Western Copper and Gold (WRN, Financial) has announced the completion of a significant step in their investor rights agreement extension with Mitsubishi Materials. The Japanese company has finalized its acquisition of two million additional common shares of Western Copper, elevating its stake to roughly 5% of the company. This development has paved the way for the extension of the investor rights agreement between the parties until May 30, 2026, following the revised terms laid out on April 15, 2025.

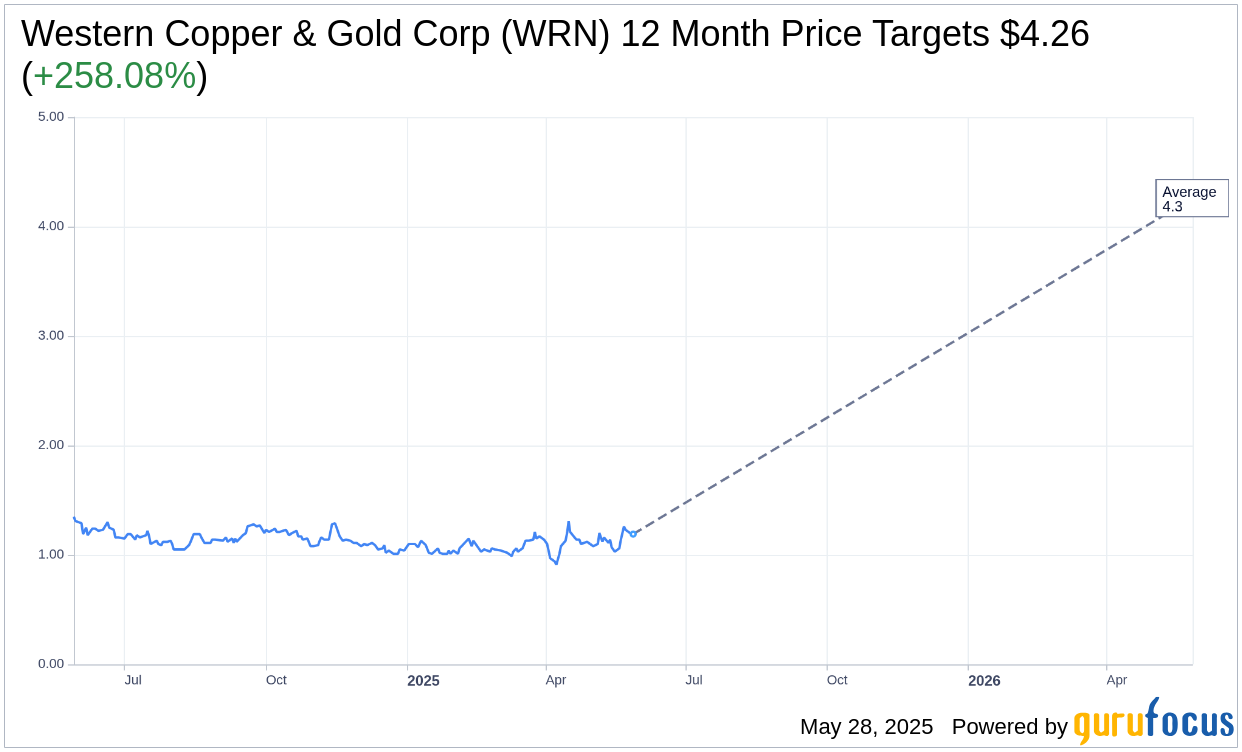

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Western Copper & Gold Corp (WRN, Financial) is $4.26 with a high estimate of $4.26 and a low estimate of $4.26. The average target implies an upside of 258.08% from the current price of $1.19. More detailed estimate data can be found on the Western Copper & Gold Corp (WRN) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Western Copper & Gold Corp's (WRN, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.