Jefferies has increased its price target for Liquidia (LQDA, Financial) from $27 to $31, while maintaining a Buy rating on the company's shares. This update follows the recent FDA approval of Yutrepia, a treatment designed for adults suffering from pulmonary arterial hypertension and interstitial lung disease-related hypertension. Despite this positive development, Liquidia's stock has experienced a slight dip. The firm attributes this to investors anxiously awaiting an upcoming decision in the '782 case, where a ruling on the temporary restraining order is expected soon from a North Carolina court.

Wall Street Analysts Forecast

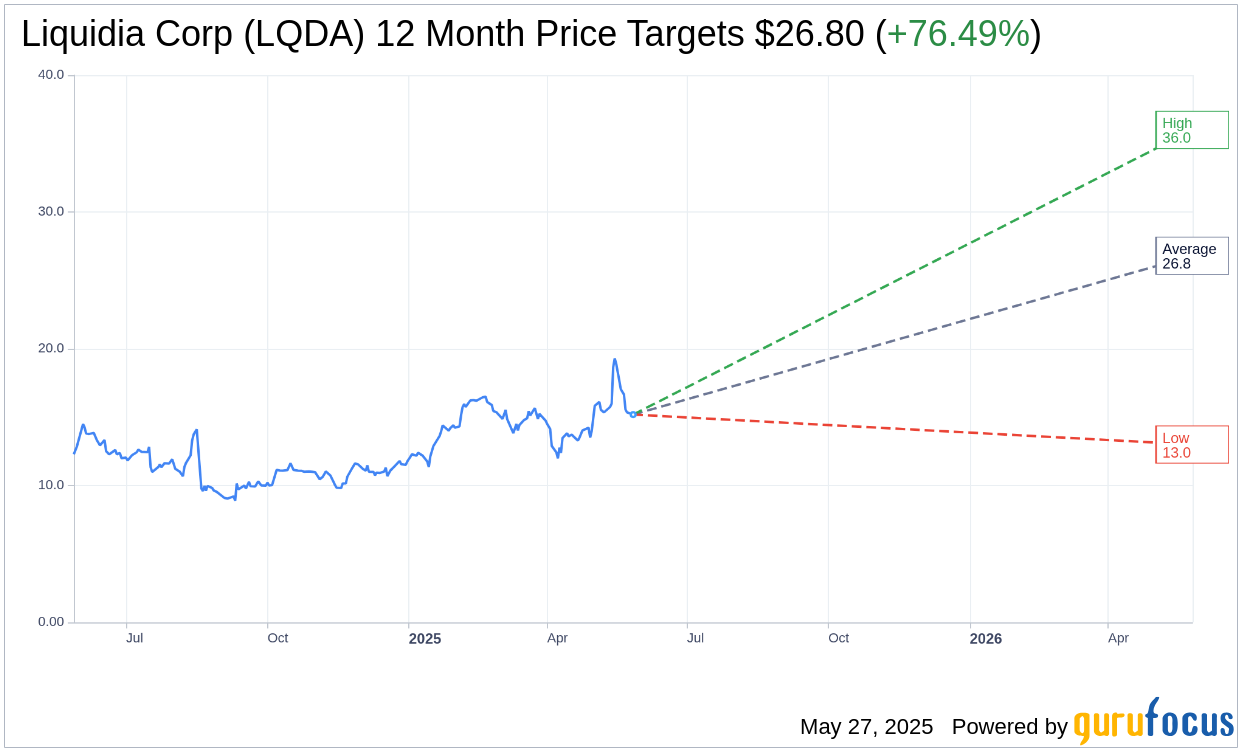

Based on the one-year price targets offered by 10 analysts, the average target price for Liquidia Corp (LQDA, Financial) is $26.80 with a high estimate of $36.00 and a low estimate of $13.00. The average target implies an upside of 76.49% from the current price of $15.19. More detailed estimate data can be found on the Liquidia Corp (LQDA) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Liquidia Corp's (LQDA, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Liquidia Corp (LQDA, Financial) in one year is $4.80, suggesting a downside of 68.39% from the current price of $15.185. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Liquidia Corp (LQDA) Summary page.

LQDA Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Liquidia Corp (LQDA, Financial) is preparing for the potential launch of its first internally developed commercial product, Erepia, which targets pulmonary arterial hypertension and pulmonary hypertension associated with interstitial lung disease.

- The company received a favorable court ruling dismissing United Therapeutics' cross claim, removing legal barriers to Erepia's potential final approval.

- Liquidia Corp (LQDA) has a strategic focus on developing a best-in-class product profile for Erepia, emphasizing its tolerability, titratability, and ease of use.

- The company has a robust sales and medical affairs team with extensive experience in rare diseases, preparing for Erepia's market launch.

- Liquidia Corp (LQDA) has established strong relationships with payers, ensuring broad access to Erepia post-launch.

Negative Points

- Revenue for the first quarter of 2025 was only slightly higher than the previous year, indicating limited growth.

- The company reported a net loss of $38.4 million for the quarter, an increase from the previous year's loss.

- General and administrative expenses increased significantly by 48%, driven by higher personnel costs and legal fees.

- There is uncertainty regarding potential legal actions from United Therapeutics, which could impact Erepia's launch.

- The company faces challenges in converting patients from existing therapies to its new dry powder formulation, as seen with competitors.