Mesa Laboratories (MLAB, Financial) reported impressive financial results for the fourth quarter, surpassing revenue estimates with $62.135 million, slightly above the projected $61.9 million. The company concluded FY25 on a strong note, demonstrating solid organic revenue growth across all segments and an increase in overall bookings in the final quarter.

The reported quarterly revenues reflect a 6.3% rise in core organic revenues, significantly driven by robust performance in the SDC division. Despite the overall profitability being somewhat constrained, with an AOI excluding unusual items at 19.7% of revenues, the increase in performance-based compensation costs was attributed to accelerated success in commercial execution during the latter half of the year.

For the full fiscal year, Mesa Laboratories generated $46.808 million in cash flows from operations and achieved $42.559 million in free cash flow. A significant portion of this cash flow was utilized to reduce debt, paying down $17.9 million in the fourth quarter alone, which brought the company's total Net Leverage Ratio down to 3.01.

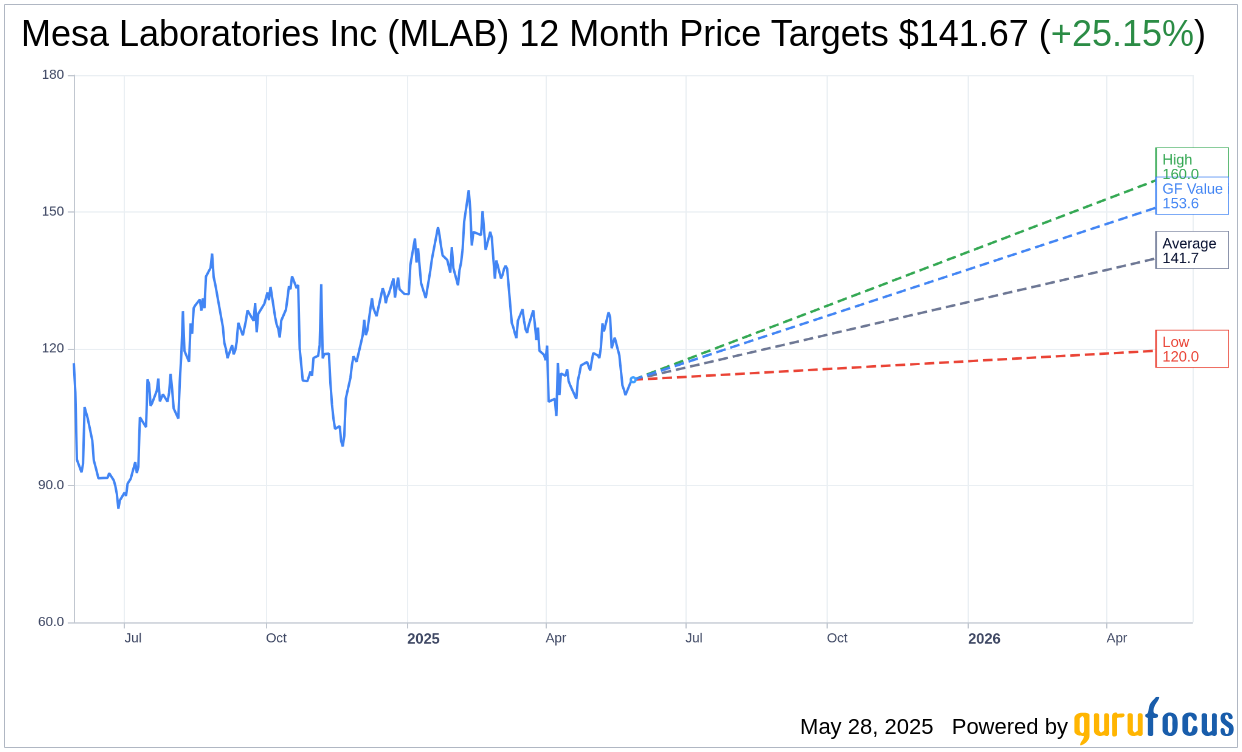

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Mesa Laboratories Inc (MLAB, Financial) is $141.67 with a high estimate of $160.00 and a low estimate of $120.00. The average target implies an upside of 25.15% from the current price of $113.20. More detailed estimate data can be found on the Mesa Laboratories Inc (MLAB) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Mesa Laboratories Inc's (MLAB, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mesa Laboratories Inc (MLAB, Financial) in one year is $153.58, suggesting a upside of 35.67% from the current price of $113.2. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mesa Laboratories Inc (MLAB) Summary page.