Ads-Tec Energy (ADSE, Financial) has launched ads-tec Energy Austria GmbH to broaden its reach in German-speaking regions and strengthen its service base in Central and Eastern Europe. Established in April, this new sales and service entity in Austria has already secured its inaugural order. The deal includes a framework agreement with an Austrian utility to deliver three significant battery storage systems, along with a separate order for a rapid charging system for electric vehicles.

The company anticipates the first battery storage system to be dispatched between the close of 2025 and the start of 2026, marking a significant step in its European expansion strategy.

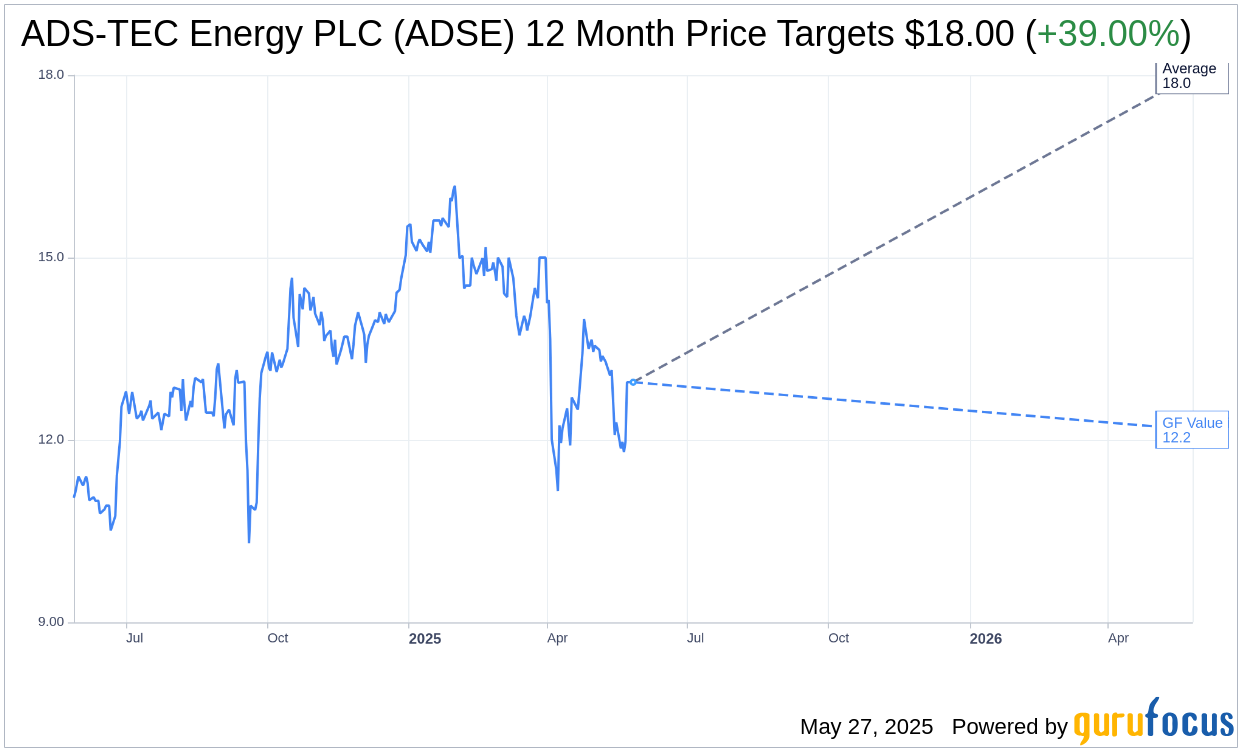

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for ADS-TEC Energy PLC (ADSE, Financial) is $18.00 with a high estimate of $18.00 and a low estimate of $18.00. The average target implies an upside of 39.00% from the current price of $12.95. More detailed estimate data can be found on the ADS-TEC Energy PLC (ADSE) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, ADS-TEC Energy PLC's (ADSE, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ADS-TEC Energy PLC (ADSE, Financial) in one year is $12.17, suggesting a downside of 6.02% from the current price of $12.95. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ADS-TEC Energy PLC (ADSE) Summary page.

ADSE Key Business Developments

Release Date: May 12, 2025

- Revenue: EUR110 million for the full year 2024, up from EUR107.4 million in 2023.

- Service Revenue: Increased from EUR2 million in 2023 to EUR5.6 million in 2024.

- Customer Base: Grew more than 200% to 55 customers across Europe, USA, and Canada.

- Gross Profit: Positive for the first time, with a gross margin of EUR90.4 million or 70.7% for 2024.

- Cost of Sales: Reduced by 80% to minus-EUR90.6 million.

- Operating Result: Improved to minus-EUR8.6 million from minus-EUR44.5 million in the previous year.

- Adjusted EBITDA: Increased from minus-EUR38.1 million to positive EUR2.2 million.

- Cash and Cash Equivalents: EUR22.9 million at the end of December 2024.

- Operating Cash Flow: Improved from EUR20.7 million to EUR16.3 million, a EUR4.4 million improvement.

- Convertible Note: Secured EUR50 million in May 2025.

- Shareholder Loans: Extended for one year, providing an additional EUR25.6 million credit line.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ADS-TEC Energy PLC (ADSE, Financial) reported its first-ever positive gross profit and adjusted EBITDA for the full year 2024.

- Service revenues nearly tripled to EUR5.6 million, indicating significant growth in recurring revenue streams.

- The customer base more than doubled, increasing by over 200% to 55 customers across Europe, the USA, and Canada.

- The company successfully mitigated risks from a major customer's business difficulties by acquiring nearly all affected customers directly.

- ADS-TEC Energy PLC (ADSE) secured a convertible note of EUR50 million, providing financial resources to expand its business operations.

Negative Points

- Revenue growth was modest, increasing only by 2.5% from EUR107.4 million in 2023 to EUR110 million in 2024.

- The market for charging infrastructure faced volatility, with some customers experiencing delays in installation.

- The company operates in a highly regulated market, which can slow down integration and expansion efforts.

- There is uncertainty regarding the financial impact of the new strategy to own and operate charging units.

- The energy trading and advertisement revenue streams are still in the early stages and not yet fully established.