CACI International (CACI, Financial) has secured a significant contract modification from the U.S. Army valued at nearly $400 million. This extension will enable the continued procurement, training, and deployment of the Terrestrial Layer System Brigade Combat Team Manpack. The agreement was awarded to Mastodon Design, LLC, a subsidiary of CACI. The project aims to provide soldiers with enhanced signals intelligence and electronic warfare capabilities, enhancing their operational effectiveness at the tactical level.

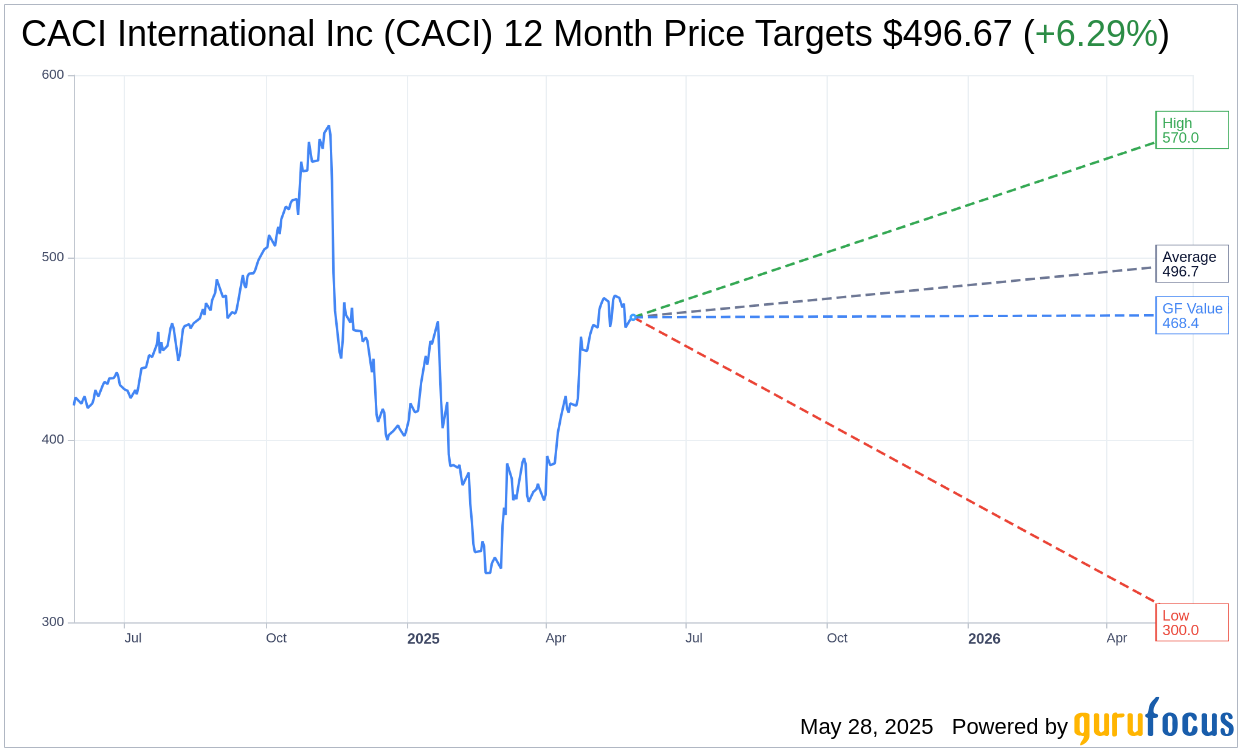

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for CACI International Inc (CACI, Financial) is $496.67 with a high estimate of $570.00 and a low estimate of $300.00. The average target implies an upside of 6.29% from the current price of $467.27. More detailed estimate data can be found on the CACI International Inc (CACI) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, CACI International Inc's (CACI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CACI International Inc (CACI, Financial) in one year is $468.39, suggesting a upside of 0.24% from the current price of $467.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CACI International Inc (CACI) Summary page.