The U.S. Department of Labor's Employee Benefits Security Administration has withdrawn a compliance release from 2022 that previously advised against including cryptocurrency options in 401(k) retirement plans. The prior guidance emphasized the need for fiduciaries to exercise significant caution before offering cryptocurrencies as investment options. This stance was considered a deviation from the Employee Retirement Income Security Act's requirements and a shift from the department's traditionally neutral approach to fiduciary investments.

By rescinding the previous directive, the Department of Labor aims to clarify that investment decisions should rest with fiduciaries rather than federal officials. The agency now maintains a neutral position on the matter, neither supporting nor opposing the inclusion of cryptocurrency in investment portfolios. Companies involved in the cryptocurrency sector, such as Bitfarms (BITF, Financial), may find this development impacts their industry landscape as it emphasizes fiduciary discretion in investment choices.

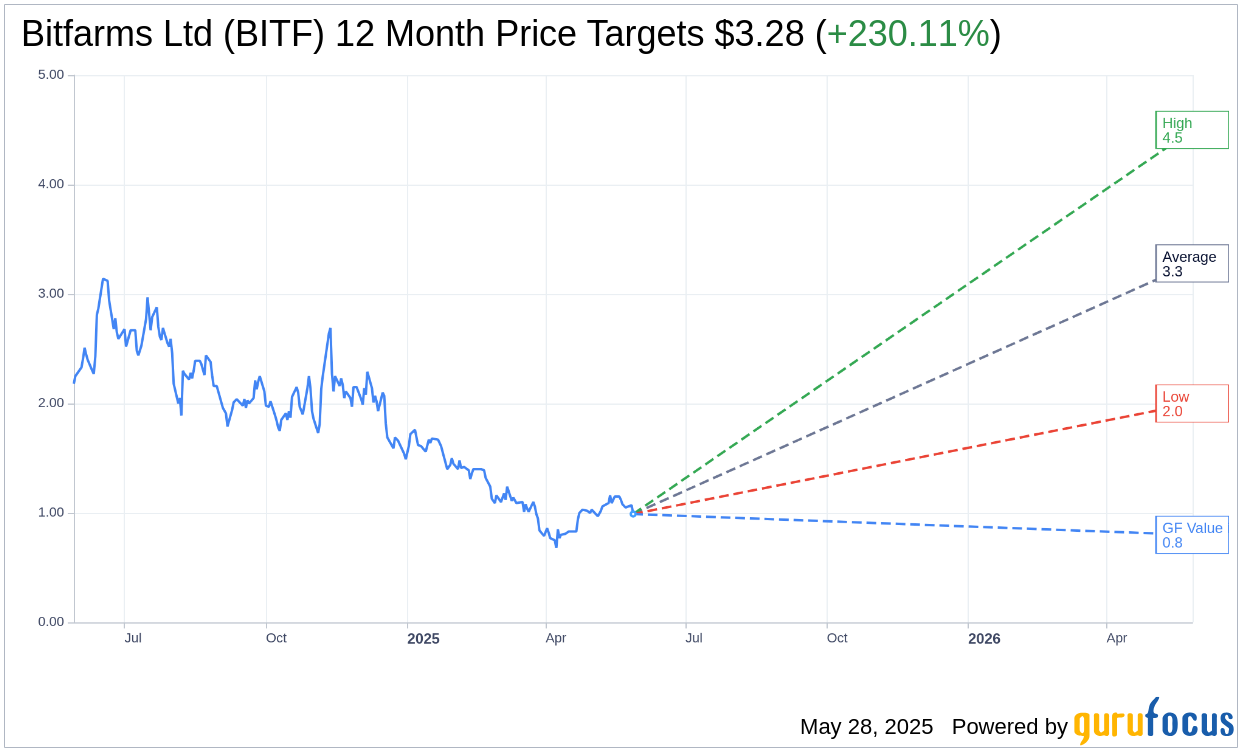

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Bitfarms Ltd (BITF, Financial) is $3.28 with a high estimate of $4.50 and a low estimate of $2.00. The average target implies an upside of 230.11% from the current price of $0.99. More detailed estimate data can be found on the Bitfarms Ltd (BITF) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Bitfarms Ltd's (BITF, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bitfarms Ltd (BITF, Financial) in one year is $0.80, suggesting a downside of 19.52% from the current price of $0.994. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bitfarms Ltd (BITF) Summary page.

BITF Key Business Developments

Release Date: May 14, 2025

- Revenue: $67 million, up 33% year over year.

- Bitcoin Mining Revenue: $65 million.

- Gross Mining Profit: $28 million, representing a 43% direct mining margin.

- Net Loss: $36 million or $0.07 per share.

- Adjusted EBITDA: $15 million or 23% of revenue.

- Direct Mining Cost per Bitcoin: $47,800.

- All-in Cash Cost to Mine a Bitcoin: $72,300.

- Revenue per Bitcoin Earned: $92,500.

- Profit per Bitcoin: Just over $20,000.

- Total Liquidity: Approximately $150 million as of May 13th.

- Projected Free Cash Flow from Mining Operations: About $8 million per month.

- Projected CapEx Needs for 2025: Under $100 million, excluding HPC and AI capital needs.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bitfarms Ltd (BITF, Financial) is strategically pivoting from solely Bitcoin mining to becoming a leading North American energy and compute infrastructure company, focusing on high-performance computing (HPC) and artificial intelligence (AI).

- The company has secured up to $300 million in financing from Macquarie Group to support the development of its Panther Creek campus, validating its HPC and AI development thesis.

- Bitfarms Ltd (BITF) has made significant progress in rebalancing its portfolio towards the United States, acquiring strategic energy campuses and power generation facilities in Pennsylvania.

- The company has completed a transformative fleet upgrade, improving its Bitcoin mining efficiency and reducing operating costs, with over 94% of its purchased miners now installed.

- Bitfarms Ltd (BITF) has a strong financial foundation with steady mining economics, no plans for additional large miner purchases, and minimal impact expected from potential tariffs.

Negative Points

- The company faces challenges in securing the necessary infrastructure and client commitments for its HPC and AI business, with ongoing development milestones required to access the full $300 million financing.

- Bitfarms Ltd (BITF) reported a net loss of $36 million for the first quarter, including $17 million in impairment charges related to its Argentine operation.

- The company has divested its Iguazu Paraguay Bitcoin mining site, which was misaligned with its new HPC and US-centric strategy, indicating a shift away from certain international operations.

- There is uncertainty regarding the timeline and costs associated with the development of the Panther Creek campus and other US sites, as the company is still finalizing its master site plans.

- Bitfarms Ltd (BITF) has decided to stop publishing monthly Bitcoin production reports, which may reduce transparency for investors focused on its Bitcoin mining operations.