Perpetua Resources (PPTA, Financial) has received an additional funding of up to $6.9 million from the U.S. Army through the Defense Ordnance Technology Consortium. This sum increases the previous $15.5 million awarded in August 2023, aimed at advancing the Ordnance Technology Initiative Agreement (OTIA). The funds are earmarked for testing the feasibility of utilizing materials from Perpetua’s Stibnite Gold Project to produce antimony trisulfide, a necessary element for specific munitions and sophisticated defense systems.

Under the OTIA, Perpetua is tasked with developing and providing a modular pilot plant to the U.S. Army that will process antimony and other materials vital to the Department of Defense. This recent financial boost will expand the scope of material sampling and the pilot plant's capabilities originally outlined in the OTIA. The total funding available under the agreement could reach up to $22.4 million, subject to adjustments by the DOTC based on various factors as the project evolves. Perpetua is also eligible for cost reimbursements under this agreement.

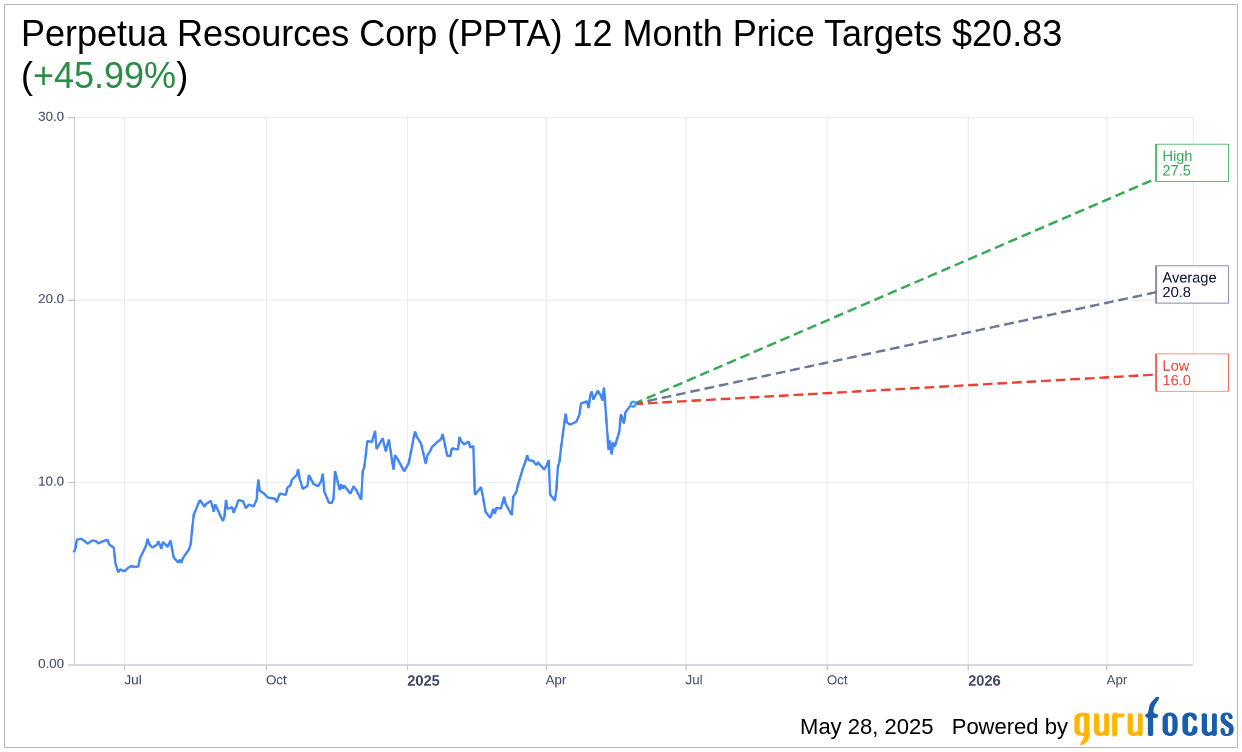

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Perpetua Resources Corp (PPTA, Financial) is $20.83 with a high estimate of $27.50 and a low estimate of $16.00. The average target implies an upside of 45.99% from the current price of $14.27. More detailed estimate data can be found on the Perpetua Resources Corp (PPTA) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Perpetua Resources Corp's (PPTA, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.