- Mesa Laboratories (MLAB, Financial) surpasses Q4 earnings expectations with strong performance.

- Analyst forecasts indicate significant stock upside potential.

- MLAB's GF Value suggests robust growth potential in the upcoming year.

Q4 Performance Overview

Mesa Laboratories (MLAB) impressed investors with its latest fourth-quarter report. The company achieved non-GAAP earnings per share of $2.25, beating forecasts by $0.18. Additionally, revenue rose to $62.14 million, reflecting a year-over-year growth of 5.5%, and exceeded projections by $0.24 million.

Analyst Forecasts and Price Targets

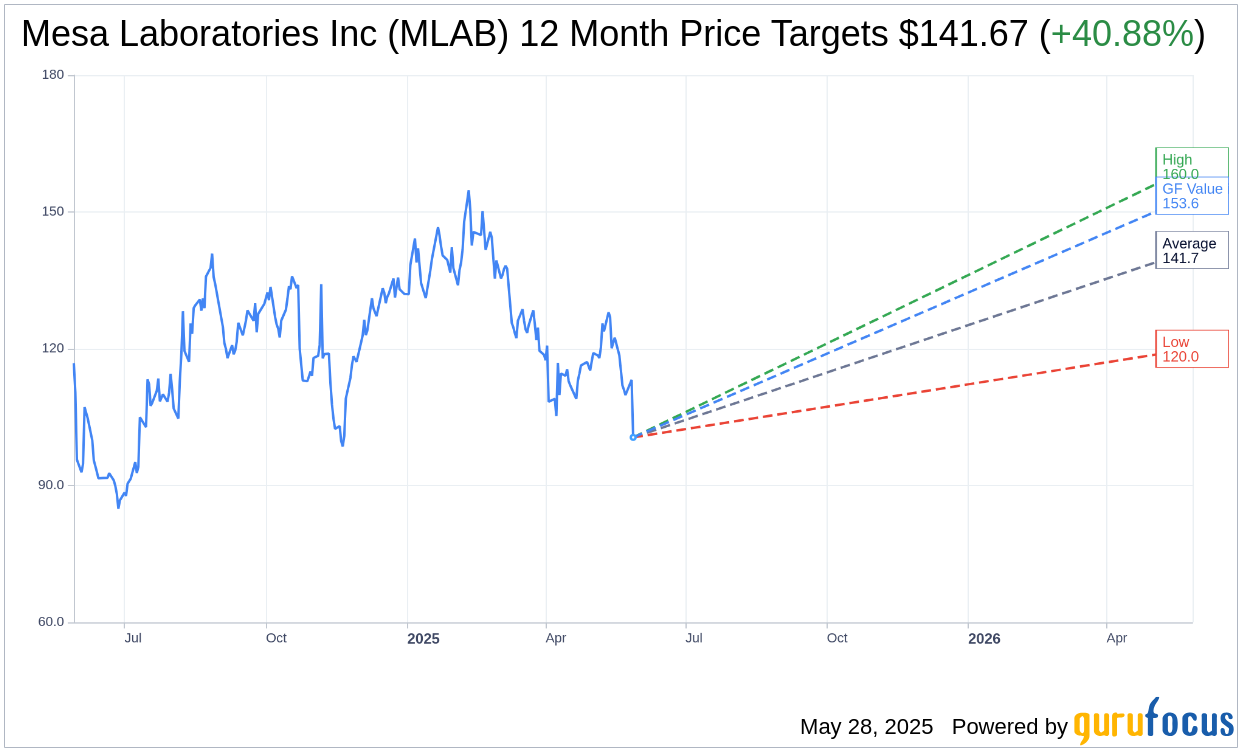

Market analysts are optimistic about Mesa Laboratories' future, projecting an average target price of $141.67 for MLAB. The estimates range from a high of $160.00 to a low of $120.00, suggesting a potential upside of 40.88% from the current share price of $100.56. For in-depth analysis, visit the Mesa Laboratories Inc (MLAB, Financial) Forecast page.

The consensus from four brokerage firms gives Mesa Laboratories an average recommendation score of 2.5, categorizing it as "Outperform." This rating scale, spanning from 1 (Strong Buy) to 5 (Sell), signals positive sentiment among analysts.

GF Value and Investment Potential

According to GuruFocus estimates, the one-year GF Value for Mesa Laboratories is pegged at $153.58. This suggests a compelling upside of 52.73% from the current trading price of $100.555. The GF Value represents GuruFocus' calculated fair value based on historical trading multiples, past performance, and future growth projections. For more comprehensive insights, explore the Mesa Laboratories Inc (MLAB, Financial) Summary page.

In conclusion, Mesa Laboratories exhibits strong growth potential, backed by favorable analyst predictions and a promising GF Value. Investors may find this stock an attractive prospect for future gains.