Key Highlights:

- Coeur Mining (CDE, Financial) announces a $75 million share repurchase program running until May 31, 2026.

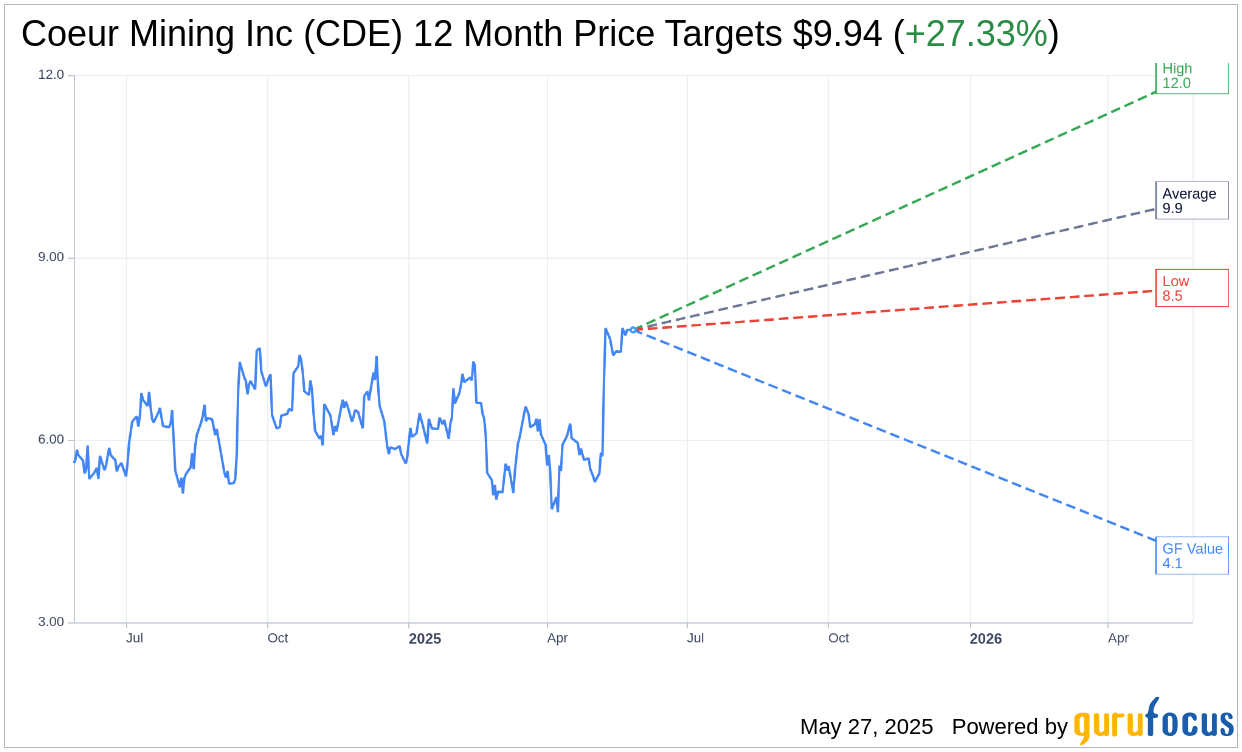

- Wall Street analysts project an average one-year target price of $9.94, implying a potential upside of 27.33%.

- Current brokerage recommendation stands at 2.0, indicating an "Outperform" status.

Coeur Mining's Strategic Repurchase Initiative

In a significant move toward enhancing shareholder value, Coeur Mining (CDE) has unveiled a $75 million share repurchase plan, effective until May 31, 2026. According to CEO Mitchell Krebs, the initiative follows substantial investments aimed at reducing debt, supporting reinvestment, and beginning to return capital to shareholders.

Wall Street’s Outlook for Coeur Mining

Wall Street analysts have set one-year price targets for Coeur Mining Inc (CDE, Financial), with an average target price of $9.94. This forecast includes a high of $12.00 and a low of $8.50, suggesting a potential upside of 27.33% from the current $7.81 price point. For a detailed breakdown of these estimates, visit the Coeur Mining Inc (CDE) Forecast page.

Brokerage Firm Ratings and Recommendations

The consensus recommendation from 9 brokerage firms places Coeur Mining Inc (CDE, Financial) at an average brokerage recommendation of 2.0, indicating an "Outperform" status. This recommendation scale ranges from 1, representing a Strong Buy, to 5, which denotes a Sell position.

Evaluating Coeur Mining’s GF Value Outlook

GuruFocus estimates the GF Value for Coeur Mining Inc (CDE, Financial) to be $4.10 in one year, suggesting a potential downside of 47.5% from its current market price of $7.81. The GF Value is derived from historical trading multiples, past business growth, and future business performance projections. For more comprehensive insights, refer to the Coeur Mining Inc (CDE) Summary page.