Altisource Portfolio Solutions S.A. (ASPS, Financial) experienced a trading halt at 19:50 EDT due to pending news. The market is currently alert, awaiting further updates regarding the company's situation. Investors are closely monitoring developments to understand the impact on ASPS and adjust their strategies accordingly.

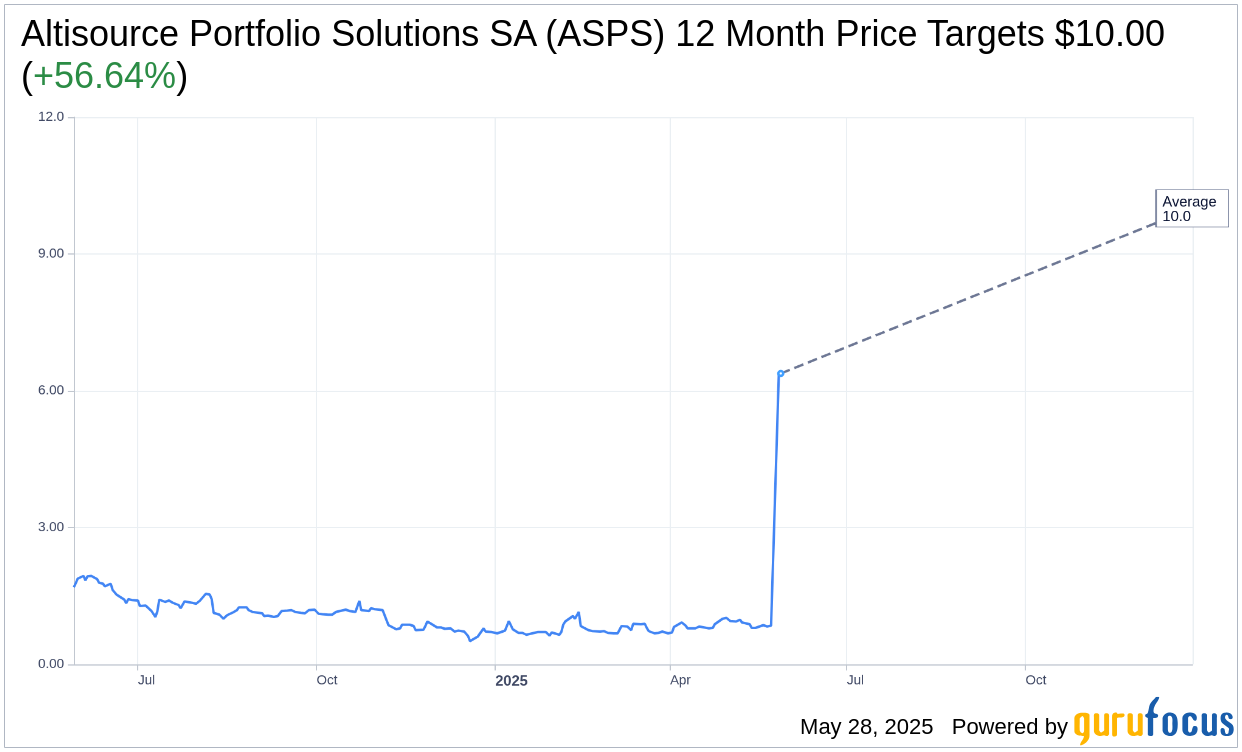

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Altisource Portfolio Solutions SA (ASPS, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an upside of 56.64% from the current price of $6.38. More detailed estimate data can be found on the Altisource Portfolio Solutions SA (ASPS) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Altisource Portfolio Solutions SA's (ASPS, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

ASPS Key Business Developments

Release Date: May 01, 2025

- Service Revenue: $40.9 million, an 11% increase over Q1 2024.

- Adjusted EBITDA: $5.3 million, a 14% increase over Q1 2024.

- Unrestricted Cash: $30.8 million at the end of the quarter.

- Long-term Debt: Reduced by over $60 million to $172.5 million.

- GAAP Interest Expense: $4.9 million, down from $9.5 million in Q1 2024.

- Servicer and Real Estate Segment Revenue: $32.9 million, a 13% increase over Q1 2024.

- Servicer and Real Estate Segment Adjusted EBITDA: $12 million, a 15% increase over Q1 2024.

- Origination Segment Revenue: $8 million, a 3% increase over Q1 2024.

- Corporate Segment Adjusted EBITDA Loss: $7.2 million, a $900,000 increase over Q1 2024.

- Foreclosure Starts: Increased by 25% in Q1 2025 compared to Q1 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Altisource Portfolio Solutions SA reported a 11% year-over-year increase in total company service revenue, reaching $40.9 million.

- Adjusted EBITDA grew by 14% to $5.3 million, outpacing service revenue growth due to scale benefits and a favorable revenue mix.

- The company significantly strengthened its balance sheet by reducing long-term debt by over $60 million and lowering interest expenses.

- The Servicer and Real Estate segment saw a 13% increase in service revenue, driven by the launch and growth of the renovation business and stronger foreclosure starts.

- Altisource Portfolio Solutions SA won new business estimated to generate $4.7 million in annual service revenue, indicating strong sales performance and future growth potential.

Negative Points

- The Corporate segment's adjusted EBITDA loss increased by $900,000 or 15% to $7.2 million, primarily due to non-recurring benefits in the previous year.

- Despite growth in certain areas, the origination segment's adjusted EBITDA remained flat, reflecting challenges in the origination market.

- Foreclosure sales for the first quarter of 2025 declined by 2% compared to last year and are 53% lower than the same period in 2019.

- The origination market continues to face challenges, with first quarter 2025 mortgage origination volume relatively flat compared to the previous year.

- The company faces potential risks from a weakening U.S. economy, which could impact loan delinquencies and foreclosure activities.