RBC Capital, under the analysis of Kenneth Lee, has maintained its "Sector Perform" rating for MFA Financial (MFA, Financial) as of May 28, 2025. The rating remains consistent with previous assessments by the firm. This decision reflects RBC Capital's continued outlook on MFA's market positioning relative to its sector.

However, the price target for MFA has been adjusted downward. The revised price target is now set at $10.00 USD, a decrease from the previous target of $12.00 USD. This represents a reduction of approximately 16.67% in the projected price level. The adjusted price target provides a new benchmark for investors considering MFA's future market performance.

Investors and market watchers tracking MFA (MFA, Financial) should take note of these adjustments as they could impact investment strategies and portfolio evaluations. The price target adjustment highlights a revised expectation for MFA's financial performance in the coming periods, as perceived by RBC Capital.

Wall Street Analysts Forecast

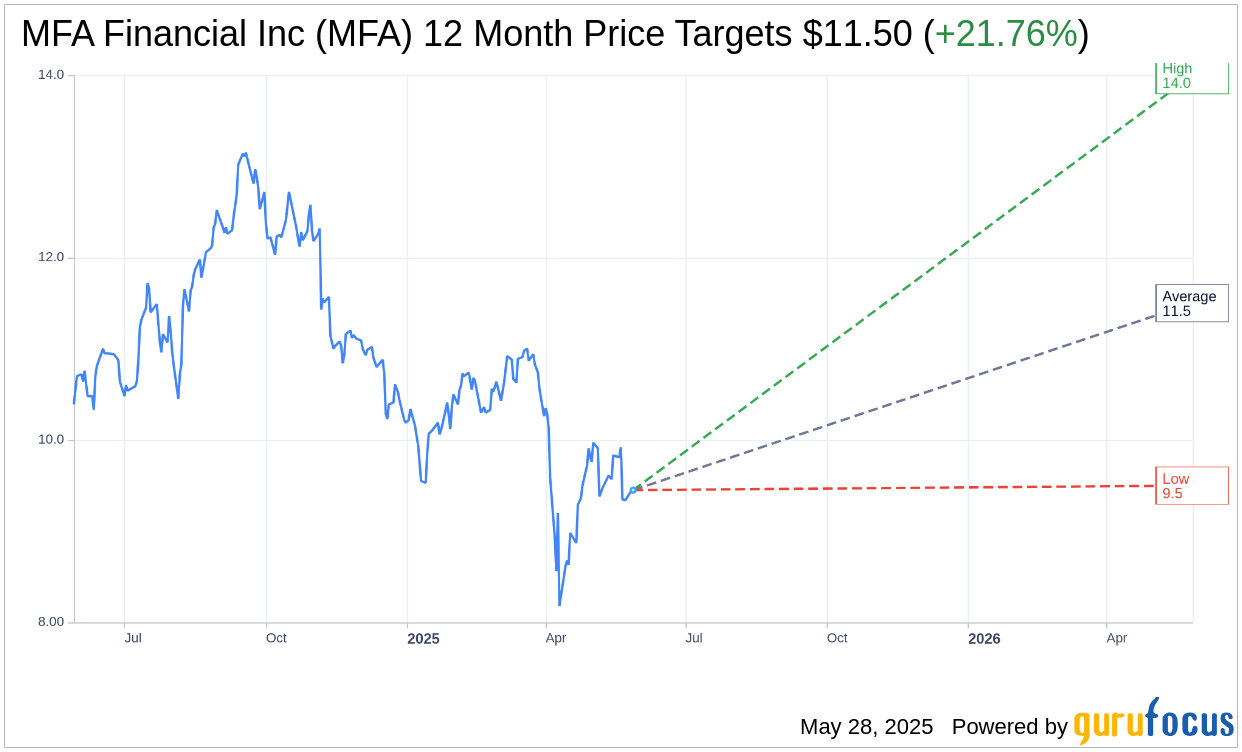

Based on the one-year price targets offered by 5 analysts, the average target price for MFA Financial Inc (MFA, Financial) is $11.50 with a high estimate of $14.00 and a low estimate of $9.50. The average target implies an upside of 21.76% from the current price of $9.45. More detailed estimate data can be found on the MFA Financial Inc (MFA) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, MFA Financial Inc's (MFA, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.