Check Point (CHKP, Financial) has unveiled significant improvements to its Quantum Force Security Gateways. These upgrades will boost threat prevention throughput by 15%-25% for all Quantum Force Security Gateways targeting data center and perimeter protection, achieved through a straightforward software update.

Additionally, Check Point has introduced a new series of AI-driven Quantum Force Branch Office Security Gateways. These devices promise enterprise-level firewall security while delivering up to four times the threat prevention performance compared to their predecessors. The new branch firewalls boast a remarkable 99.9% block rate and enhanced cloud application speeds, optimized for SD-WAN to accommodate the needs of hybrid networks and dispersed workforce demands.

Recent findings from Check Point Research indicate that branch offices now encounter around 713 cyber attack attempts on average each week at each location, marking a 36% increase from last year. Furthermore, half of these offices face challenges from external vulnerabilities, underscoring the critical need for strong branch security and flexible management in today's AI-driven landscape.

Wall Street Analysts Forecast

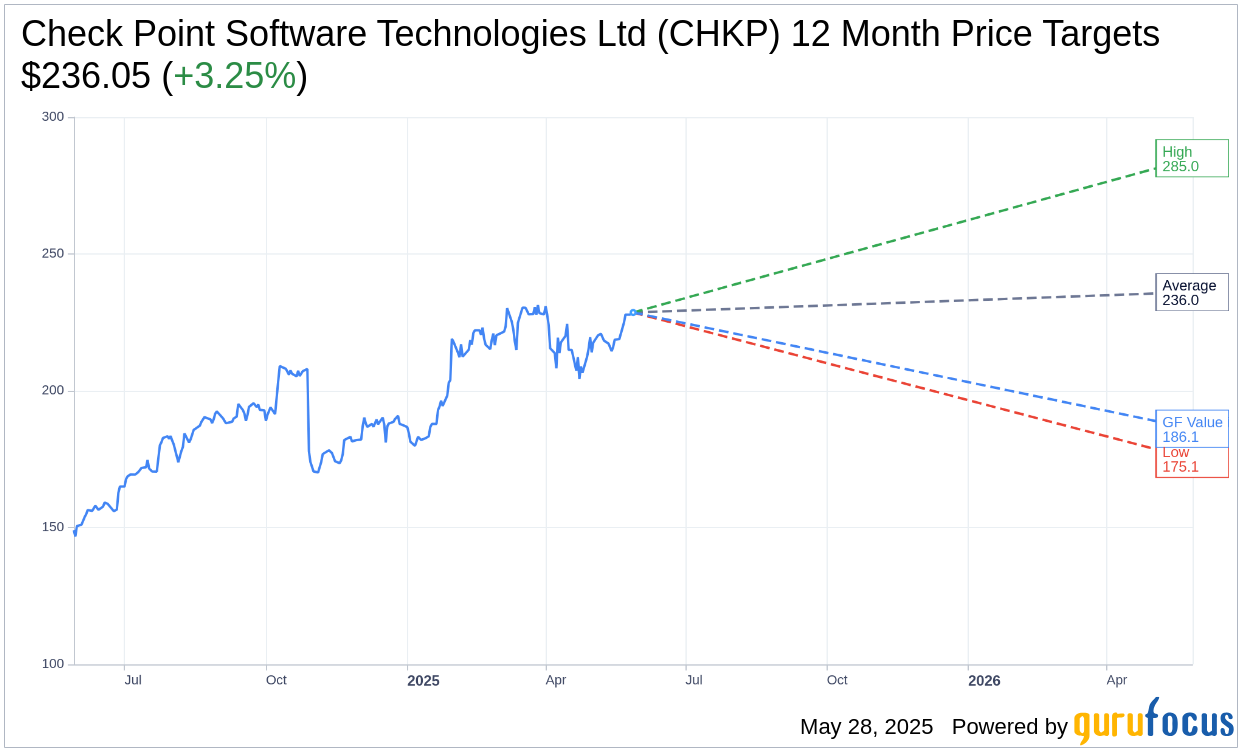

Based on the one-year price targets offered by 31 analysts, the average target price for Check Point Software Technologies Ltd (CHKP, Financial) is $236.05 with a high estimate of $285.00 and a low estimate of $175.12. The average target implies an upside of 3.25% from the current price of $228.62. More detailed estimate data can be found on the Check Point Software Technologies Ltd (CHKP) Forecast page.

Based on the consensus recommendation from 40 brokerage firms, Check Point Software Technologies Ltd's (CHKP, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Check Point Software Technologies Ltd (CHKP, Financial) in one year is $186.14, suggesting a downside of 18.58% from the current price of $228.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Check Point Software Technologies Ltd (CHKP) Summary page.