Raymond James has increased its price target for Viper Energy (VNOM, Financial) from $52 to $54, maintaining an Outperform rating. This adjustment follows the latest first-quarter results, where strengthened commodity prices played a significant role in the upward revision. The analysis predicts consistent production growth each quarter, projecting that by 2026, Viper Energy could achieve a production rate of 92.5 thousand barrels of oil equivalent per day, with oil volumes reaching 52.5 thousand barrels per day. These forecasts highlight positive expectations for the company's future performance.

Wall Street Analysts Forecast

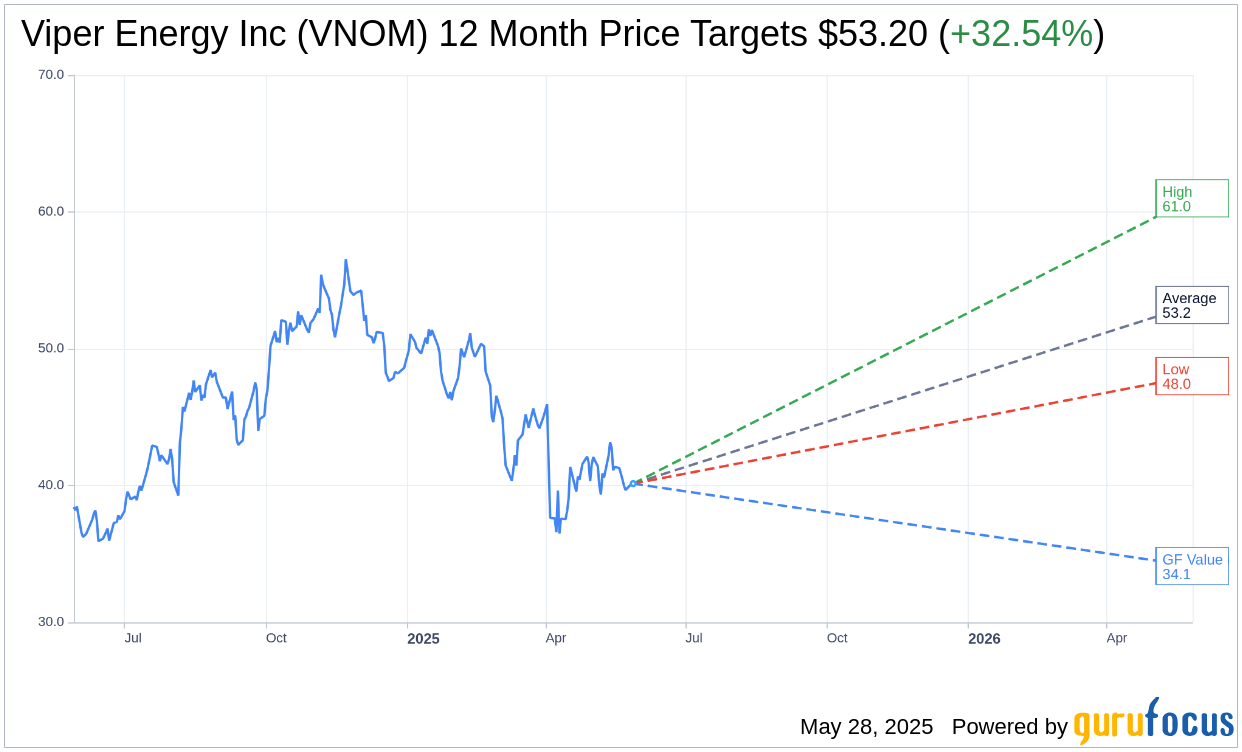

Based on the one-year price targets offered by 15 analysts, the average target price for Viper Energy Inc (VNOM, Financial) is $53.20 with a high estimate of $61.00 and a low estimate of $48.00. The average target implies an upside of 32.54% from the current price of $40.14. More detailed estimate data can be found on the Viper Energy Inc (VNOM) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Viper Energy Inc's (VNOM, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Viper Energy Inc (VNOM, Financial) in one year is $34.12, suggesting a downside of 15% from the current price of $40.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Viper Energy Inc (VNOM) Summary page.

VNOM Key Business Developments

Release Date: May 06, 2025

- Oil and Total Production: Above the high end of their respective guidance ranges for Q1 2025.

- Free Cash Flow Margins: High, contributing to Viper's strong position during market volatility.

- Leverage: Expected to remain below 1 time even in a sustained $50 per barrel WTI environment.

- Share Issuance: Approximately $28 million shares issued in January for dropdown transaction funding.

- Net Proceeds: Roughly $1.3 billion from the primary equity offering, resulting in deleveraging.

- Q1 Dividend: $0.57 per share, approximately $0.07 lower due to timing of dropdown closing.

- Incremental Capital Retention: Roughly $25 million retained on the balance sheet for future capital allocation.

- Production Guidance: Maintained for oil production for the remainder of 2025 despite potential market weakness.

- Third-Party Production: 45% of current production operated by third parties, with ExxonMobil leading.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Viper Energy Inc (VNOM, Financial) reported strong oil and total production, exceeding the high end of their guidance ranges for the first quarter of 2025.

- The company successfully closed a transformative drop-down transaction with Diamondback, which is expected to maintain leverage below 1 time even in a $50 per barrel WTI environment.

- Viper Energy Inc (VNOM) has a strong balance sheet, allowing for opportunistic share repurchases during market volatility.

- The company maintains a durable production outlook and has kept its previous guidance for oil production for the remainder of 2025.

- Viper Energy Inc (VNOM) was upgraded to investment grade by Fitch, enhancing its access to capital and positioning it well in the mineral space.

Negative Points

- The company is facing a period of lower commodity prices and significant market volatility, which could impact future financial performance.

- Viper Energy Inc (VNOM) did not receive production or cash flow from acquired assets during the first quarter due to the timing of the drop-down closing.

- The Q1 dividend was $0.57, which was $0.07 lower than it would have been without the share issuance, and the company decided to retain $25 million of incremental capital due to market volatility.

- There is potential for sustained weakness in commodity prices, which could affect Viper's production and financial results.

- The company acknowledges that if the sub-$50 oil environment persists, it could impact Viper's production and financial performance in the latter half of the year and into the next year.