On May 28, 2025, Oxford Industries (OXM, Financial) saw a significant development as Truist Securities initiated coverage on the stock. The analyst behind this move, Joseph Civello, set a "Hold" rating for the company. Additionally, Truist Securities announced a price target of $56.00 USD for OXM.

This initiation by Truist Securities marks the entry of the firm into analyzing Oxford Industries, setting a neutral outlook with the "Hold" recommendation. The absence of prior ratings or price targets for OXM by Truist Securities highlights the beginning of their evaluation.

The current price target of $56.00 USD does not reflect a percentage change as this is the initial target set by the analyst. Investors and market watchers may look to see how Oxford Industries' stock (OXM, Financial) aligns with this new analysis and rating in the coming months.

Wall Street Analysts Forecast

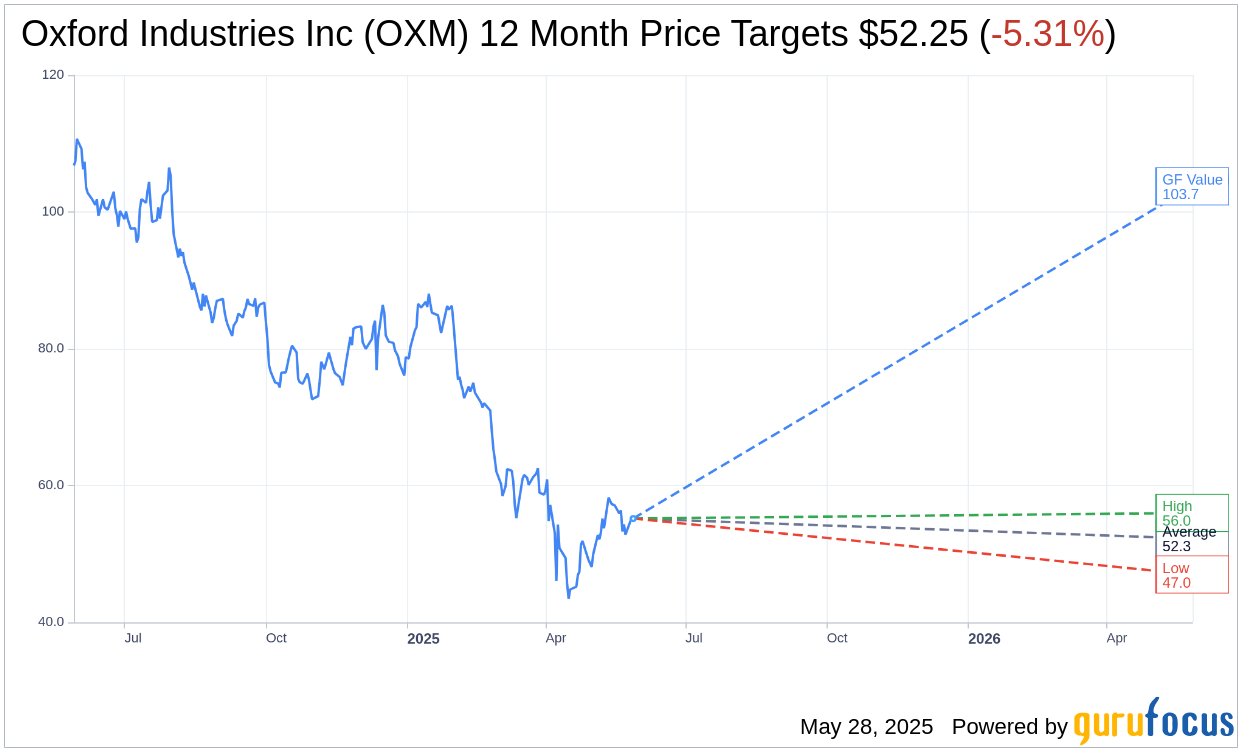

Based on the one-year price targets offered by 4 analysts, the average target price for Oxford Industries Inc (OXM, Financial) is $52.25 with a high estimate of $56.00 and a low estimate of $47.00. The average target implies an downside of 5.31% from the current price of $55.18. More detailed estimate data can be found on the Oxford Industries Inc (OXM) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Oxford Industries Inc's (OXM, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Oxford Industries Inc (OXM, Financial) in one year is $103.74, suggesting a upside of 88% from the current price of $55.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Oxford Industries Inc (OXM) Summary page.