STMicroelectronics (STM, Financial) has successfully secured approval for all proposals during its 2025 Annual General Meeting of Shareholders. Key highlights include the adoption of the company's financial statements for 2024, which align with International Financial Reporting Standards. These financials, filed on March 27, 2025, with the Netherlands Authority for the Financial Markets, are accessible on both the company's and the AFM’s websites.

The meeting also confirmed a dividend distribution of $0.36 per share, set to be paid in $0.09 quarterly installments from the second quarter of 2025 through the first quarter of 2026, benefiting shareholders on record in each respective quarter.

Notably, the AGM included significant appointments and reappointments within the Supervisory Board. Werner Lieberherr and Ms. Simonetta Acri were newly appointed, while Ms. Anna de Pro Gonzalo and Ms. Helene Vletter-van Dort were reappointed, all for terms that conclude in 2028. PricewaterhouseCoopers Accountants N.V. has been named the external auditor for 2026-2029, also tasked with auditing sustainability reports for 2026-2027.

Further resolutions encompassed approvals of stock-based compensation for the President, CEO, and CFO, authorization for share repurchase, and delegations for issuing new shares and managing pre-emptive rights. Additionally, discharges were granted for both the Managing and Supervisory Boards.

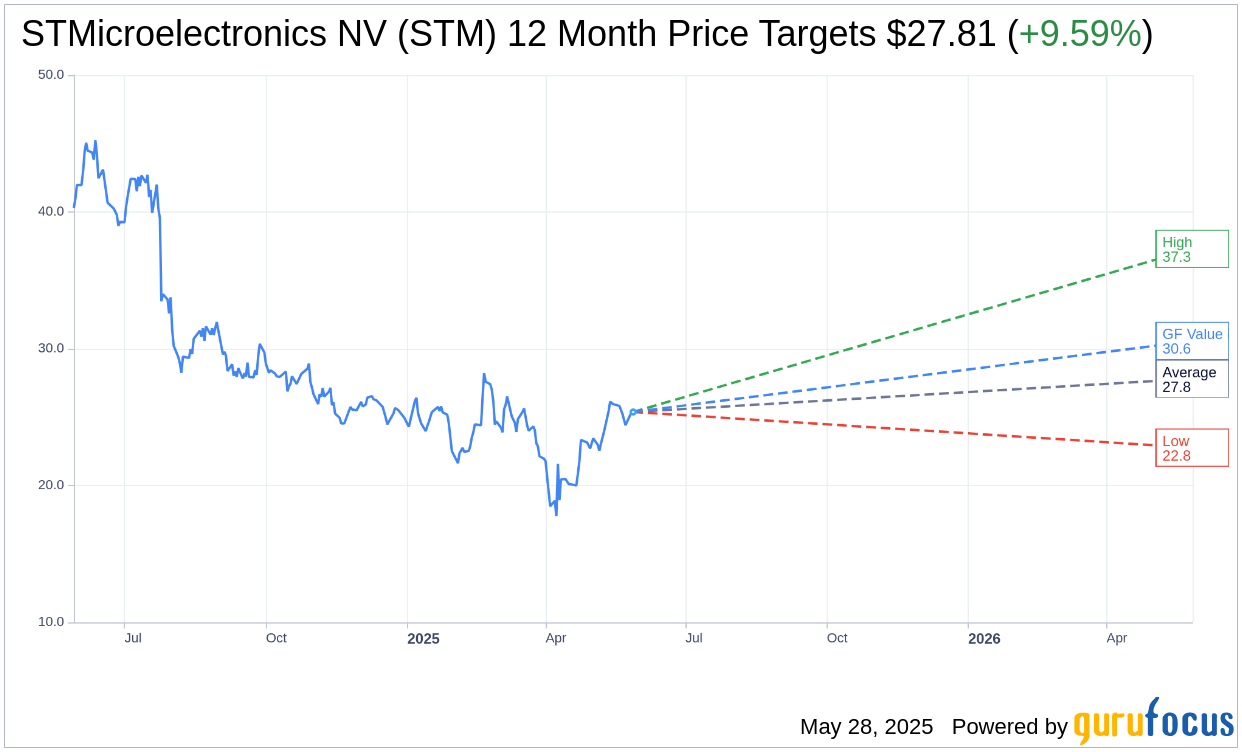

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for STMicroelectronics NV (STM, Financial) is $27.81 with a high estimate of $37.30 and a low estimate of $22.77. The average target implies an upside of 9.59% from the current price of $25.38. More detailed estimate data can be found on the STMicroelectronics NV (STM) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, STMicroelectronics NV's (STM, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for STMicroelectronics NV (STM, Financial) in one year is $30.57, suggesting a upside of 20.45% from the current price of $25.38. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the STMicroelectronics NV (STM) Summary page.