Williams (WMB, Financial) is preparing to revisit its plans for the Constitution and Northeast Supply Enhancement pipelines following discussions between President Donald Trump and New York Governor Kathy Hochul. These pipelines aim to transport natural gas from Appalachian sites to the Northeast. Williams intends to submit the necessary permits to federal energy regulators, seeking to advance these previously stalled projects in New York, as reported by sources familiar with the situation.

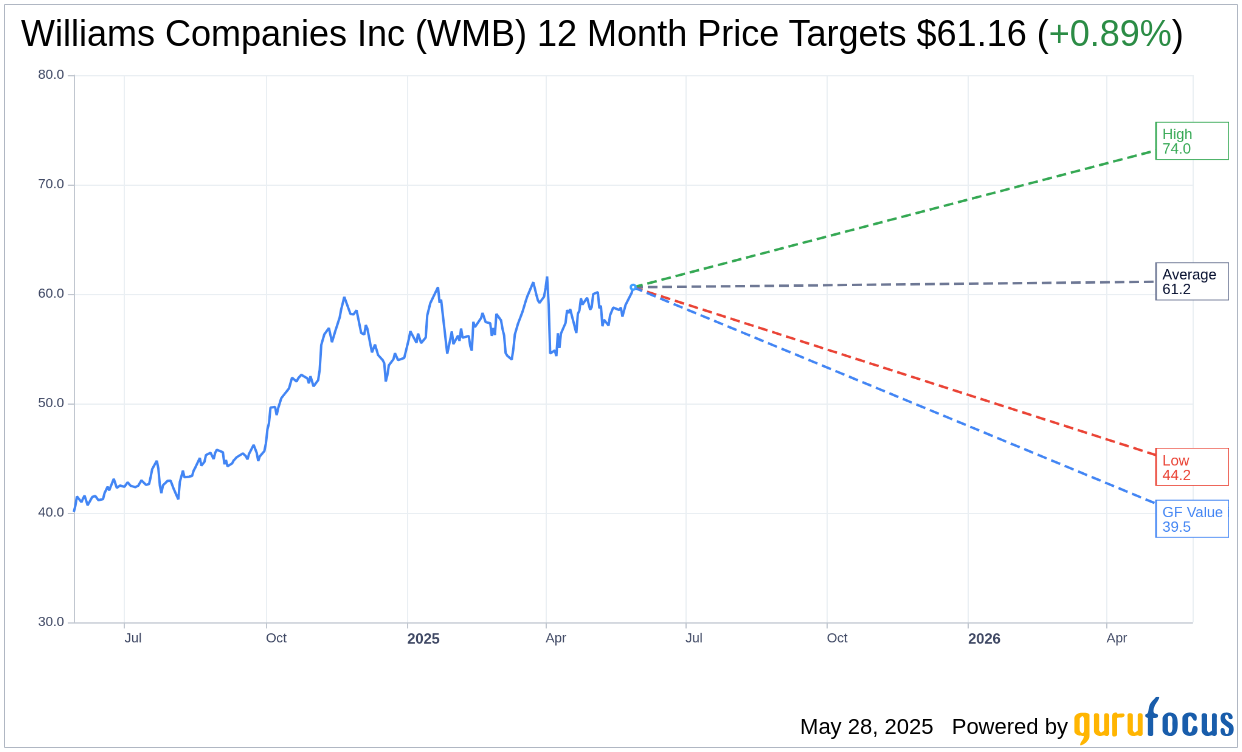

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Williams Companies Inc (WMB, Financial) is $61.16 with a high estimate of $74.00 and a low estimate of $44.21. The average target implies an upside of 0.89% from the current price of $60.62. More detailed estimate data can be found on the Williams Companies Inc (WMB) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Williams Companies Inc's (WMB, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Williams Companies Inc (WMB, Financial) in one year is $39.47, suggesting a downside of 34.89% from the current price of $60.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Williams Companies Inc (WMB) Summary page.

WMB Key Business Developments

Release Date: May 06, 2025

- Adjusted EBITDA: Increased by 3% to $1.989 billion for Q1 2025, up from $1.934 billion in Q1 2024.

- Revenue Growth: Transmission and Gulf business improved by $23 million or 3% due to higher revenues from expansion projects.

- CapEx: Increased by $925 million, reflecting the Socrates project update.

- Credit Rating: Upgraded to BBB+ by S&P, with a positive outlook from Moody's.

- Dividend Increase: Quarterly dividend increased by 5.3% to $0.50 per share.

- Guidance Update: Adjusted EBITDA guidance midpoint raised by $50 million to $7.7 billion for 2025.

- Segment Performance: Northeast G&P business improved by $10 million or 2%; West segment increased by $26 million or 8%.

- Sequent Marketing Business: Achieved $155 million in adjusted EBITDA, marking the third consecutive year exceeding $150 million in Q1.

- Project Developments: Completion of Whale and Ballymore projects in Deepwater, with Shenandoah and other projects expected to contribute in 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Williams Companies Inc (WMB, Financial) reported a 9% growth in the first quarter, driven by exceptional results within its base business.

- The company has fully contracted the Socrates project, which is expected to generate earnings consistent with a 5x EBITDA build multiple.

- Williams Companies Inc (WMB) is raising its adjusted EBITDA guidance midpoint by $50 million to $7.7 billion, reflecting strong base business performance.

- The company received an S&P credit rating upgrade to BBB+ and a positive outlook from Moody's, indicating financial strength.

- Williams Companies Inc (WMB) continues to deliver on high-return projects, with several expansions and new projects expected to accelerate earnings growth throughout the year.

Negative Points

- The Northeast G&P business was unfavorably impacted by the divestiture of Sable, affecting overall volumes.

- The West segment faced a step down in minimum volume commitments at Eagle Ford, impacting performance.

- The marketing business segment saw a decline of $34 million compared to 2024, despite a strong start to the year.

- The company faces challenges in the permitting process, which is exposed to litigation and obstructive environmental actions.

- There is uncertainty regarding the timing and execution of some deepwater projects, which could impact expected contributions.