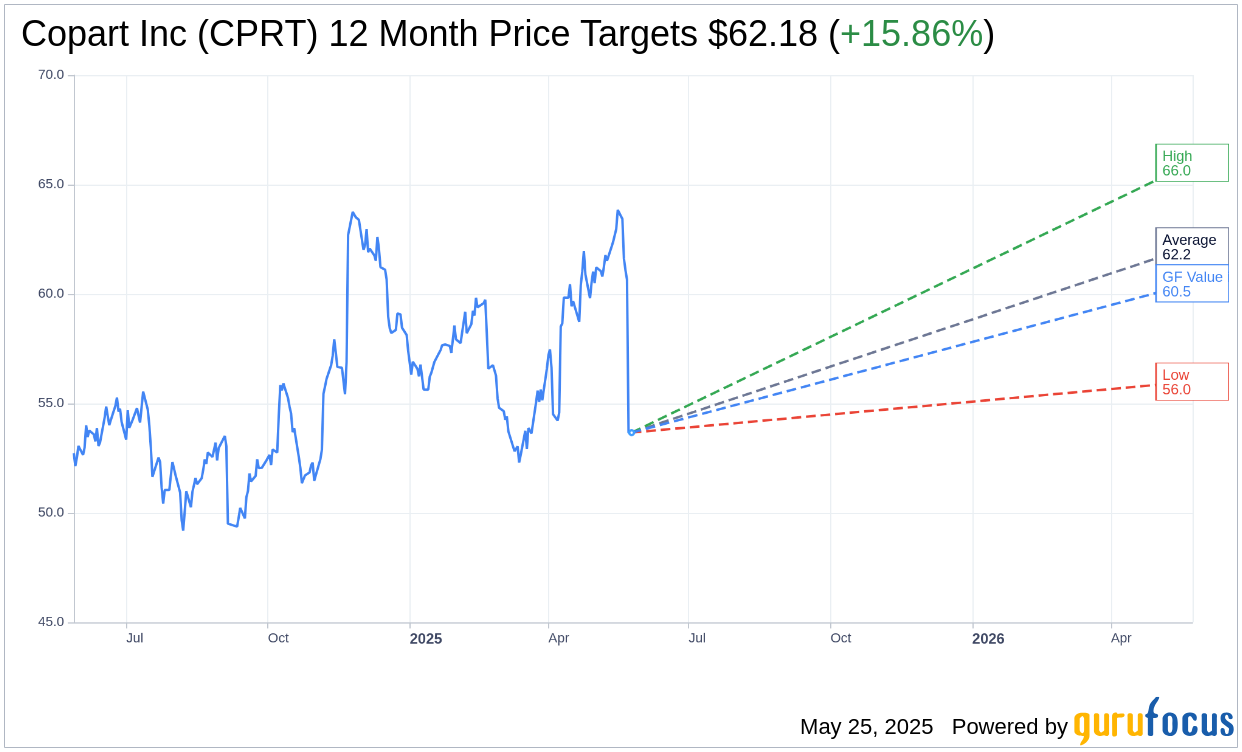

- The stock shows potential with a one-year analyst price target average indicating a 15.86% upside.

- Brokerage firms give Copart an "Outperform" recommendation with a 2.2 rating.

Copart's Recent Market Performance

In a notable shift within the industrial sector, Copart (CPRT) saw its stock plummet by 15.93% this week. This decline followed the company's announcement of third-quarter revenue figures, which fell short of expectations by $30 million, marking Copart as a significant underperformer recently.

Analysts' Price Forecast for Copart

Wall Street analysts have weighed in on Copart's future performance. According to projections from six analysts, the average one-year target price for Copart Inc (CPRT, Financial) is $62.18. This consensus includes a high estimate of $66.00 and a low of $56.00, suggesting a potential upside of 15.86% from the current trading price of $53.67. Investors seeking more data can explore comprehensive estimates on the Copart Inc (CPRT) Forecast page.

Brokerage Recommendations

Analyst insights further reflect on Copart's market stance. With input from 11 brokerage firms, Copart Inc (CPRT, Financial) is assigned an average brokerage recommendation of 2.2, which translates to an "Outperform" rating. This scale runs from 1, representing a Strong Buy, to 5, indicating a Sell.

GuruFocus Value Estimations

According to GuruFocus estimates, Copart's GF Value is pegged at $60.49 for the next year. This suggests a 12.71% upside from its current price of $53.67. The GF Value is GuruFocus' estimate of the stock's fair value, calculated considering historical trading multiples, past business growth, and future performance projections. Detailed insights are available on the Copart Inc (CPRT, Financial) Summary page.