Salesforce (CRM, Financial) is set to release its fiscal Q1 earnings after the market closes on Wednesday, May 28, with a follow-up conference call at 5:00 pm ET. For the first quarter, the company has projected adjusted earnings per share (EPS) between $2.53 and $2.55, with anticipated revenue ranging from $9.71 billion to $9.76 billion. The consensus estimates, having slipped slightly from original figures, now stand at an EPS of $2.55 and revenue of $9.75 billion.

Salesforce has been active in expanding its portfolio and partnerships. In February, an enhanced collaboration with Google was announced, focusing on AI-powered solutions. In March, Salesforce launched AgentExchange to broaden its digital labor market offerings. It also revealed updates to its digital labor platform, Agentforce 2dx, and integrated solutions for Singapore Airlines.

In terms of leadership, Robin Washington recently assumed the role of president and chief operating and financial officer. Additionally, Salesforce plans to acquire Informatica for about $8 billion, with the transaction expected to be finalized in fiscal year 2027. This deal aims to deliver financial synergies and enhance Salesforce’s data capabilities.

Analysts have varied views. Stifel maintains a Buy rating with a $375 target, citing slightly better than expected Q1 insights. Conversely, Citi adjusted Salesforce’s price target to $320, emphasizing mixed demand signals. BMO Capital also lowered its target to $350 while staying optimistic on long-term prospects.

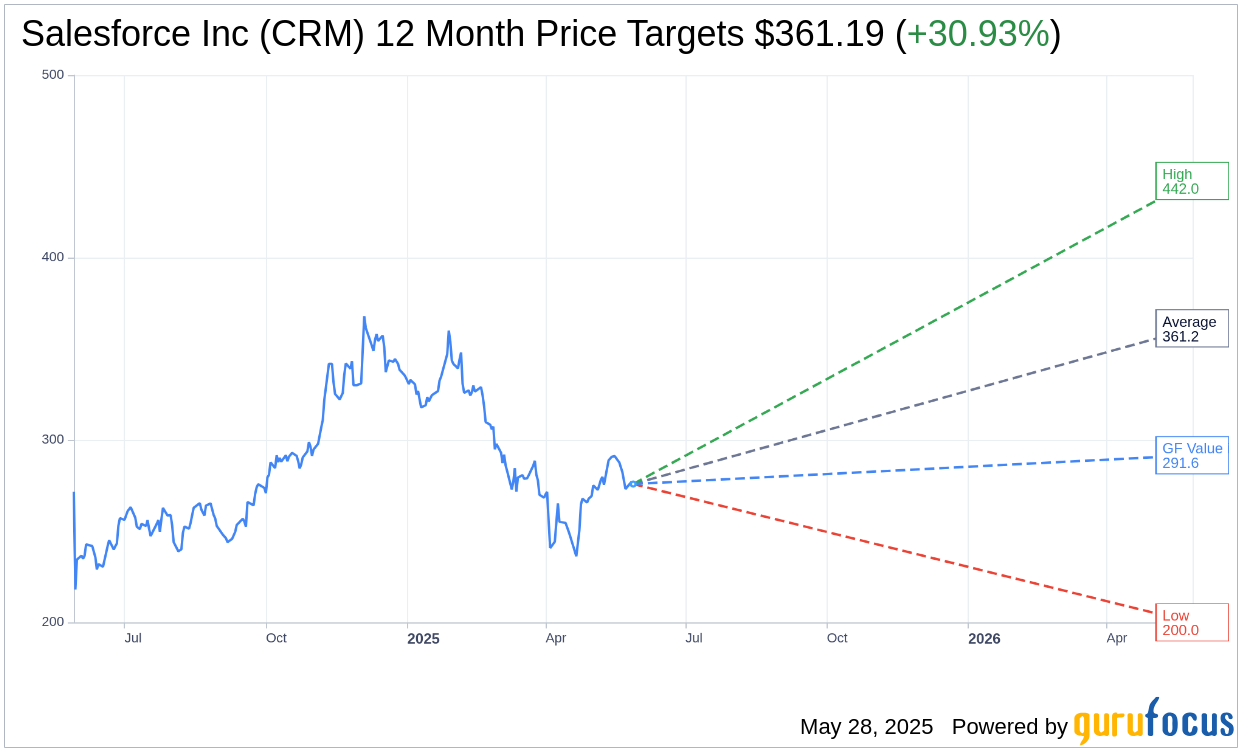

Wall Street Analysts Forecast

Based on the one-year price targets offered by 48 analysts, the average target price for Salesforce Inc (CRM, Financial) is $361.19 with a high estimate of $442.00 and a low estimate of $200.00. The average target implies an upside of 30.93% from the current price of $275.86. More detailed estimate data can be found on the Salesforce Inc (CRM) Forecast page.

Based on the consensus recommendation from 54 brokerage firms, Salesforce Inc's (CRM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Salesforce Inc (CRM, Financial) in one year is $291.64, suggesting a upside of 5.72% from the current price of $275.8638. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Salesforce Inc (CRM) Summary page.