Key Takeaways:

- Nvidia faces new export license challenges for its H20 GPUs in China, but upside potential remains.

- Morgan Stanley analyst highlights increased rack supply forecasts and demand growth as potential growth drivers.

- Analysts predict substantial upside for Nvidia with average price targets and GF Value metrics suggesting significant growth.

Nvidia's Potential Challenges and Opportunities

Nvidia (NVDA, Financial) has recently encountered hurdles due to a new export license requirement from the U.S. for its H20 GPUs, especially concerning its sales in China. Despite this regulatory challenge, Morgan Stanley analyst Joseph Moore maintains an optimistic outlook. He underscores that the projected increase in rack supply and the growing demand for inference could serve as substantial offsets to these challenges.

Wall Street Analysts Forecast

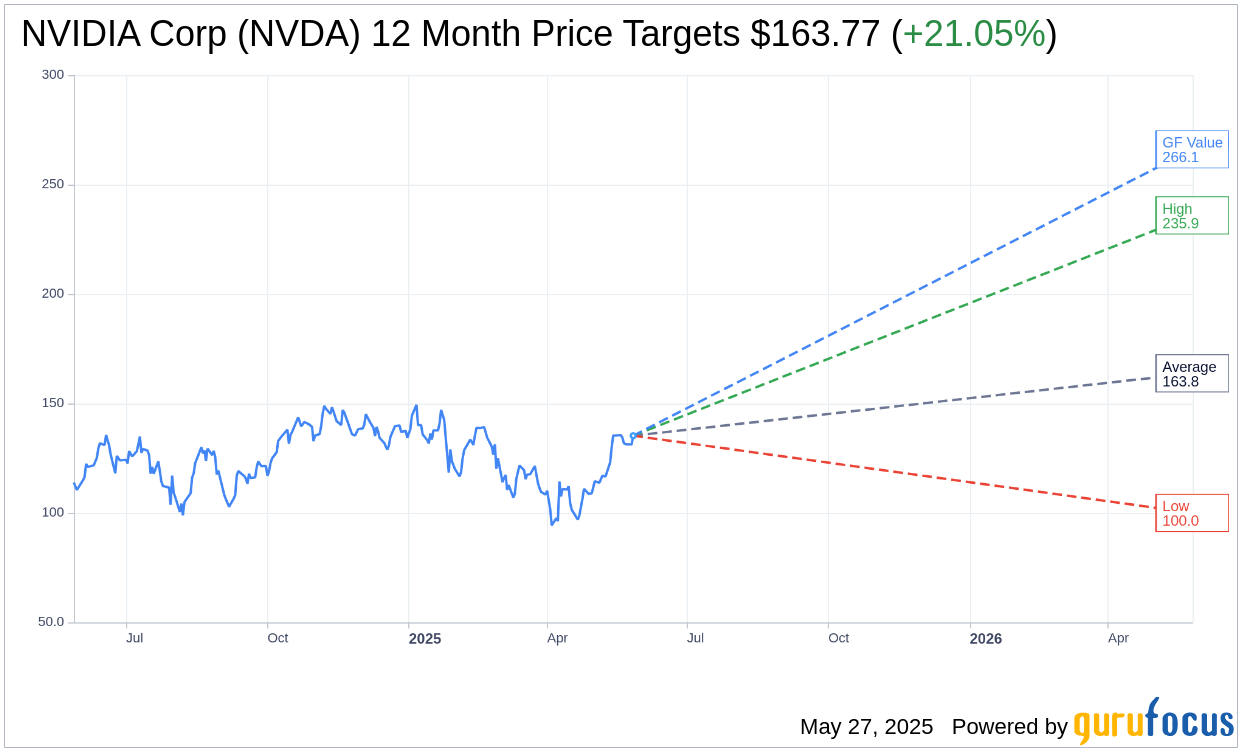

The consensus among 51 analysts indicates an average one-year price target for NVIDIA Corp (NVDA, Financial) at $163.77. Notably, the high estimate reaches $235.92, while the low estimate stands at $100.00. This average target suggests a potential upside of 21.05% from the current trading price of $135.29. Investors seeking more detailed estimate data may refer to the NVIDIA Corp (NVDA) Forecast page.

Furthermore, NVIDIA Corp's (NVDA, Financial) stock enjoys an average brokerage recommendation of 1.8 from 64 brokerage firms, indicating an "Outperform" status. On the recommendation scale, 1 equates to a Strong Buy, while 5 denotes a Sell.

Significant Growth Potential through GF Value

According to GuruFocus estimates, the estimated GF Value for NVIDIA Corp (NVDA, Financial) in the next year is calculated to be $266.11. This estimate suggests a remarkable upside of 96.69% from the current price of $135.2948. The GF Value metric represents GuruFocus' estimation of a stock's fair market value based on historical trading multiples, previous business growth, and future performance projections. For a more comprehensive overview, please visit the NVIDIA Corp (NVDA) Summary page.