On May 28, 2025, Columbus McKinnon Corp (CMCO, Financial) released its 8-K filing detailing the financial results for its fiscal year and fourth quarter ending March 31, 2025. Columbus McKinnon Corp, a leader in intelligent motion solutions, designs, manufactures, and markets products such as hoists, crane components, and digital power systems, primarily serving the U.S. and international markets.

Fiscal Year 2025 Highlights

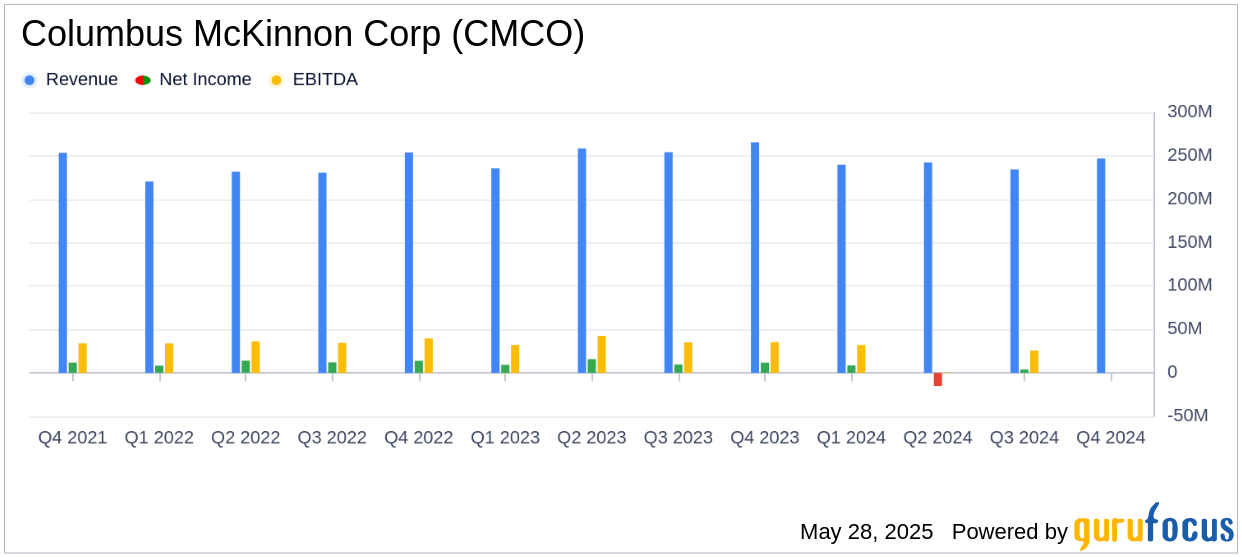

Columbus McKinnon Corp reported record orders of $1.0 billion, marking a 3% increase despite a 1% negative impact from foreign exchange. This growth was driven by an 8% rise in project-related business and a 19% increase in precision conveyance. However, net sales decreased by 5% to $963.0 million, influenced by short cycle order softness and longer delivery timeframes for project-related orders.

Financial Performance and Challenges

The company faced a net loss of $5.1 million, with a net margin of -0.5%, primarily due to significant non-cash pension settlement costs, factory consolidation expenses, and costs related to the pending acquisition of Kito Crosby. Adjusted EBITDA stood at $150.5 million, with an adjusted EBITDA margin of 15.6%. The company also repaid $60.7 million of debt during the fiscal year.

Fourth Quarter 2025 Overview

In the fourth quarter, Columbus McKinnon Corp's orders increased by 2%, despite a 2% negative foreign exchange impact. Net sales were $246.9 million, a 7% decline from the previous year, driven by short cycle demand softness. The company reported a net loss of $2.7 million, with a net margin of -1.1%.

| Metric | Q4 FY 25 | Q4 FY 24 | Change | % Change |

|---|---|---|---|---|

| Net Sales | $246.9 million | $265.5 million | $(18.6) million | (7.0)% |

| Gross Profit | $79.8 million | $94.3 million | $(14.5) million | (15.4)% |

| Net Income (Loss) | $(2.7) million | $11.8 million | $(14.5) million | NM |

Strategic Initiatives and Future Outlook

Columbus McKinnon Corp is focused on mitigating the impact of tariff policies through supply chain adjustments and pricing strategies. The company is also progressing with the acquisition of Kito Crosby, which is expected to enhance its product offerings and geographic reach. The acquisition is anticipated to close later this year, pending regulatory clearance.

“We enter fiscal 2026 with a strong backlog and continued order growth as our commercial initiatives gain traction. Our conviction in Columbus McKinnon's strategy and business model remains strong as we continue to anticipate tailwinds from industry megatrends like on-shoring, scarcity of labor, and global infrastructure investments over time,” said David Wilson, President and Chief Executive Officer.

Financial Metrics and Analysis

Key financial metrics include a gross profit margin of 33.8% for the fiscal year, down from 37.0% the previous year. The adjusted EPS for the fourth quarter was $0.60, a decrease from $0.75 in the prior year. These metrics are crucial for evaluating the company's operational efficiency and profitability in the competitive Farm & Heavy Construction Machinery industry.

Columbus McKinnon Corp's strategic focus on debt reduction and capital allocation towards its Intelligent Motion strategy positions it for potential growth and resilience in the face of market volatility. The company's ability to navigate challenges and leverage industry trends will be critical in achieving its fiscal 2026 objectives.

For the fourth quarter, the reported net sales of $246.9 million were below the estimated revenue of $250.05 million. The adjusted EPS of $0.60 exceeded the estimated earnings per share of $0.49. For the fiscal year, the net sales of $963.0 million were below the estimated revenue of $966.13 million. The adjusted EPS for the year was not provided in the article, but the annual estimate was $0.41.

Explore the complete 8-K earnings release (here) from Columbus McKinnon Corp for further details.