- Guidewire Software plans significant workforce expansion in India, targeting 1,000 employees by 2028.

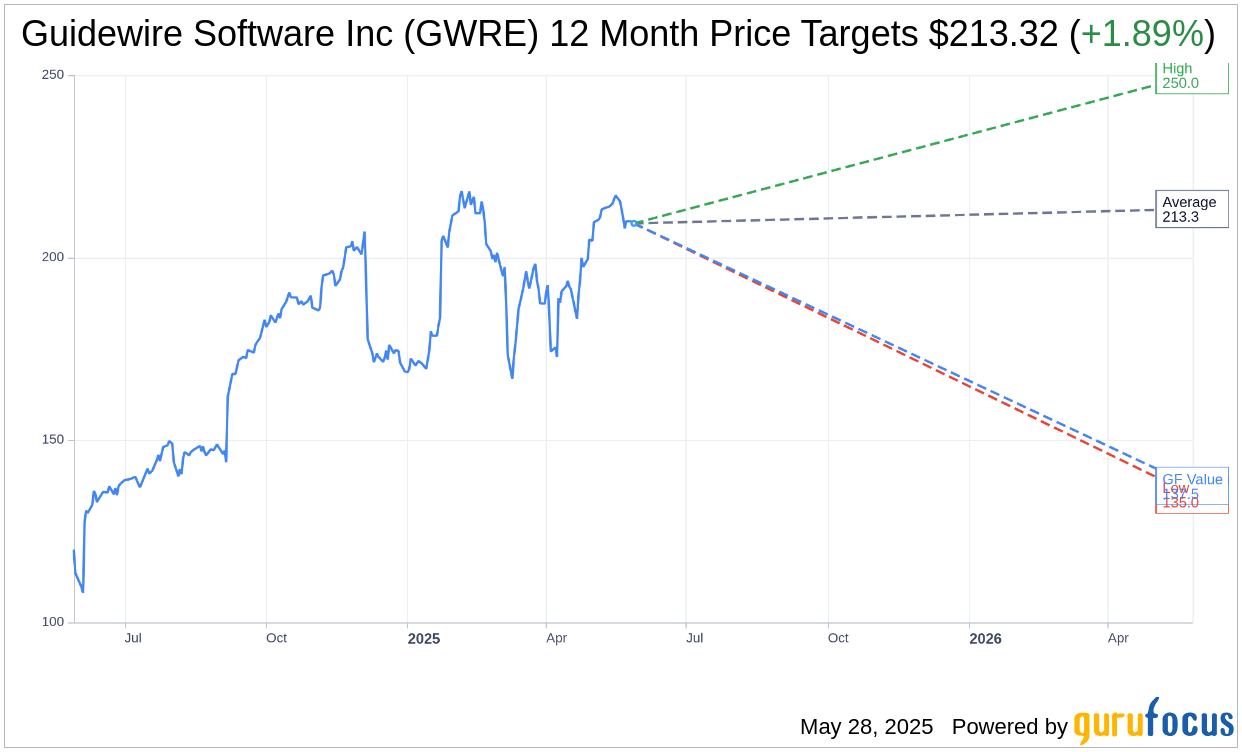

- Wall Street analysts have set a one-year price target range of $135 to $250 for GWRE, with an upside potential of 1.89%.

- GuruFocus estimates suggest a downside of 34.34% from the current price based on GF Value metrics.

Guidewire Software (GWRE, Financial), a prominent player in technology solutions for the insurance sector, is poised for substantial growth in India. The company aims to increase its employee base to 1,000 in India by the end of 2028, with a strategic focus on boosting their professional services division, particularly in their Bengaluru hub.

Wall Street Analysts Forecast

In an analysis by 12 seasoned analysts, Guidewire Software Inc (GWRE, Financial) has an average one-year price target of $213.32. This projection spans a high estimate of $250.00 and a low of $135.00, averaging in an upside potential of 1.89% from the current market price of $209.36. Investors seeking more detailed projections can visit the Guidewire Software Inc (GWRE) Forecast page.

The general consensus from 15 brokerage firms rates Guidewire Software Inc (GWRE, Financial) at 2.1, signaling an "Outperform" recommendation. This rating operates on a scale from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the projected GF Value for Guidewire Software Inc (GWRE, Financial) over the next year stands at $137.46. This suggests a 34.34% downside from the current trading price of $209.36. The GF Value reflects GuruFocus' assessment of the stock's fair trading value, calculated based on historical trading multiples and anticipated business performance. For a deeper dive into these metrics, visit the Guidewire Software Inc (GWRE) Summary page.