XPeng (XPEV, Financial) is experiencing significant bearish sentiment as the trading volume for put options has reached 18,467 contracts, about five times the usual amount. Among these, the most actively traded are the September 2025 $16 puts and the June 2025 $18.5 puts, which together account for nearly 16,000 contracts. The Put/Call Ratio stands at 2.78, indicating a higher interest in puts over calls. Additionally, the at-the-money implied volatility (ATM IV) has risen by almost 2 percentage points today. Investors are closely monitoring XPeng (XPEV) as its earnings report is anticipated on August 19th.

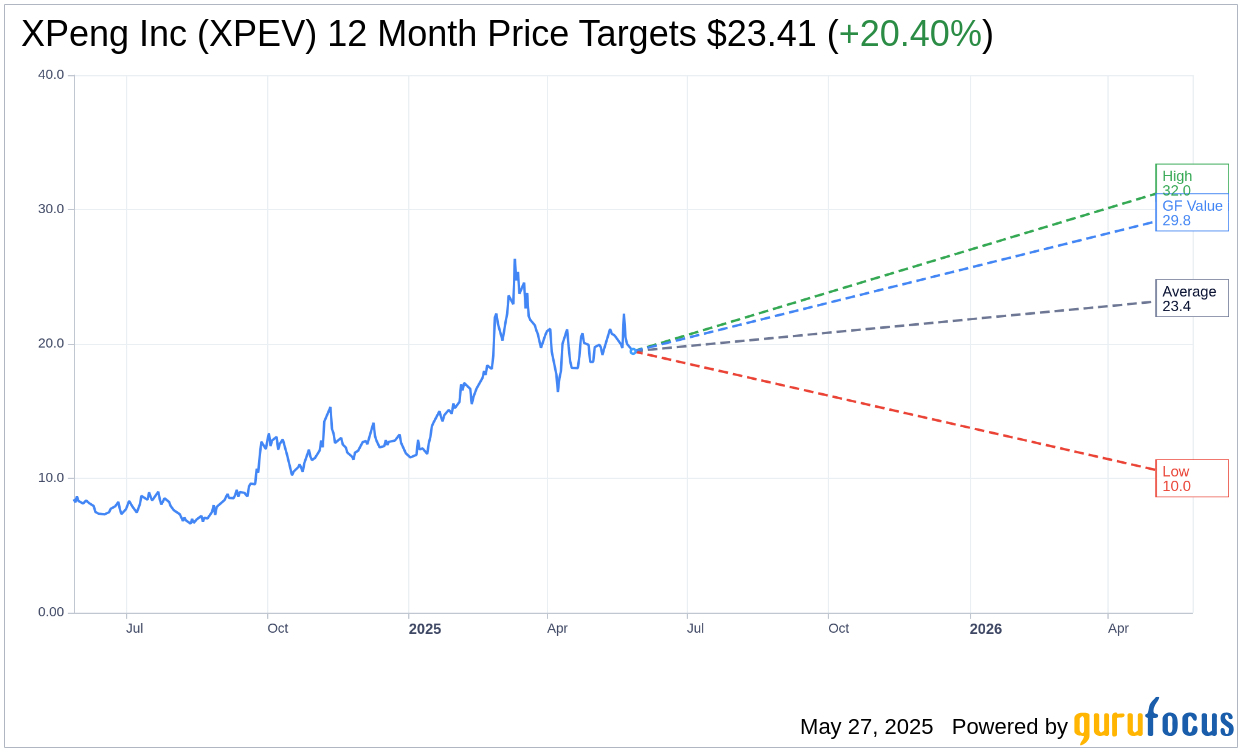

Wall Street Analysts Forecast

Based on the one-year price targets offered by 26 analysts, the average target price for XPeng Inc (XPEV, Financial) is $23.41 with a high estimate of $32.00 and a low estimate of $10.00. The average target implies an upside of 20.40% from the current price of $19.45. More detailed estimate data can be found on the XPeng Inc (XPEV) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, XPeng Inc's (XPEV, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for XPeng Inc (XPEV, Financial) in one year is $29.79, suggesting a upside of 53.2% from the current price of $19.445. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the XPeng Inc (XPEV) Summary page.

XPEV Key Business Developments

Release Date: May 21, 2025

- Q1 Deliveries: 94,008 units, a 331% year-over-year increase.

- Gross Margin: 15.6% in Q1 2025, improved for seven consecutive quarters.

- Free Cash Flow: Exceeded RMB3 billion in Q1.

- Total Revenue: RMB15.81 billion, a 141.5% year-over-year increase.

- Vehicle Sales Revenue: RMB14.37 billion, a 159.2% year-over-year increase.

- Services and Others Revenue: RMB1.44 billion, a 43.6% year-over-year increase.

- Vehicle Margin: 10.5% in Q1 2025, up from 5.5% in Q1 2024.

- R&D Expenses: RMB1.98 billion, a 46.7% year-over-year increase.

- SG&A Expenses: RMB1.95 billion, a 40.2% year-over-year increase.

- Net Loss: RMB0.66 billion, reduced from RMB1.37 billion year-over-year.

- Cash and Equivalents: RMB45.28 billion as of March 31, 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- XPeng Inc (XPEV, Financial) achieved a record high of 94,008 vehicle deliveries in Q1 2025, marking a 331% year-over-year increase.

- The company's vehicle gross margin improved for seven consecutive quarters, reaching a record high of 15.6% in Q1 2025.

- XPeng Inc (XPEV) reported significant progress in AI-driven tech innovation, enhancing capabilities in AI-assisted driving, smart cabins, and Turing chips.

- The company successfully expanded its global presence, with overseas deliveries increasing by more than 31,700 year-over-year.

- XPeng Inc (XPEV) anticipates achieving profitability in Q4 2025 and generating substantial free cash flow for the entire year.

Negative Points

- Despite the impressive growth, XPeng Inc (XPEV) reported a net loss of RMB0.66 billion for Q1 2025.

- The company faced inventory provisions and losses on purchase commitments related to the upgrade of certain vehicle models.

- R&D expenses increased by 46.7% year-over-year, driven by higher expenses related to new vehicle models and technologies.

- XPeng Inc (XPEV) is exposed to foreign exchange risks, particularly due to its business in Europe.

- The company faces increased competition from both domestic and international automakers, impacting market dynamics.