JPMorgan has revised its price target for Privia Health (PRVA, Financial), raising it to $32 from the previous $29, while maintaining an Overweight rating on the stock. This decision follows a recent update to the company's financial model, reflecting strong optimism about its future prospects. The adjustment underscores confidence in Privia Health's potential for growth in the healthcare industry.

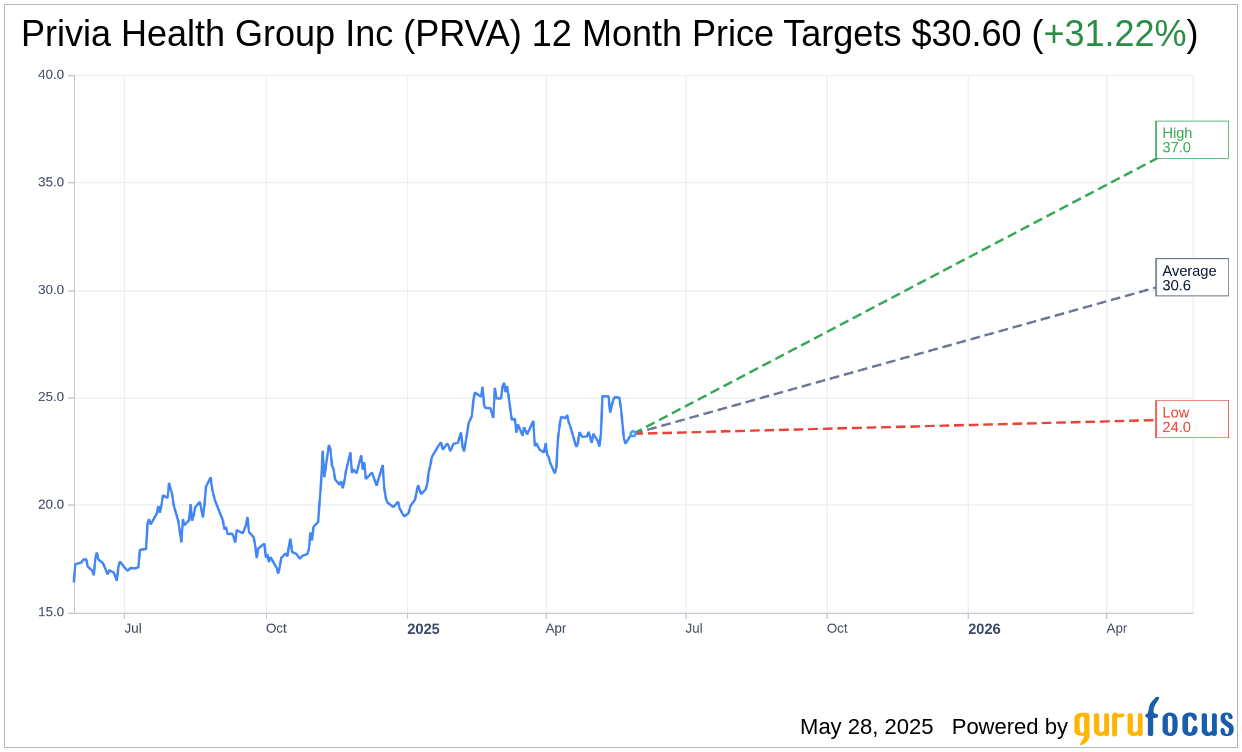

Wall Street Analysts Forecast

Based on the one-year price targets offered by 20 analysts, the average target price for Privia Health Group Inc (PRVA, Financial) is $30.60 with a high estimate of $37.00 and a low estimate of $24.00. The average target implies an upside of 31.22% from the current price of $23.32. More detailed estimate data can be found on the Privia Health Group Inc (PRVA) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Privia Health Group Inc's (PRVA, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Privia Health Group Inc (PRVA, Financial) in one year is $47.91, suggesting a upside of 105.45% from the current price of $23.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Privia Health Group Inc (PRVA) Summary page.

PRVA Key Business Developments

Release Date: May 08, 2025

- Implemented Provider Growth: 11.7% year-over-year increase.

- Value-Based Attribution Growth: 11.1% year-over-year increase.

- Practice Collections: Increased 12.8% to $798.6 million.

- Adjusted EBITDA: Increased 35.1% to $26.9 million.

- EBITDA Margin: Expanded by 460 basis points year-over-year.

- Cash Position: $469 million with no debt.

- Attributed Lives: 1.27 million, a 11.1% increase from the previous year.

- Commercial Attributed Lives: Increased 13.6% to 779,000.

- Medicare Shared Savings Program Lives: Increased nearly 5%.

- Medicare Advantage and Medicaid Attribution: Increased more than 8% and 11%, respectively.

- Arizona Market Entry: $95 million transaction value.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Privia Health Group Inc (PRVA, Financial) reported strong growth with a 12.8% increase in Practice Collections and a 35.1% rise in Adjusted EBITDA year-over-year.

- The company expanded its market presence by entering Arizona, partnering with IMS, a large multi-specialty practice, which is expected to be EBITDA positive by Q4 2025.

- Privia Health Group Inc (PRVA) operates across 15 states and the District of Columbia, with a diversified portfolio of over 5.2 million patients and 1.27 million attributed lives.

- The company maintains a strong financial position with $469 million in cash and no debt, providing flexibility for future growth opportunities.

- Privia Health Group Inc (PRVA) raised its full-year 2025 guidance to the mid-to-high end of initial ranges, reflecting confidence in continued strong performance.

Negative Points

- The financial results are preliminary and subject to change until the Form 10-K is filed with the SEC.

- Attributed Lives guidance remains unchanged, indicating potential challenges in expanding this metric.

- The company faces headwinds in the Medicare Advantage space, with a cautious approach to full capitation contracts due to industry pressures.

- New market entry costs are expected to impact financials, although the Arizona acquisition is anticipated to offset some of these expenses.

- The healthcare environment presents risks and uncertainties that could affect future financial and operating performance.