On May 28, 2025, Salesforce Inc (CRM, Financial) released its 8-K filing for the first quarter of fiscal 2026, showcasing impressive financial results that exceeded analyst expectations. Salesforce, a leader in enterprise cloud computing solutions, reported a revenue of $9.8 billion, surpassing the estimated $9.749 billion. The company's earnings per share (EPS) also outperformed projections, reaching $1.59 compared to the estimated $1.53.

Company Overview

Salesforce Inc (CRM, Financial) is renowned for its customer relationship management (CRM) technology, which unites companies and customers through its Customer 360 platform. This platform integrates customer data across various systems, apps, and devices, enabling companies to enhance sales, service, marketing, and commerce operations. Salesforce also offers specialized solutions like Service Cloud, Marketing Cloud, Commerce Cloud, and the Salesforce Platform, along with data integration services through MuleSoft.

Performance and Challenges

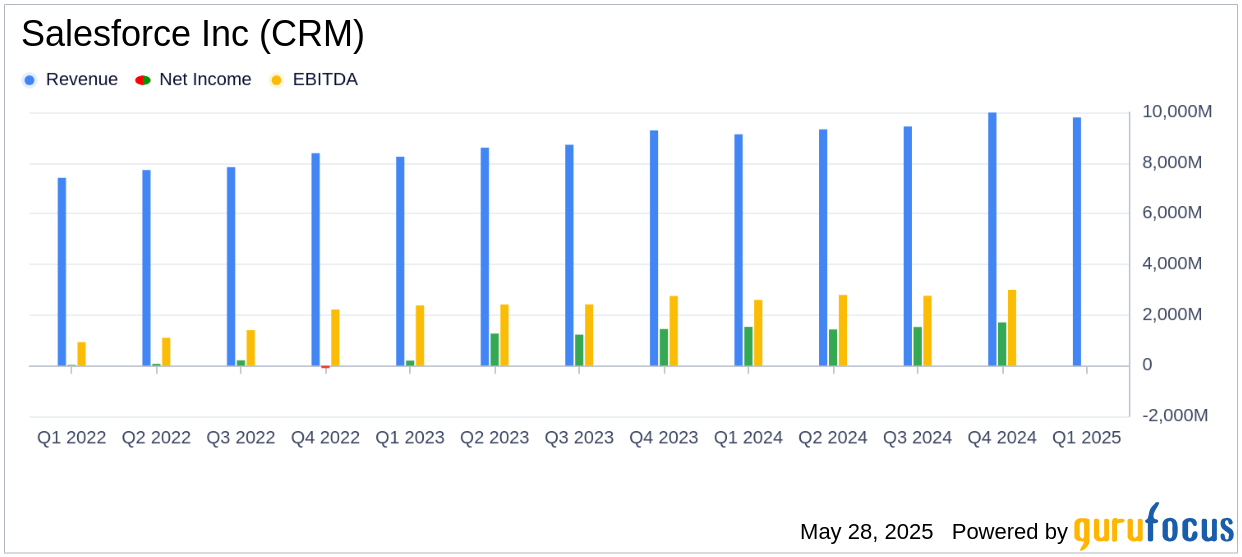

Salesforce's first quarter results reflect an 8% year-over-year increase in revenue, driven by robust subscription and support revenue, which also grew by 8% to $9.3 billion. The company's current remaining performance obligation (cRPO) rose by 12% year-over-year, indicating strong future revenue potential. However, challenges such as strategic investment losses, which amounted to $63 million, could pose risks to future profitability.

Financial Achievements

Salesforce achieved a GAAP operating margin of 19.8% and a non-GAAP operating margin of 32.3% for the quarter. Operating cash flow increased by 4% year-over-year to $6.5 billion, with free cash flow also rising by 4% to $6.3 billion. These metrics underscore Salesforce's operational efficiency and its ability to generate substantial cash flow, which is crucial for sustaining growth and shareholder returns in the competitive software industry.

Key Financial Metrics

Salesforce's income statement reveals a net income of $1.541 billion, slightly up from $1.533 billion in the previous year. The balance sheet highlights a strong cash position, enabling the company to return $3.1 billion to shareholders through share repurchases and dividends. The company's strategic focus on innovation and operational excellence is evident in its financial performance.

“We delivered strong Q1 results and are raising our guidance by $400 million to $41.3 billion at the high end of the range,” said Marc Benioff, Chair and CEO, Salesforce.

Analysis and Future Outlook

Salesforce's strategic initiatives, including the acquisition of Informatica, are expected to enhance its AI and data platform capabilities, positioning the company for sustained growth. The company's guidance for the second quarter of fiscal 2026 projects revenue between $10.11 billion and $10.16 billion, reflecting an 8% to 9% year-over-year increase. Salesforce's ability to capitalize on AI opportunities and its commitment to innovation are likely to drive future success.

Overall, Salesforce Inc (CRM, Financial) has demonstrated strong financial performance in the first quarter of fiscal 2026, exceeding analyst estimates and setting a positive trajectory for the remainder of the fiscal year. Investors and stakeholders will be keenly watching how the company's strategic acquisitions and AI advancements contribute to its long-term growth and market leadership.

Explore the complete 8-K earnings release (here) from Salesforce Inc for further details.