Summary:

- Potential easing of China’s rare earth export restrictions could benefit ASML and other European semiconductor companies.

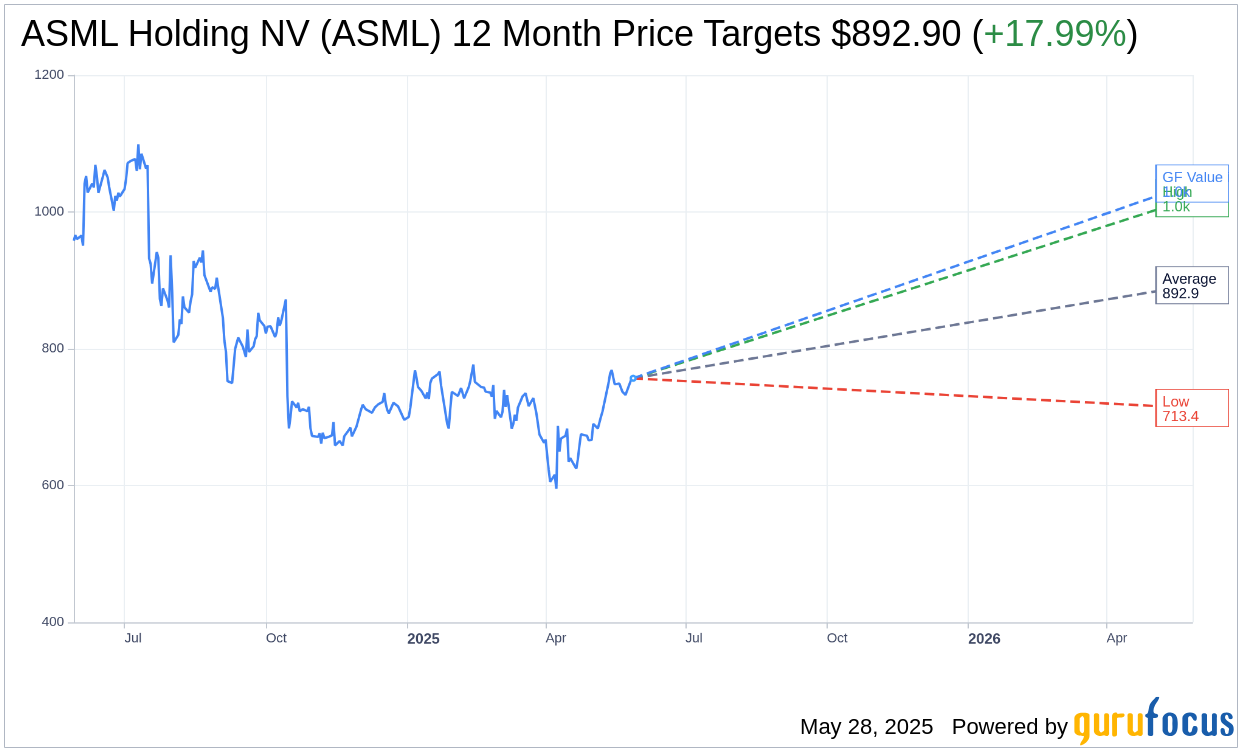

- Analysts forecast a potential 17.99% upside for ASML with a consensus "Outperform" rating.

- GuruFocus estimates a 37.63% upside for ASML, highlighting its attractive valuation.

China's Strategic Shift: Implications for European Semiconductors

Recent discussions among Chinese officials indicate a potential easing of restrictions on rare earth exports, a move that could significantly impact the European semiconductor sector. Among the companies poised to benefit is ASML Holding NV (NASDAQ: ASML), which relies on these crucial materials for its manufacturing processes. This strategic shift could enhance the supply chain stability for semiconductor firms across Europe.

Wall Street Analysts' Perspectives

Analysts have set an average one-year price target of $892.90 for ASML Holding NV, projecting a high of $1,020.22 and a low of $713.42. With the current price at $756.79, this average target suggests a potential upside of 17.99%. Investors can find more in-depth forecast details on the ASML Holding NV (ASML, Financial) Forecast page.

Furthermore, ASML enjoys an "Outperform" recommendation from 15 brokerage firms, with an average rating of 1.8. This rating reflects a strong consensus towards growth, where 1 is a Strong Buy and 5 is a Sell.

GuruFocus Valuation Insights

GuruFocus provides a compelling valuation estimate for ASML Holding NV with a projected GF Value of $1041.57, signifying a potential upside of 37.63% from its current price. The GF Value is derived from historical trading multiples, business growth trends, and future performance estimates. More details are available on the ASML Holding NV (ASML, Financial) Summary page.

Investors monitoring the semiconductor space should consider these potential opportunities and risks, as shifting market dynamics may significantly influence ASML's trajectory.