- Motorola Solutions is set to acquire Silvus Technologies for $4.4 billion, bolstering its defense capabilities.

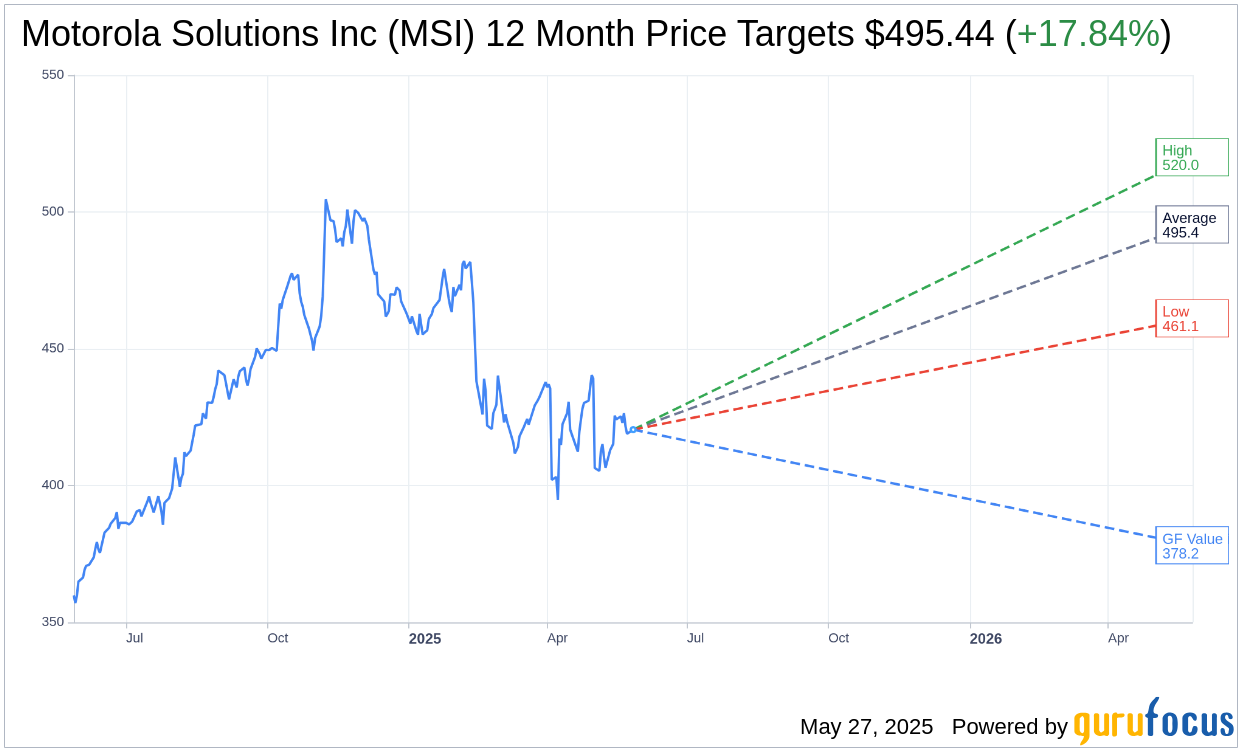

- Analysts forecast an average target price of $495.44, indicating potential upside.

- Current GuruFocus estimate suggests a downside of 10.05% from the present stock price.

Motorola Solutions (MSI, Financial) has taken a strategic step forward with the announcement of its plan to acquire Silvus Technologies for a substantial $4.4 billion, primarily in cash. This acquisition is a key move to amplify its offerings in the defense sector. Notably, Silvus Technologies could also earn an additional $600 million contingent upon performance benchmarks by 2027 and 2028. The transaction is projected to be finalized by late 2025.

Wall Street Analysts' Insights and Projections

In terms of future growth, Wall Street analysts are placing optimistic bets on Motorola Solutions Inc (MSI, Financial). From the one-year price targets provided by 7 financial analysts, the average target price stands at $495.44. While the highest estimate reaches $520.00, the lowest dips to $461.11. This data suggests an implied upside of 17.84% from the current trading price of $420.44. For deeper insights, investors can refer to the Motorola Solutions Inc (MSI) Forecast page.

The analyst consensus, derived from 13 brokerage firms, places Motorola Solutions Inc (MSI, Financial) with an average brokerage recommendation of 1.8, which translates to an "Outperform" status. Within the rating scale, 1 is the pinnacle, indicating a Strong Buy, while 5 points towards a Sell recommendation.

Evaluating GF Value and Investment Considerations

From a valuation perspective, the GuruFocus estimated GF Value for Motorola Solutions Inc (MSI, Financial) in the upcoming year is $378.18. This figure indicates a potential downside of 10.05% from the current stock price of $420.44. The GF Value is an analytical tool that estimates the fair trading value of a stock, utilizing historical pricing multiples, past business growth, and future performance forecasts. Detailed valuation metrics are accessible on the Motorola Solutions Inc (MSI) Summary page.