Quick Highlights:

- Editas Medicine joins the Russell Microcap Index, marking a significant milestone in the healthcare sector.

- Analysts suggest a potential upside of over 100% from current stock prices.

- The company holds a "Hold" rating based on consensus from multiple brokerage firms.

Inclusion in the Russell Microcap Index

Editas Medicine (EDIT, Financial) is poised to join the ranks of the Russell Microcap Index following the latest annual reconstitution by FTSE Russell. Scheduled to take effect after market close on June 27, this inclusion underscores Editas Medicine's evolving position within the competitive healthcare sector. The transition not only solidifies its standing among emerging companies but also aligns with strategic developments as several peers face removal from the index.

Analyst Forecasts and Price Targets

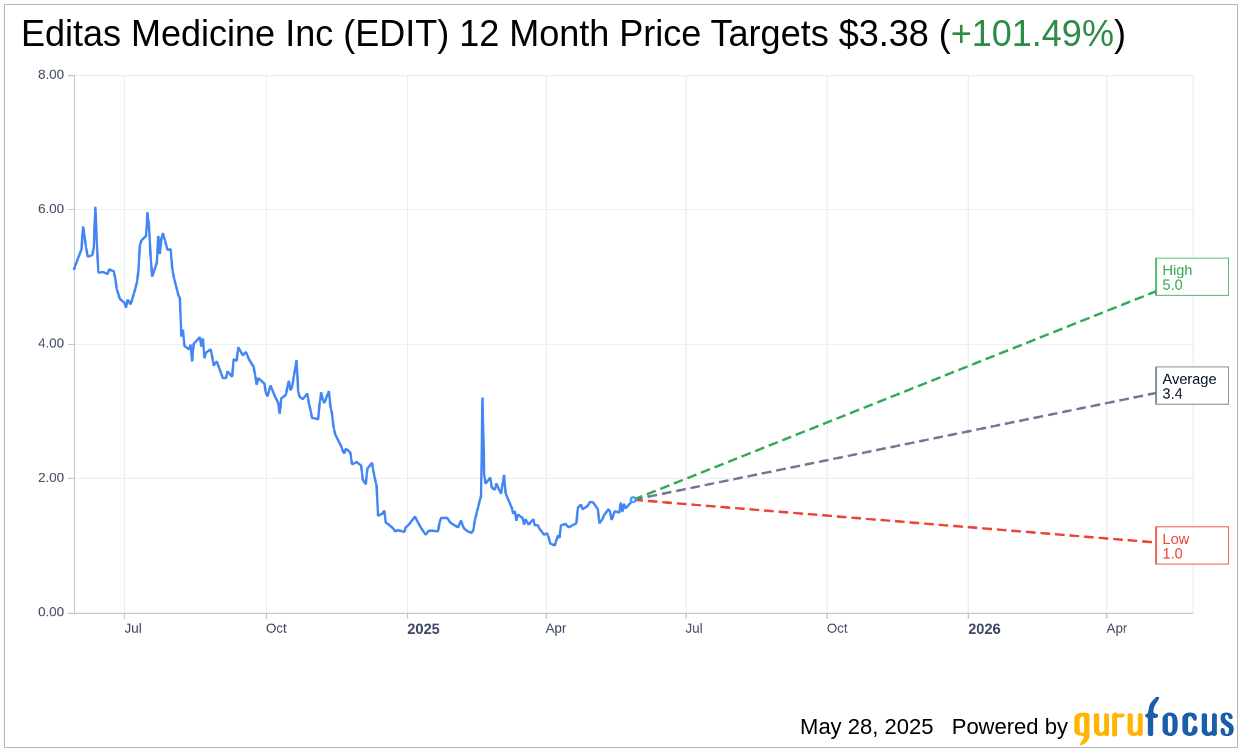

The company's prospects appear promising based on the analysis of eight financial experts. The median one-year price target for Editas Medicine Inc (EDIT, Financial) is estimated at $3.38. Projections range from a high of $5.00 to a low of $1.00, suggesting a notable upside potential of 101.49% from the current stock price of $1.68. Investors can explore more in-depth forecasting data on the Editas Medicine Inc (EDIT) Forecast page.

Brokerage Recommendations

Consensus among 15 brokerage firms places Editas Medicine Inc (EDIT, Financial) at an average recommendation of 2.7, categorizing it as a "Hold." This rating scale spans from 1, indicating a Strong Buy, to 5, which suggests Sell. This consensus reflects a cautious optimism in the stock's potential, urging investors to monitor developments closely.

GF Value and Future Outlook

According to GuruFocus estimates, the projected GF Value for Editas Medicine Inc (EDIT, Financial) stands at $3.47 in one year, signifying a potential upside of 107.16% from the current trading price of $1.675. The GF Value represents a fair value estimate, calculated from historical trading multiples and anticipated business growth. For comprehensive insights, visit the Editas Medicine Inc (EDIT) Summary page.