- Fannie Mae partners with Palantir Technologies to revolutionize its fraud detection with AI.

- Analysts predict a significant downside for Fannie Mae's stock price.

- GuruFocus's GF Value indicates a potential overvaluation of FNMA shares.

Fannie Mae (FNMA, Financial) is embarking on a transformative journey by joining forces with Palantir Technologies (PLTR) to harness the power of artificial intelligence for fraud detection. This strategic collaboration is set to revolutionize Fannie Mae's new Crime Detection Unit, enhancing its capabilities to identify mortgage fraud more efficiently and accurately.

Wall Street Analysts' Insights

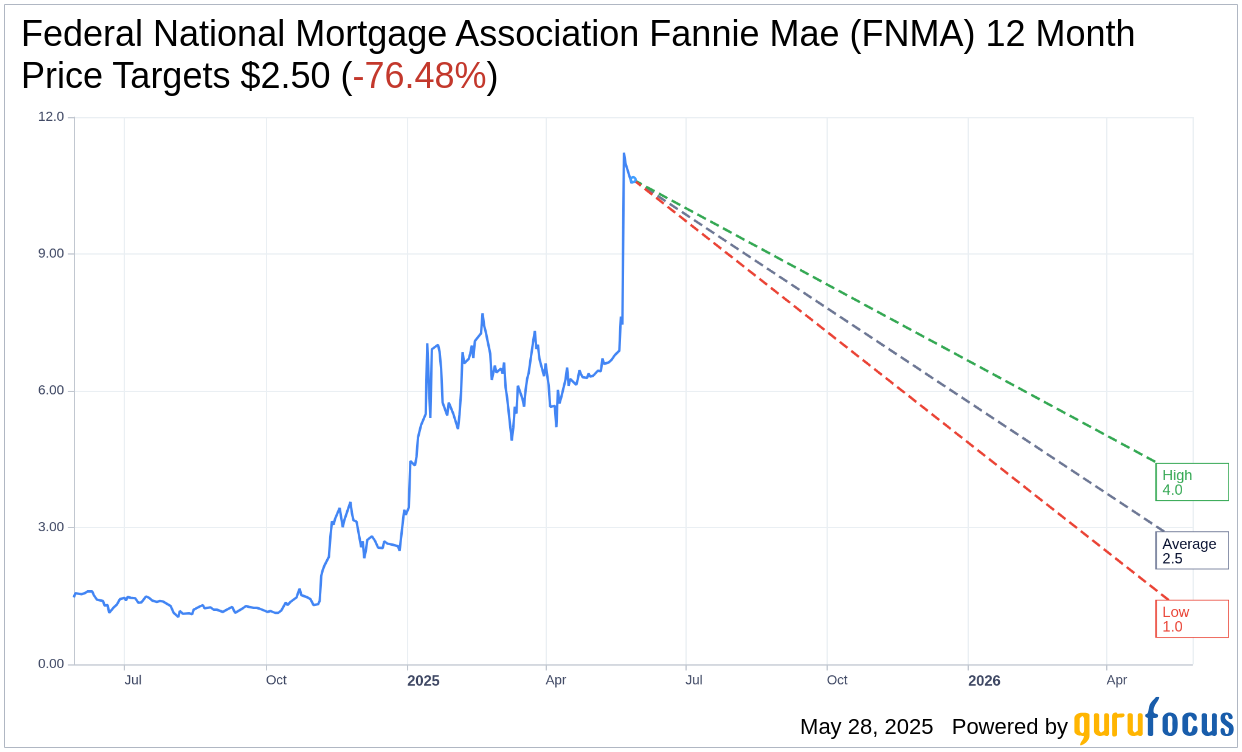

According to projections by two analysts, the Federal National Mortgage Association Fannie Mae (FNMA, Financial) has a one-year average price target of $2.50. This target encompasses a high estimate of $4.00 and a low estimate of $1.00. The average price target suggests a significant downside of 76.48% from the current trading price of $10.63. For a more detailed breakdown, visit the Federal National Mortgage Association Fannie Mae (FNMA) Forecast page.

Brokerage firm consensus, based on one firm's recommendation, rates Federal National Mortgage Association Fannie Mae's (FNMA, Financial) stock as "Underperform", with an average recommendation score of 4.0. The rating scale ranges from 1 to 5, where 1 is a Strong Buy, and 5 is a Sell.

Assessing the GF Value

GuruFocus has pegged the estimated GF Value for FNMA at $0.80 in the coming year. This estimation indicates a potential downside of 92.47% from the current market price of $10.63. The GF Value is a reflection of the fair value that the stock is anticipated to trade at, derived from historical trading multiples, past business growth, and forecasted performance. For additional information, explore the FNMA Summary page.