In a recent development, Advanced Micro Devices (AMD, Financial) has been upgraded by HSBC. The analyst responsible for this change, Frank Lee, adjusted the stock's rating from a previous 'Reduce' to a current 'Hold'. This update was released on May 27, 2025. However, it should be noted that no price target adjustments were specified alongside the rating update.

HSBC's action towards AMD (Advanced Micro Devices) comes as a notable change, especially considering the previous 'Reduce' rating. While there are no further details on any potential price target changes, this upgrade may signal a shift in the analyst's outlook on AMD's future market performance.

Investors and stakeholders of AMD will likely be interested in this development, as the stock continues to be a significant player in the technology industry on the NASDAQ. The change in rating from a reputable financial institution such as HSBC could potentially influence market perceptions and investor decisions regarding AMD.

Wall Street Analysts Forecast

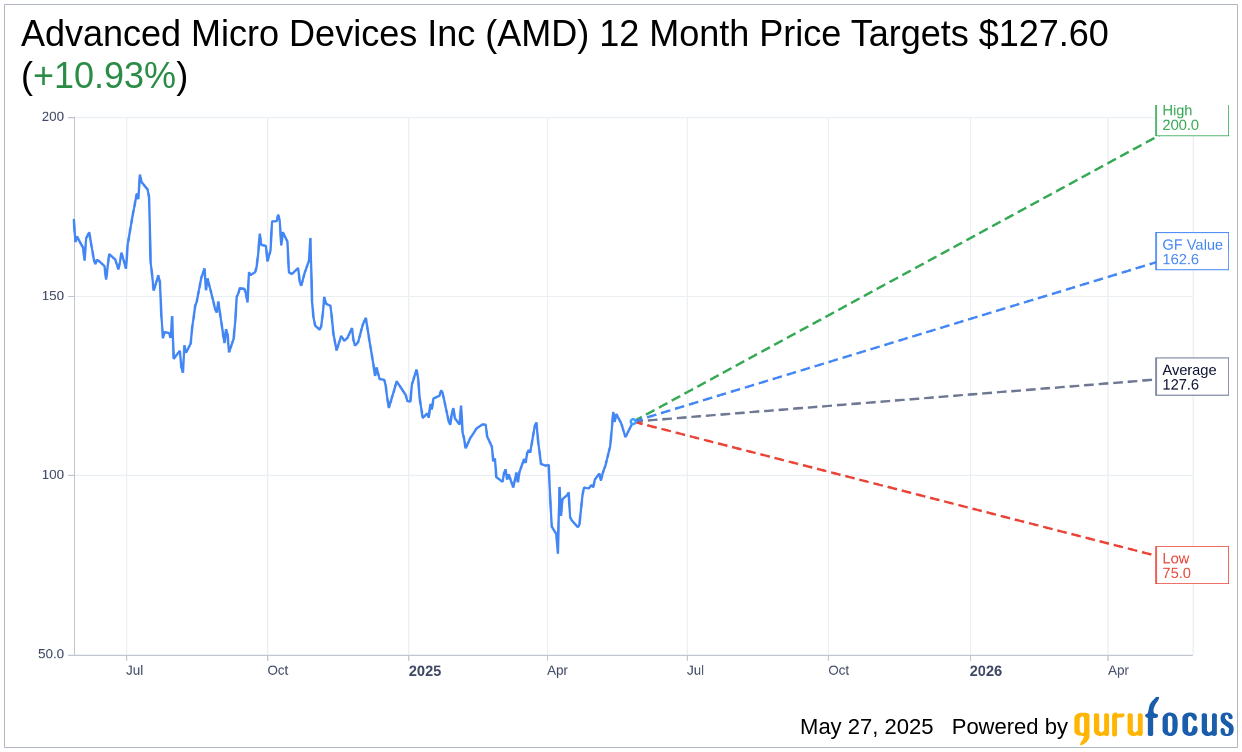

Based on the one-year price targets offered by 41 analysts, the average target price for Advanced Micro Devices Inc (AMD, Financial) is $127.60 with a high estimate of $200.00 and a low estimate of $75.00. The average target implies an upside of 10.93% from the current price of $115.03. More detailed estimate data can be found on the Advanced Micro Devices Inc (AMD) Forecast page.

Based on the consensus recommendation from 52 brokerage firms, Advanced Micro Devices Inc's (AMD, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Advanced Micro Devices Inc (AMD, Financial) in one year is $162.60, suggesting a upside of 41.36% from the current price of $115.025. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Advanced Micro Devices Inc (AMD) Summary page.