Coeur Mining (CDE, Financial) has revealed that its board of directors has approved a share repurchase initiative valued at $75 million. This program is scheduled to be in effect until May 31, 2026, enabling the company to buy back its shares over this period. This move reflects a strategic effort by Coeur Mining to enhance shareholder value and demonstrate confidence in its financial standing.

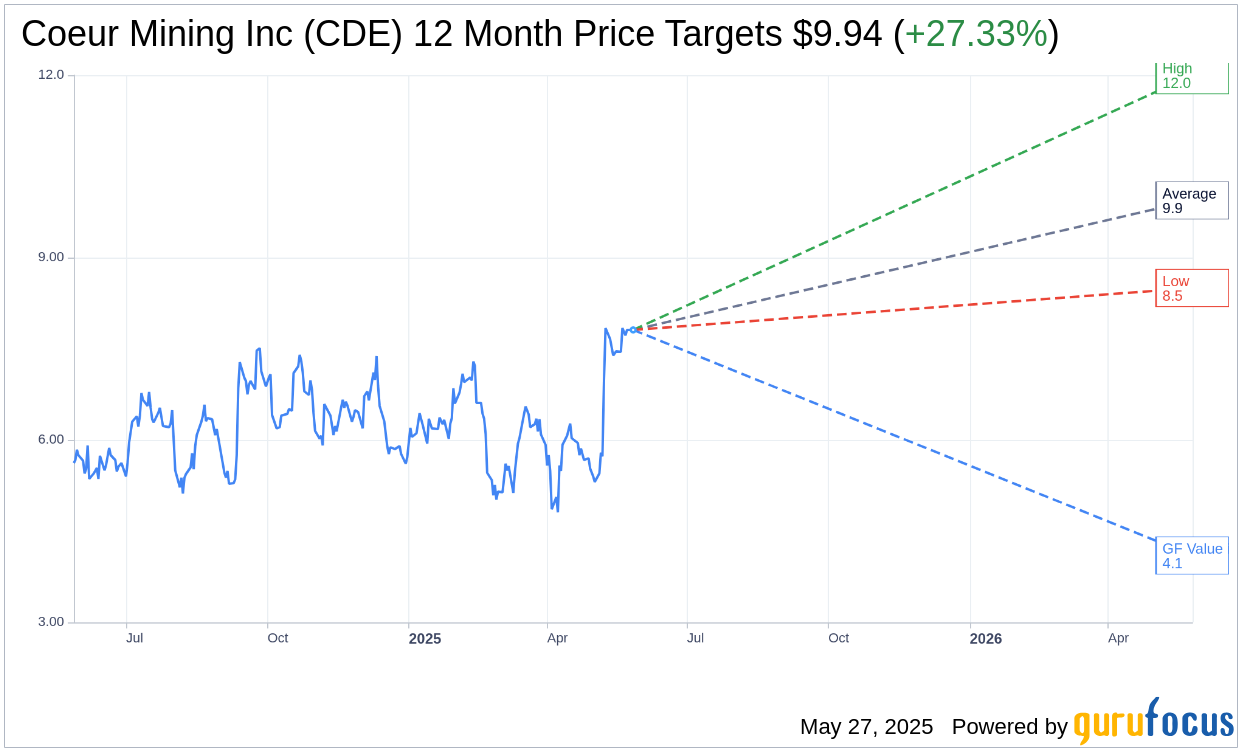

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Coeur Mining Inc (CDE, Financial) is $9.94 with a high estimate of $12.00 and a low estimate of $8.50. The average target implies an upside of 27.33% from the current price of $7.81. More detailed estimate data can be found on the Coeur Mining Inc (CDE) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Coeur Mining Inc's (CDE, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Coeur Mining Inc (CDE, Financial) in one year is $4.10, suggesting a downside of 47.5% from the current price of $7.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Coeur Mining Inc (CDE) Summary page.

CDE Key Business Developments

Release Date: May 08, 2025

- Revenue: $360 million for the first quarter.

- Adjusted EBITDA: $149 million, with a margin increase to 41%.

- Net Income: $33 million for the quarter.

- Free Cash Flow: $18 million, with an adjusted figure of approximately $76 million excluding one-time items.

- Gold and Silver Sales: Just under 90,000 ounces of gold and 4 million ounces of silver sold.

- Debt Reduction: Nearly $130 million of debt and metal prepay facilities eliminated.

- Las Chispas Production: 714,000 ounces of silver and over 7,000 ounces of gold produced.

- Las Chispas Free Cash Flow: $20 million for the partial quarter.

- Forecasted Free Cash Flow: $75 million to $100 million per quarter for the rest of 2025.

- Expected Full Year Adjusted EBITDA: Over $700 million.

- Expected Full Year Free Cash Flow: More than $300 million.

- Leverage Ratio: Expected to be close to zero by year-end.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Coeur Mining Inc (CDE, Financial) reported its fourth consecutive quarter of positive EPS and another quarter of positive free cash flow.

- The company successfully eliminated nearly $130 million of debt and metal prepay facilities in the first quarter.

- Integration of Las Chispas is proceeding smoothly, with high-grade production at low costs.

- Exploration efforts resulted in a significant discovery in the gap zone between the Babicanora and Las Chispas zones.

- Coeur Mining Inc (CDE) is on track to achieve its full-year guidance, with anticipated silver and gold production growth expected to drive full-year adjusted EBITDA to over $700 million and free cash flow to more than $300 million.

Negative Points

- The first quarter is expected to be the lightest production quarter of the year, with several one-time and quarter-specific items impacting results.

- Despite improvements, Rochester's crusher performance still requires optimization to achieve desired throughput and crush size.

- The integration of Las Chispas led to higher costs applicable to sales due to inventory acquired at fair value.

- There are nearly $300 million of deferred tax liabilities from the SilverCrest acquisition, impacting future income tax expense.

- The company faces ongoing challenges in managing cost pressures, particularly at Rochester and Kensington, despite some relief in consumables.