On May 27, 2025, Compass Pathways (CMPS, Financial) received a notable update from investment firm Cantor Fitzgerald. The firm, led by analyst Josh Schimmer, initiated coverage on CMPS with an "Overweight" rating, signaling potential favorability in the stock's performance.

Furthermore, Cantor Fitzgerald announced a price target of $12.00 USD for Compass Pathways. This target indicates the firm's optimistic outlook on CMPS's future price trajectory.

Despite the absence of a prior rating or price target, this announcement places CMPS in the spotlight for investors looking for growth opportunities in the healthcare and biotechnology sectors.

The "Overweight" rating suggests that Cantor Fitzgerald believes that Compass Pathways (CMPS, Financial) will outperform its peer group and provides promising prospects for long-term investors.

This update is noteworthy as CMPS continues to navigate the complex landscape of mental health treatment innovation. Investors should monitor Compass Pathways' performance closely to gauge its trajectory against the announced price target.

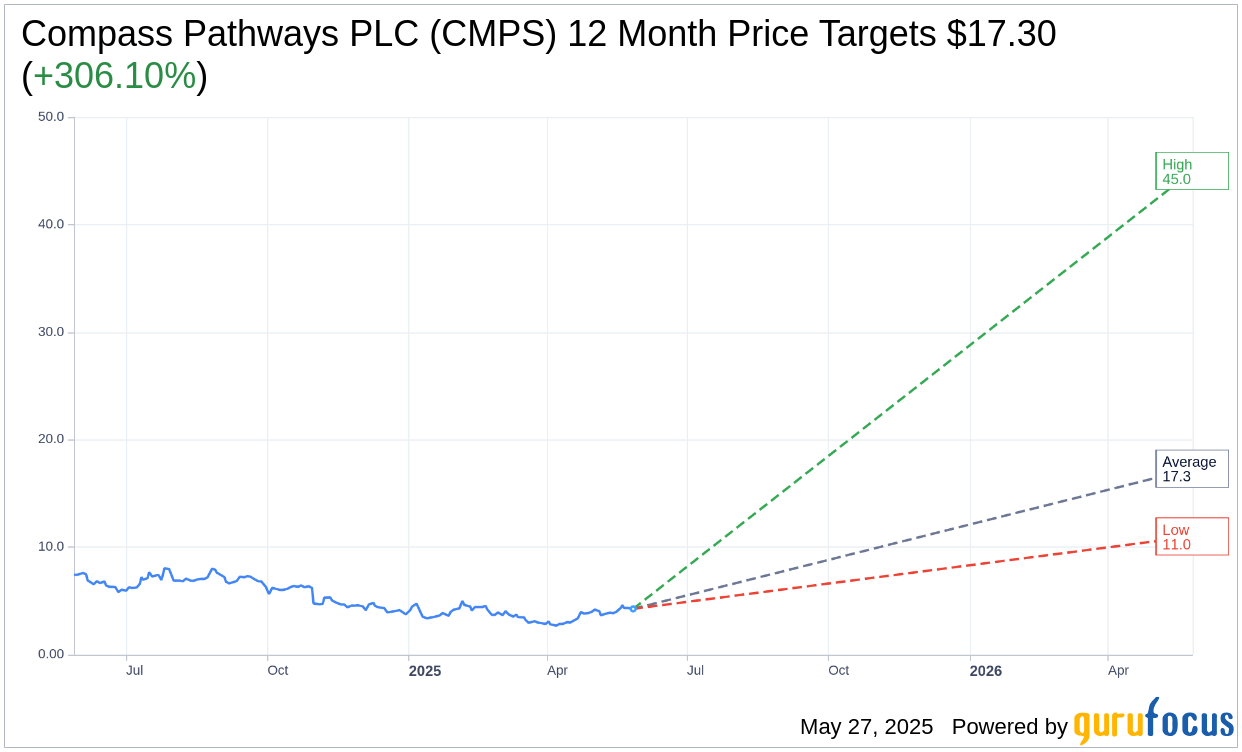

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Compass Pathways PLC (CMPS, Financial) is $17.30 with a high estimate of $45.00 and a low estimate of $11.00. The average target implies an upside of 306.10% from the current price of $4.26. More detailed estimate data can be found on the Compass Pathways PLC (CMPS) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Compass Pathways PLC's (CMPS, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.