Key Highlights:

- CACI International secures a major $400 million contract extension from the U.S. Army.

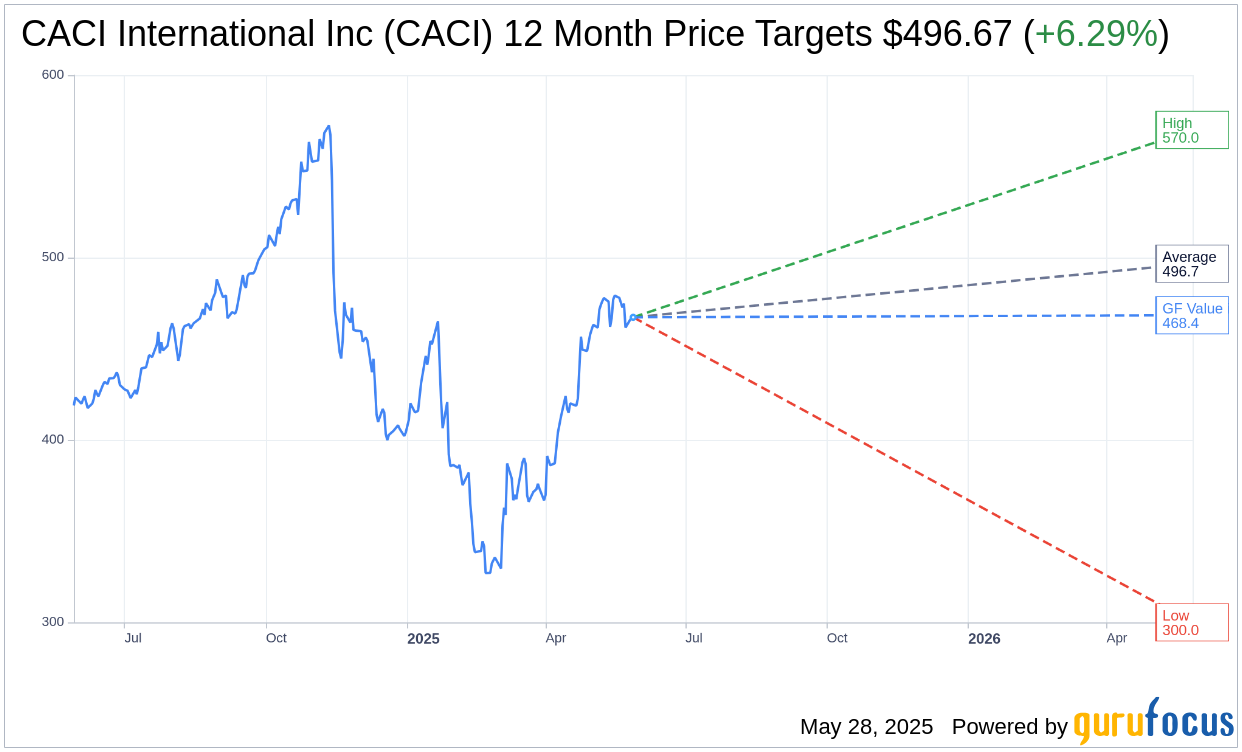

- Analysts project a potential upside of 6.29% for CACI International's stock.

- Company maintains an "Outperform" status with an average recommendation of 2.0.

CACI International's Strategic Military Contract

CACI International Inc. (CACI) has successfully acquired a significant $400 million contract modification from the U.S. Army. This contract is aimed at enhancing the Terrestrial Layer System Brigade Combat Team Manpack. With this extension, Mastodon Design, a subsidiary of CACI, is set to propel its state-of-the-art, adaptable, and compact technology, thereby amplifying signals intelligence and electronic warfare capabilities for tactical military units.

Wall Street Analysts' Perspective on CACI

According to projections from 14 analysts, CACI International Inc.'s stock is anticipated to reach an average price target of $496.67 over the next year. Their estimates suggest a potential high of $570.00 and a low of $300.00. This average target reflects an encouraging upside of 6.29% from the current stock price of $467.27. Investors seeking further insights can explore more detailed estimates on the CACI International Inc (CACI, Financial) Forecast page.

Market Recommendations and GF Value Assessment

The consensus among 17 brokerage firms places CACI International Inc. with an average brokerage recommendation of 2.0, classifying it as "Outperform." This rating scale ranges from 1 to 5, where 1 indicates a Strong Buy and 5 reflects a Sell status.

Utilizing GuruFocus' proprietary metrics, the estimated GF Value of CACI International Inc. is calculated to be $468.39, suggesting a modest potential upside of 0.24% from the current market price. The GF Value is determined based on historical stock multiples, past business growth, and future performance projections. Investors can access more comprehensive data on the CACI International Inc (CACI, Financial) Summary page.