On May 27, 2025, Semtech Corp (SMTC, Financial) released its 8-K filing for the first quarter of fiscal year 2026, showcasing a notable performance that exceeded analyst expectations. The company, known for its expertise in designing and manufacturing analog and mixed-signal semiconductors, reported net sales of $251.1 million, surpassing the estimated revenue of $250.09 million. This represents a 22% year-over-year growth, highlighting the company's strong market position and demand for its products.

Company Overview and Segment Performance

Semtech Corp is a prominent player in the semiconductor industry, focusing on analog and mixed-signal semiconductors, IoT systems, and cloud connectivity services. The company operates through four segments: Signal Integrity, Analog Mixed Signal and Wireless, IoT Systems, and IoT Connected Services. The majority of its revenue is derived from the Analog Mixed Signal and Wireless segment, with a significant portion of sales coming from the Asia Pacific region.

Financial Achievements and Challenges

Semtech Corp reported a GAAP gross margin of 52.3%, an improvement from 48.3% in the previous year, and a non-GAAP adjusted gross margin of 53.5%. The company's GAAP operating margin increased to 14.3%, while the non-GAAP adjusted operating margin reached 19.0%. These margins reflect the company's ability to manage costs effectively and enhance profitability.

The company's GAAP diluted earnings per share (EPS) was $0.22, a significant turnaround from a loss of $0.36 a year ago. The non-GAAP adjusted diluted EPS was $0.38, exceeding the analyst estimate of $0.11. This improvement in earnings is crucial for maintaining investor confidence and supporting future growth initiatives.

Income Statement and Key Metrics

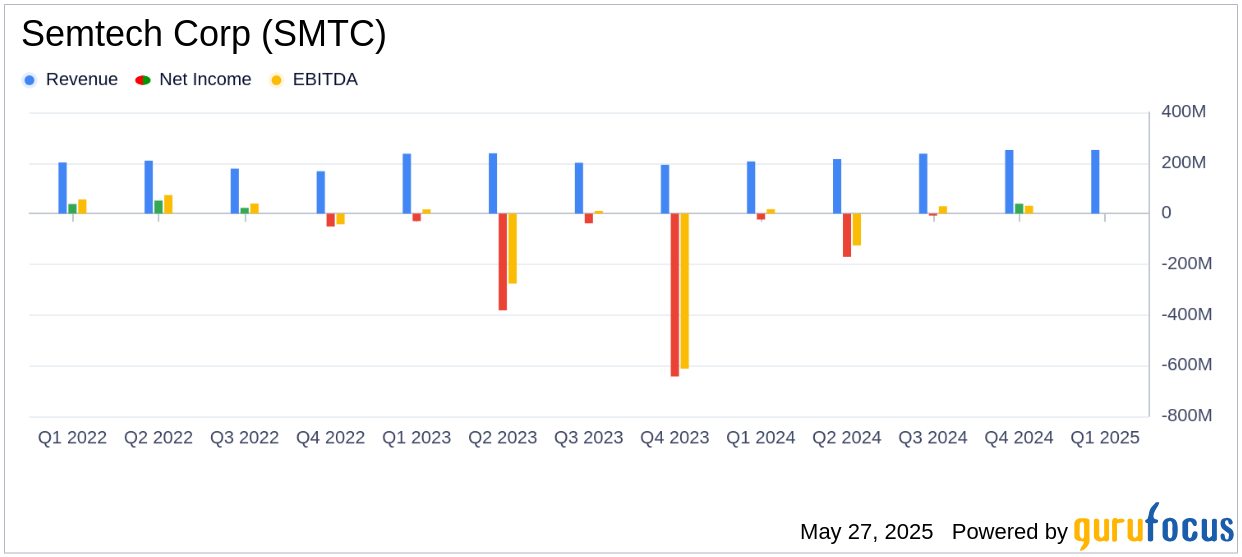

Semtech Corp's income statement reveals a net income of $19.3 million, compared to a net loss of $23.2 million in the same quarter last year. The company's adjusted EBITDA margin improved to 22.1% from 16.1% a year ago, indicating enhanced operational efficiency.

| Metric | Q1 FY2026 | Q4 FY2025 | Q1 FY2025 |

|---|---|---|---|

| Net Sales | $251.1 million | $251.0 million | $206.1 million |

| Gross Margin | 52.3% | 52.0% | 48.3% |

| Operating Income | $36.0 million | $21.2 million | $3.1 million |

| Net Income (Loss) | $19.3 million | $39.1 million | $(23.2) million |

| Diluted EPS | $0.22 | $0.43 | $(0.36) |

Strategic Investments and Future Outlook

Semtech Corp continues to invest strategically in innovation and operational scale, which is essential for sustaining growth and creating long-term value. The company made a $10 million term loan principal prepayment in the first quarter and an additional $15 million in the second quarter, demonstrating its commitment to reducing debt and improving financial stability.

I am pleased with our solid first quarter results, that reflected improving demand trends, strong business fundamentals and disciplined execution in a dynamic environment," said Hong Hou, president and chief executive officer.

Overall, Semtech Corp's strong financial performance and strategic initiatives position it well for future growth in the competitive semiconductor industry. Investors and stakeholders will be keenly watching the company's ability to maintain this momentum and capitalize on emerging opportunities in the IoT and connectivity markets.

Explore the complete 8-K earnings release (here) from Semtech Corp for further details.