Monro Inc (MNRO, Financial) released its 8-K filing on May 28, 2025, detailing its financial performance for the fourth quarter and fiscal year ended March 29, 2025. The company, a leading provider of automotive undercar repair and tire services in the United States, reported a decrease in sales and an increase in operating expenses, leading to a net loss for the quarter.

Company Overview

Monro Inc is a prominent provider of automobile service stations across the United States. The company offers a range of services, including maintenance, repair, tire, and fleet management, with a focus on undercar services such as brake, steering, exhaust, drivetrain, and suspension systems. Monro also operates tire stores specializing in tire replacement and service.

Fourth Quarter Financial Performance

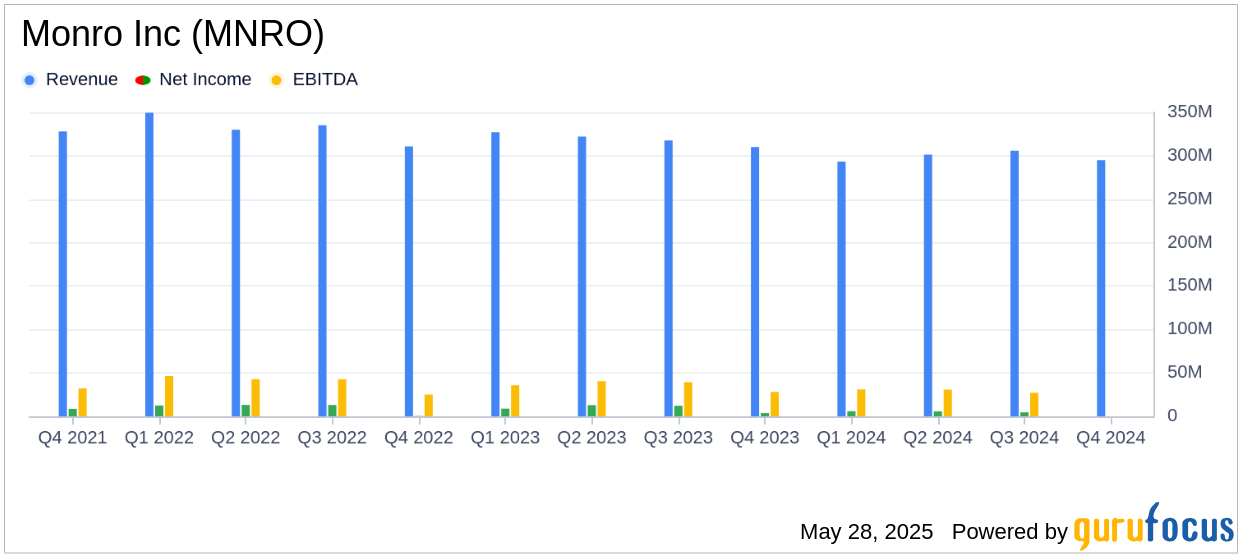

For the fourth quarter of fiscal 2025, Monro Inc reported sales of $295.0 million, a 4.9% decrease from $310.1 million in the same period of fiscal 2024. This decline was attributed to six fewer selling days compared to the previous year. Despite this, comparable store sales increased by 2.8% when adjusted for days, although they decreased by 3.6% unadjusted for days.

The company's gross margin decreased by 250 basis points, primarily due to higher material costs and increased technician labor costs. Operating expenses rose to $121.1 million, or 41.1% of sales, up from $99.7 million, or 32.2% of sales, in the prior year period. This increase was mainly due to $20.9 million in store impairment costs.

Net Loss and Earnings Per Share

Monro Inc reported a net loss of $21.3 million for the fourth quarter, compared to a net income of $3.7 million in the same period of the previous year. The diluted loss per share was $0.72, missing the analyst estimate of $0.08. The adjusted diluted loss per share was $0.09, compared to adjusted diluted earnings per share of $0.21 in the prior year period.

Strategic Initiatives and Challenges

Monro Inc announced a strategic review of its store portfolio, identifying 145 underperforming locations for closure in the first quarter of fiscal 2026. This decision is part of a broader strategy to improve customer experience, drive profitable customer acquisition, and increase merchandising productivity.

“While the results of our fourth quarter were impacted by extreme weather in the first half of the quarter, we drove positive comparable store sales growth in the quarter, adjusted for days, as well as sequential improvement in comparable store sales and gross margin as the months of the quarter progressed,” said Peter Fitzsimmons, President and Chief Executive Officer.

Financial Position and Cash Flow

During fiscal 2025, Monro Inc generated $132 million in cash from operating activities. The company ended the fiscal year with $508.7 million available under its credit facility and $20.8 million in cash and equivalents. Additionally, Monro declared a cash dividend of $0.28 per share for the first quarter of fiscal 2026.

Conclusion

Monro Inc's fourth-quarter results highlight the challenges the company faces, including decreased sales and increased operating expenses. However, the company's strategic initiatives, including store closures and a focus on improving customer experience, aim to enhance profitability and shareholder returns in fiscal 2026. Investors and stakeholders will be keen to see how these strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Monro Inc for further details.