PDD Holdings (PDD, Financial) just posted a steep 47% drop in Q1 profit as rising ad spend, aggressive discounts, and global trade friction chipped away at margins. Revenue came in nearly 7% below estimates, marking the fourth straight miss—an uncomfortable streak for a company once hailed as China's fastest-growing e-commerce disruptor. U.S.-listed shares dropped over 17% as investors reacted to the earnings gap and signs that Temu, PDD's international growth story, is feeling the sting from new tariff dynamics and operational shifts. Management insists the spending spree is strategic—aimed at long-term merchant success—but the near-term pain is piling up.

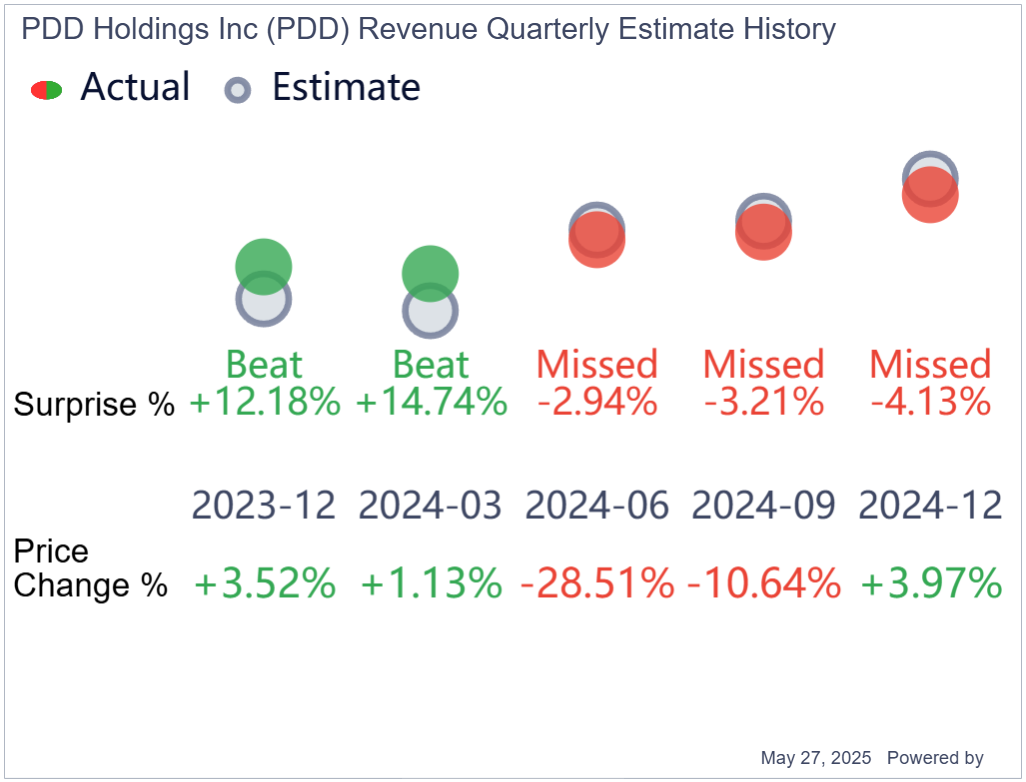

The quarterly miss follows a telling pattern. PDD beat expectations comfortably in late 2023 and early 2024, but the tide quickly turned. The attached chart shows a consistent drop in revenue surprises from Q2 2024 onward, despite fluctuating stock reactions. Notably, after Q2's earnings miss, the stock tanked 28.5%. Yet after Q4—despite another shortfall—shares climbed close to 4%.

That kind of divergence suggests the market could be recalibrating expectations. Investors may be starting to look past the short-term volatility, betting that PDD's international expansion and cost-heavy strategy will eventually pay off.

Still, this is a high-stakes balancing act. The domestic e-commerce war in China is heating up. Alibaba (BABA, Financial) is slipping, JD.com (JD, Financial) is holding firm thanks to appliance trade-ins, and everyone's slashing prices. PDD's decision to keep Temu prices low—even amid tariff pressure—adds more stress to its margins. But if the company can stabilize global logistics, shift more fulfillment to local sellers, and keep merchant engagement high, there's a shot this rough patch turns into a base for recovery. The market isn't patient forever, though. Four misses in a row raises eyebrows. A fifth? That could be the tipping point.