Ituran (ITRN, Financial) has reported impressive financial results for the first quarter, with revenue reaching $86.46 million, a rise from $85.03 million in the same period last year. The company achieved a significant milestone by adding 99,000 net new subscribers, bringing its total subscriber base to over 2.5 million, surpassing plans.

This notable increase in subscribers was partly driven by a new telematics service agreement with Stellantis, the largest car manufacturer in Latin America. Under this agreement, Ituran began servicing Stellantis’s subscriber base as of March. Looking forward, the company has raised its forecast for 2025, expecting net new subscribers to grow by 220,000 to 240,000.

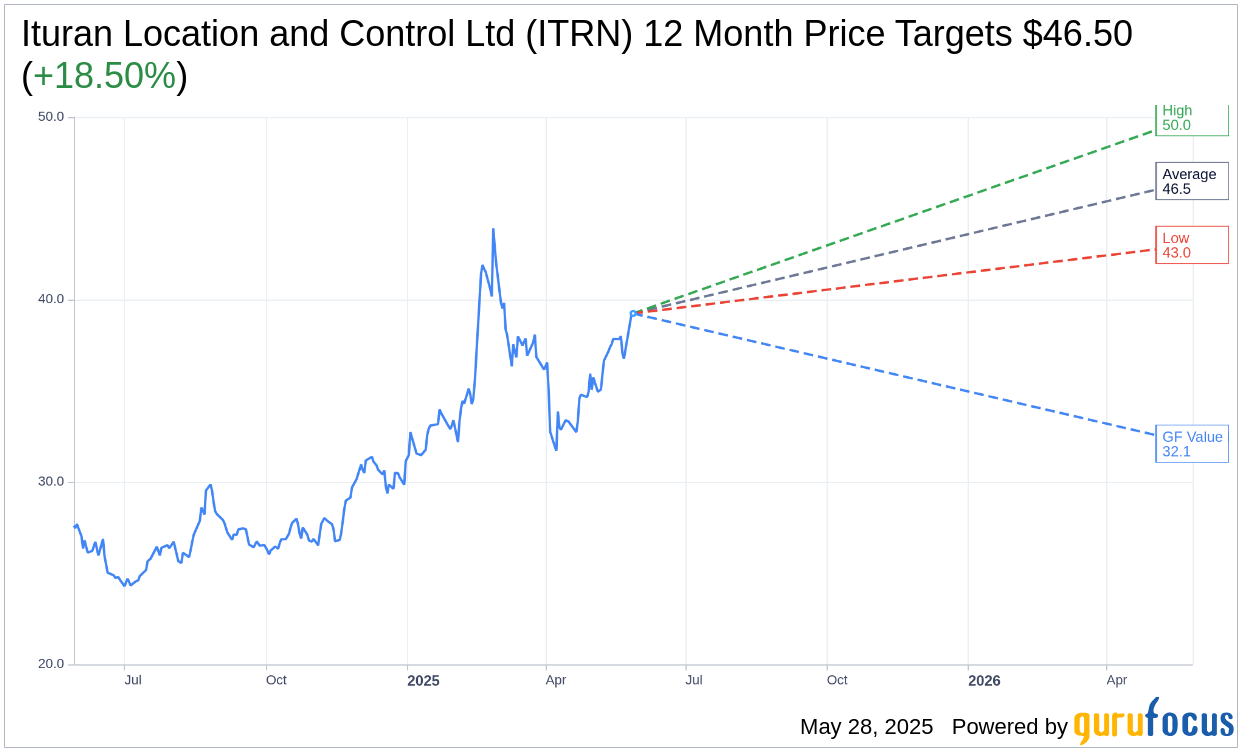

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Ituran Location and Control Ltd (ITRN, Financial) is $46.50 with a high estimate of $50.00 and a low estimate of $43.00. The average target implies an upside of 18.50% from the current price of $39.24. More detailed estimate data can be found on the Ituran Location and Control Ltd (ITRN) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Ituran Location and Control Ltd's (ITRN, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ituran Location and Control Ltd (ITRN, Financial) in one year is $32.10, suggesting a downside of 18.2% from the current price of $39.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ituran Location and Control Ltd (ITRN) Summary page.

ITRN Key Business Developments

Release Date: February 26, 2025

- Fourth Quarter Revenue: $82.9 million, a 7% increase year-over-year.

- Subscription Fees Revenue: $61.5 million, a 4% increase year-over-year.

- Product Revenue: $21.3 million, a 16% increase year-over-year.

- EBITDA: $22.5 million, 27.2% of revenues, a 3% increase year-over-year.

- Net Income: $13.8 million, or $0.70 diluted earnings per share, a 15% increase year-over-year.

- Cash Flow from Operations (Q4): $22.7 million.

- Full Year Revenue: $336 million, a 5% increase over 2023.

- Full Year Subscription Fees Revenue: $242.5 million, a 3% increase over 2023.

- Full Year Product Revenue: $93.8 million, a 10% increase over 2023.

- Full Year EBITDA: $91.3 million, 27.1% of revenues, a 5% increase over 2023.

- Full Year Net Income: $53.7 million, or $2.70 fully diluted earnings per share, an 11% increase over 2023.

- Cash Flow from Operations (Full Year): $74.3 million.

- Net Cash Position: $77.3 million as of December 30, 2024.

- Dividend Increase: Quarterly dividend increased by 25% to $10 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ituran Location and Control Ltd (ITRN, Financial) reported a 7% year-over-year increase in fourth-quarter revenues, reaching $82.9 million.

- The company added 40,000 net subscribers in the fourth quarter, reaching the top end of their expectations.

- A successful joint venture in India with LUMAX and a contract with Daimler India are expected to drive future growth.

- A new 5-year contract with Nissan in Chile and recognition as 'Supplier of the Year' by Nissan in Mexico highlight strong OEM partnerships.

- The Board of Directors increased the quarterly dividend by 25%, reflecting strong cash flow and a solid financial position.

Negative Points

- The strengthening of the USD negatively impacted financial results when translated from local currencies.

- Gross margins were affected by the product mix and sales volatility across different regions.

- Currency volatility, especially due to changes in the US presidency, poses challenges for financial predictions.

- The OEM segment, while growing, operates at lower margins compared to the retail market.

- ARPU (Average Revenue Per User) may face downward pressure due to the introduction of new solutions and OEM contracts with lower ARPU.