MSC Industrial (MSM, Financial) has been upgraded by JPMorgan analyst Patrick Baumann, who raised the stock's rating from Neutral to Overweight. Baumann also increased the price target for MSM, setting it at $89, which is up from the previous target of $73. This upgrade reflects a positive outlook on the company's future performance, suggesting potential for growth and resilience in the market.

Wall Street Analysts Forecast

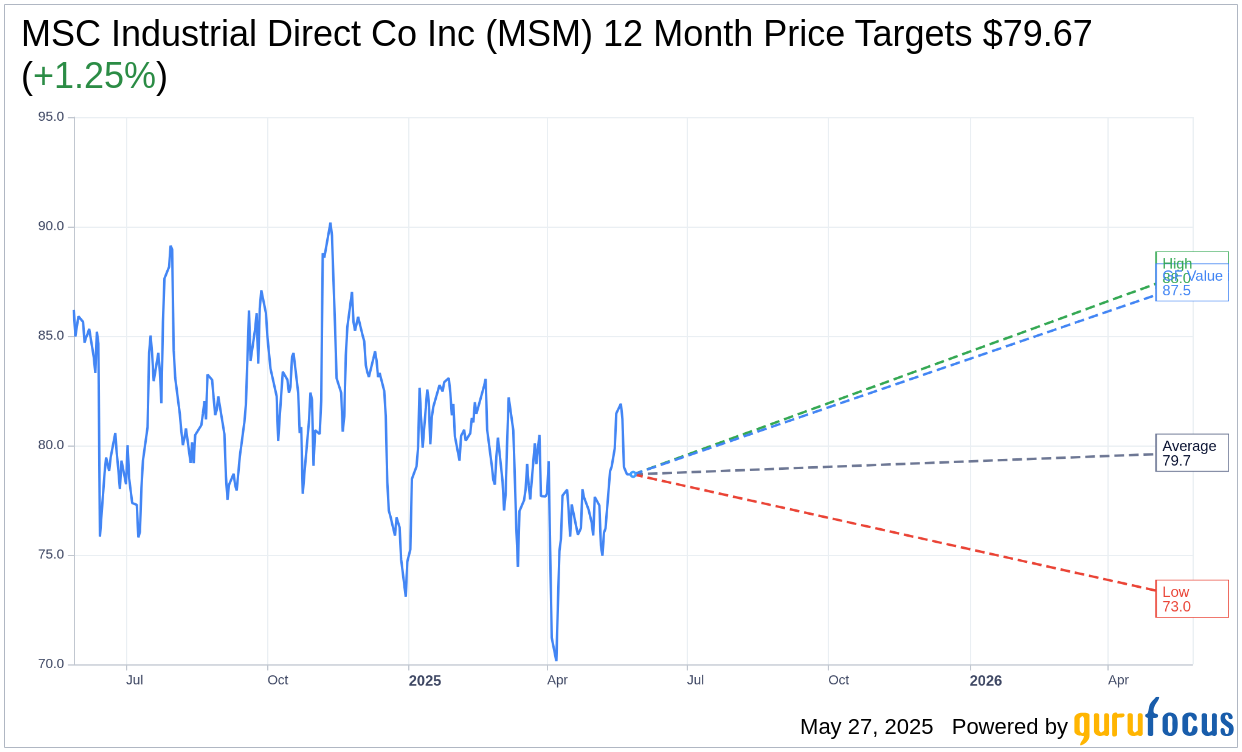

Based on the one-year price targets offered by 6 analysts, the average target price for MSC Industrial Direct Co Inc (MSM, Financial) is $79.67 with a high estimate of $88.00 and a low estimate of $73.00. The average target implies an upside of 1.25% from the current price of $78.68. More detailed estimate data can be found on the MSC Industrial Direct Co Inc (MSM) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, MSC Industrial Direct Co Inc's (MSM, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MSC Industrial Direct Co Inc (MSM, Financial) in one year is $87.45, suggesting a upside of 11.15% from the current price of $78.68. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MSC Industrial Direct Co Inc (MSM) Summary page.

MSM Key Business Developments

Release Date: April 03, 2025

- Revenue: Fiscal second-quarter sales of $892 million, a decline of 4.7% year over year.

- Average Daily Sales: Declined 4.7% year over year; sequential decline of 5.5%.

- Gross Margin: 41%, a decline of 50 basis points year over year.

- Operating Margin: Reported operating margin of 7%; adjusted operating margin of 7.1%, a decline of 340 basis points year over year.

- Net Income: GAAP earnings per share of $0.70 compared to $1.10 in the prior-year quarter; adjusted earnings per share of $0.72 compared to $1.18 in the prior year.

- Public Sector Growth: 13.2% improvement year over year.

- National Accounts: Declined 5.4% year over year.

- Core and Other Customers: Declined 6.8% year over year.

- Vending Sales: Average daily sales up 1% year over year, representing 18% of total company net sales.

- In-Plant Program Sales: Grew 1% year over year, representing approximately 18% of total company net sales.

- Cash Flow Conversion: Operating cash flow conversion of 139% in the quarter.

- Free Cash Flow Conversion: Approximately 63% in the fiscal second quarter and 125% fiscal year-to-date.

- Capital Expenditures: Increased approximately $4 million year over year to $30 million.

- Share Repurchase: Approximately 158,000 shares repurchased during the quarter.

- Capital Return to Shareholders: Approximately $60 million returned in fiscal 2Q and $125 million year-to-date.

- Net Debt: Approximately $498 million, representing roughly 1.2 times EBITDA.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MSC Industrial Direct Co Inc (MSM, Financial) reported improved trends in January and February, outperforming historical sequential averages.

- The company maintained momentum in its high-touch solutions, with a 24% increase in In-Plant programs and a 9% increase in installed Vending machines year-over-year.

- Website upgrades have been completed, improving product discovery, streamlining the buying journey, and increasing personalization, which has led to positive early indicators such as increased website traffic and new customer acquisition.

- The company has a robust made-in-USA product offering, which is expected to differentiate MSC in the marketplace amid tariff uncertainties.

- MSC Industrial Direct Co Inc (MSM) is on track with its network optimization initiatives, aiming for $10 million to $15 million in annualized savings by fiscal year 2026.

Negative Points

- Average daily sales declined 4.7% year-over-year, reflecting a soft demand environment.

- Gross margin declined by 50 basis points year-over-year due to higher-priced inventories, customer mix, and acquisition headwinds.

- Operating margin decreased significantly, with a reported operating margin of 7% compared to 9.7% in the prior year.

- The macro environment remains uncertain, with hesitancy among customers due to tariff uncertainty, potential inflation, and high interest rates.

- E-commerce sales were down 4% in the quarter, with some movement in e-commerce being depressed at the end of December and beginning of January.