Piper Sandler has adjusted its price target for Expand Energy (EXE, Financial), increasing it from $136 to $139, while maintaining an Overweight rating for the stock. This update follows an observed improvement in SWPA productivity, positioning Expand Energy as a favored choice in the gas sector. The firm highlights the company's strong potential to benefit from heightened demand linked to expanding LNG export capacity along the Gulf Coast, alongside sustainable power demand trends.

Wall Street Analysts Forecast

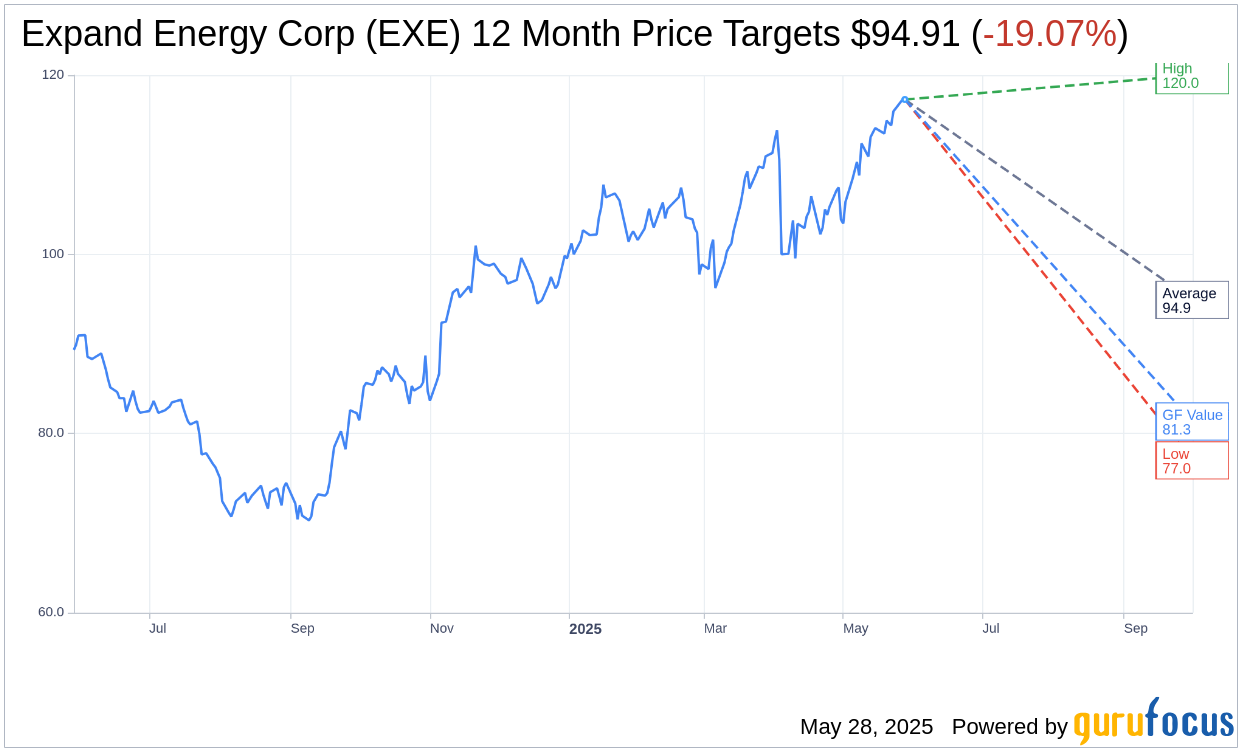

Based on the one-year price targets offered by 18 analysts, the average target price for Expand Energy Corp (EXE, Financial) is $94.91 with a high estimate of $120.00 and a low estimate of $77.00. The average target implies an downside of 19.07% from the current price of $117.28. More detailed estimate data can be found on the Expand Energy Corp (EXE) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Expand Energy Corp's (EXE, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Expand Energy Corp (EXE, Financial) in one year is $81.34, suggesting a downside of 30.64% from the current price of $117.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Expand Energy Corp (EXE) Summary page.