IMUNON (IMNN, Financial) is set to present significant findings from their immune biomarker analysis, derived from the Phase 2 OVATION 2 Study, at the upcoming European Society for Medical Oncology (ESMO) Gynaecological Cancers Congress 2025. This event will occur in Vienna, Austria, from June 19 to 21, 2025. The abstract, focusing on this analysis, will cover IL-12 gene therapy, known as IMNN-001, used in combination with Neo/Adjuvant Chemotherapy for women with newly diagnosed advanced epithelial ovarian cancer.

Dr. Premal H. Thaker, who serves as both Interim Chief of Gynecologic Oncology and Director of Gynecologic Oncology Clinical Research at Washington University School of Medicine, will deliver the presentation. Dr. Thaker is also the Study Chair for both the current OVATION 2 trial and the upcoming Phase 3 OVATION 3 trial. This exposure at ESMO represents a significant milestone for IMUNON as they advance their research on IL-12 gene therapy in treating advanced ovarian cancer.

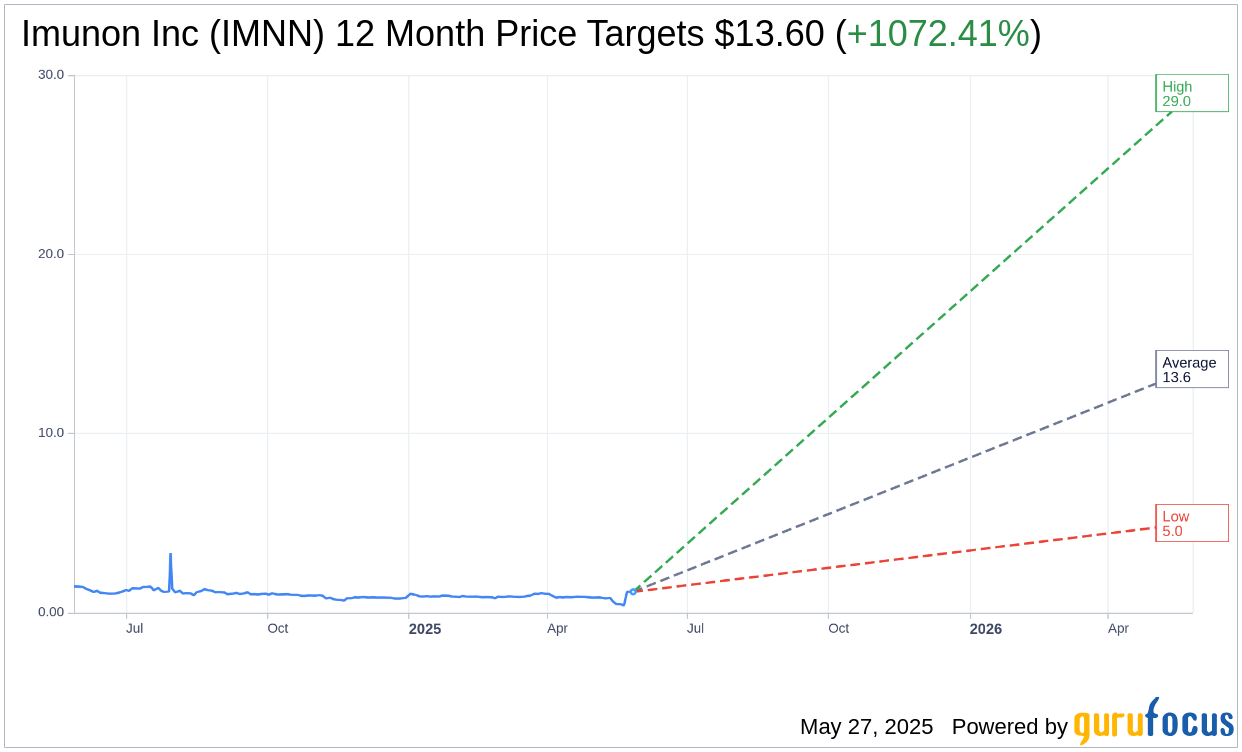

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Imunon Inc (IMNN, Financial) is $13.60 with a high estimate of $29.00 and a low estimate of $5.00. The average target implies an upside of 1,072.41% from the current price of $1.16. More detailed estimate data can be found on the Imunon Inc (IMNN) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Imunon Inc's (IMNN, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Imunon Inc (IMNN, Financial) in one year is $0.41, suggesting a downside of 64.66% from the current price of $1.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Imunon Inc (IMNN) Summary page.

IMNN Key Business Developments

Release Date: May 12, 2025

- Cash and Cash Equivalents: $2.9 million as of March 31, 2025.

- Research & Development Costs: $2.2 million for Q1 2025, down from $3.3 million in Q1 2024.

- General & Administrative Expenses: $2 million for Q1 2025, up from $1.7 million in Q1 2024.

- Net Loss: $4.1 million or $0.28 per share for Q1 2025, compared to $4.9 million or $0.52 per share in Q1 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Imunon Inc (IMNN, Financial) has initiated the first clinical site for their Phase 3 pivotal study of Imunon-001, targeting advanced ovarian cancer.

- The Phase 3 study, OVATION 3, is recognized by the medical community as a critical step towards delivering a new frontline treatment for women with limited options.

- Imunon-001's data has been accepted for an oral presentation at the ASCO Annual Meeting and for publication in the peer-reviewed journal Gynecologic Oncology.

- The company has a strategy to focus initially on a subgroup of HRD positive patients, which could lead to a faster and more cost-effective trial readout.

- Imunon Inc (IMNN) is actively working on value-added financing and partnerships to secure a cash runway that supports their clinical timelines and strategic objectives.

Negative Points

- Imunon Inc (IMNN) reported a net loss of $4.1 million for the first quarter of 2025, indicating ongoing financial challenges.

- The company had only $2.9 million in cash and cash equivalents as of March 31, 2025, highlighting the need for near-term financing.

- General & administrative expenses increased to $2 million in Q1 2025, up from $1.7 million in the same period in 2024, primarily due to higher employee-related expenses.

- The decrease in research & development costs from $3.3 million in Q1 2024 to $2.2 million in Q1 2025 may indicate reduced investment in certain areas.

- Imunon Inc (IMNN) is facing dilution concerns as they consider options for raising capital to support their product development goals.