Palisade Bio (PALI, Financial) has released encouraging topline results from its Phase 1 trials of PALI-2108, an innovative treatment targeting fibrostenotic Crohn’s disease and moderate to severe ulcerative colitis. The drug acts as a locally-activated phosphodiesterase-4 B/D inhibitor, specifically in the terminal ileum and colon. The Phase 1 study included tests such as single ascending dose, multiple ascending dose, and cross-over food effect trials, conducted on both healthy volunteers and a small group of ulcerative colitis patients.

The results showed that PALI-2108 achieved its primary goals concerning safety, tolerability, and pharmacokinetics, indicating positive safety profiles across the study groups. These findings provide a solid basis for advancing PALI-2108 into Phase 2 trials, potentially offering a new therapeutic option for patients with these challenging conditions.

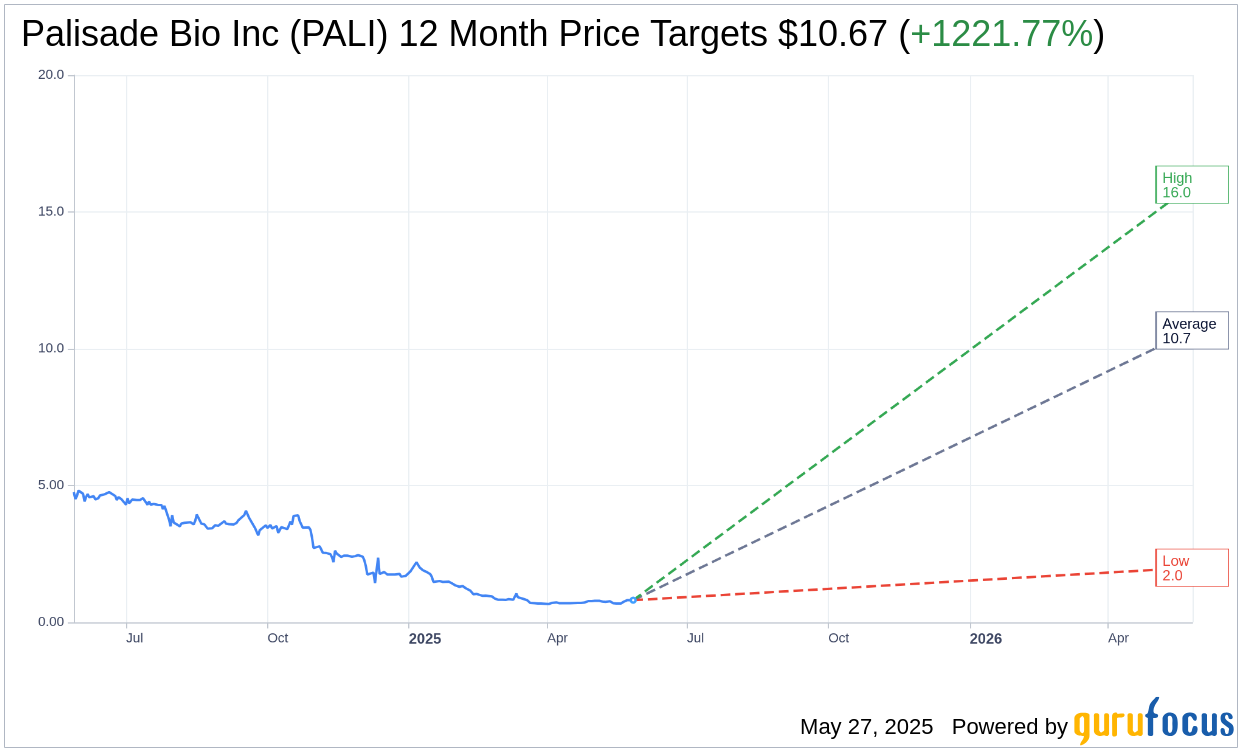

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Palisade Bio Inc (PALI, Financial) is $10.67 with a high estimate of $16.00 and a low estimate of $2.00. The average target implies an upside of 1,221.77% from the current price of $0.81. More detailed estimate data can be found on the Palisade Bio Inc (PALI) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Palisade Bio Inc's (PALI, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.