A significant meeting concerning the future progress of RSI will take place in San Francisco on May 29. The event is set to be hosted by Needham, providing a platform for key discussions and networking opportunities.

Investors aiming to make informed decisions may find valuable insights by exploring a company's Key Performance Indicators. Understanding these metrics can be crucial for evaluating stock potential.

Additionally, those interested in discovering undervalued and market-resilient stocks might benefit from resources like the Smart Value Newsletter, which offers curated stock recommendations.

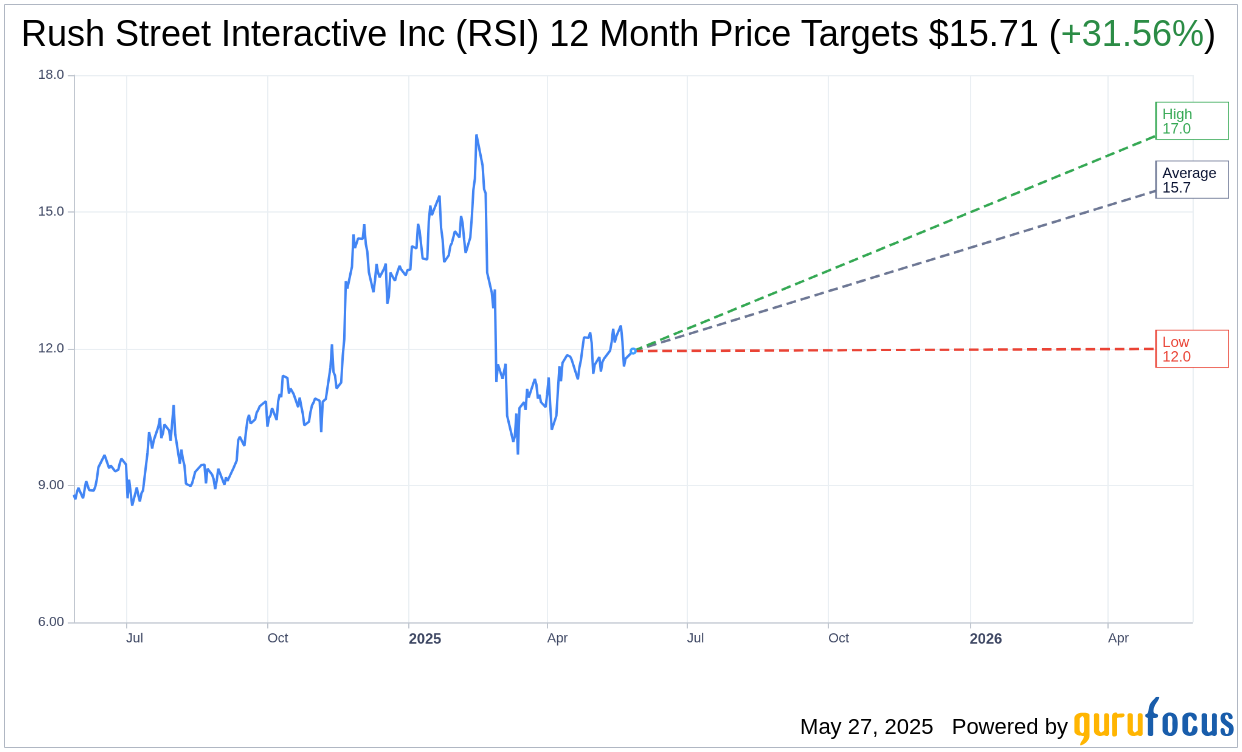

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Rush Street Interactive Inc (RSI, Financial) is $15.71 with a high estimate of $17.00 and a low estimate of $12.00. The average target implies an upside of 31.56% from the current price of $11.95. More detailed estimate data can be found on the Rush Street Interactive Inc (RSI) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Rush Street Interactive Inc's (RSI, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rush Street Interactive Inc (RSI, Financial) in one year is $2.77, suggesting a downside of 76.81% from the current price of $11.945. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rush Street Interactive Inc (RSI) Summary page.

RSI Key Business Developments

Release Date: April 30, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rush Street Interactive Inc (RSI, Financial) reported a 21% year-over-year increase in revenue for Q1 2025, reaching $262 million.

- Adjusted EBITDA nearly doubled compared to the same period last year, reaching $33 million.

- The company experienced strong growth in both online casino (25% growth) and sports betting (11% growth) verticals.

- RSI's North American monthly active users (MAUs) grew by 17% year over year, with Latin America MAUs increasing by 61%.

- The company maintained a strong cash position with $228 million in unrestricted cash and no debt.

Negative Points

- The newly imposed 19% VAT tax in Colombia negatively impacted net revenue growth, despite strong gross gaming revenue (GGR) performance.

- RSI's net revenue in Colombia was flat year over year in April, despite a 55% increase in GGR.

- The company anticipates facing tougher comparisons as the year progresses, particularly in markets like Delaware.

- Marketing spend increased by 3% compared to last year, although it was leveraged to achieve record EBITDA.

- The VAT tax in Colombia is expected to remain a headwind throughout the year, affecting net revenue and profitability.