- Innovative Solutions and Support Inc. (ISSC, Financial) reported a substantial revenue increase this quarter.

- Analysts project an optimistic future for ISSC, with potential upsides in stock value.

- GuruFocus estimates suggest significant room for growth in ISSC's stock price.

Innovative Solutions and Support Inc. (ISSC) achieved remarkable growth in its second-quarter financial results, with revenue more than doubling to $21.9 million. Net income soared by 300%, reaching $5.3 million, and adjusted earnings per share (EPS) jumped from $0.07 last year to $0.30. Additionally, the company recorded a noteworthy increase in adjusted EBITDA, which rose to $7.7 million from a previous $2.4 million.

Wall Street Analysts Forecast

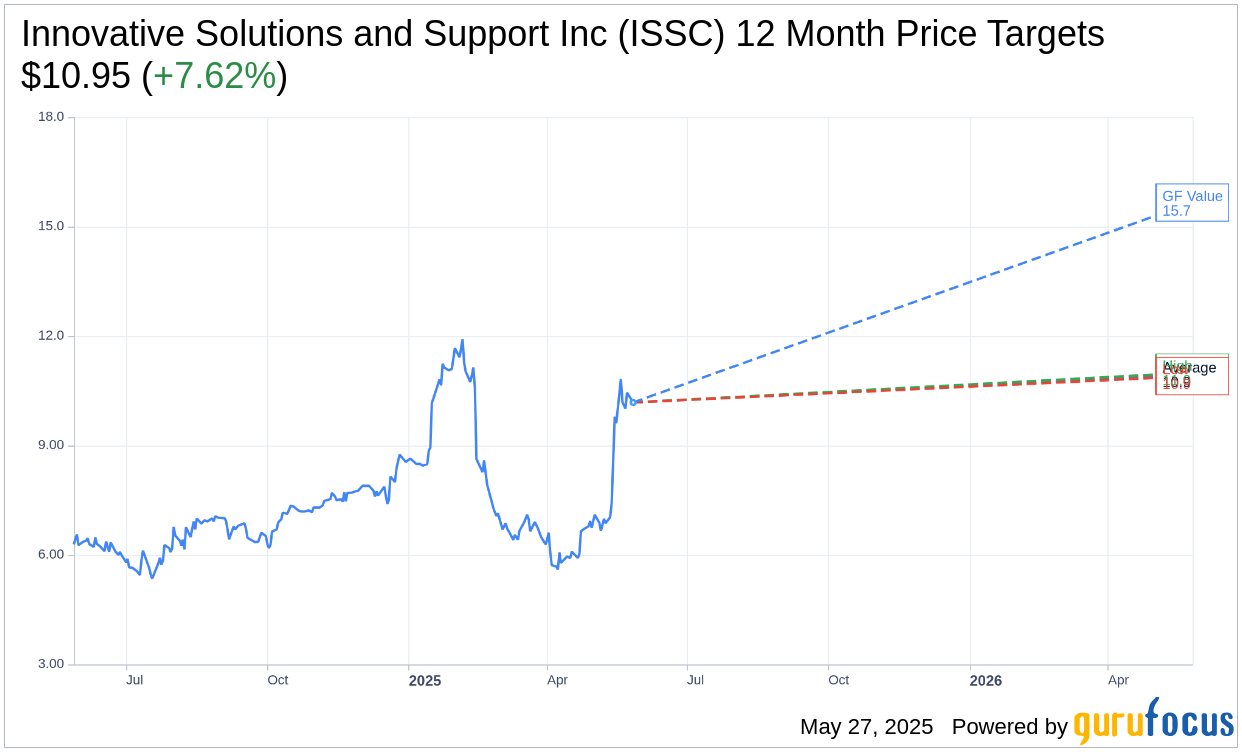

Wall Street analysts have set a one-year price target for Innovative Solutions and Support Inc. (ISSC, Financial), with an average target price of $10.95. Estimates range from a high of $11.00 to a low of $10.90, indicating a potential upside of 7.62% from the current stock price of $10.18. For more detailed forecast data, visit the Innovative Solutions and Support Inc. (ISSC) Forecast page.

The consensus recommendation from two brokerage firms places ISSC's average brokerage recommendation at 1.5, which falls into the "Buy" category. This scale ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell.

According to GuruFocus estimates, the projected GF Value for Innovative Solutions and Support Inc. (ISSC, Financial) in one year is $15.66. This valuation suggests a substantial upside of 53.91% from the current trading price of $10.175. The GF Value reflects GuruFocus' calculation of the fair value of the stock, based on historical trading multiples, past business growth, and future performance estimates. For more insights, visit the Innovative Solutions and Support Inc. (ISSC) Summary page.