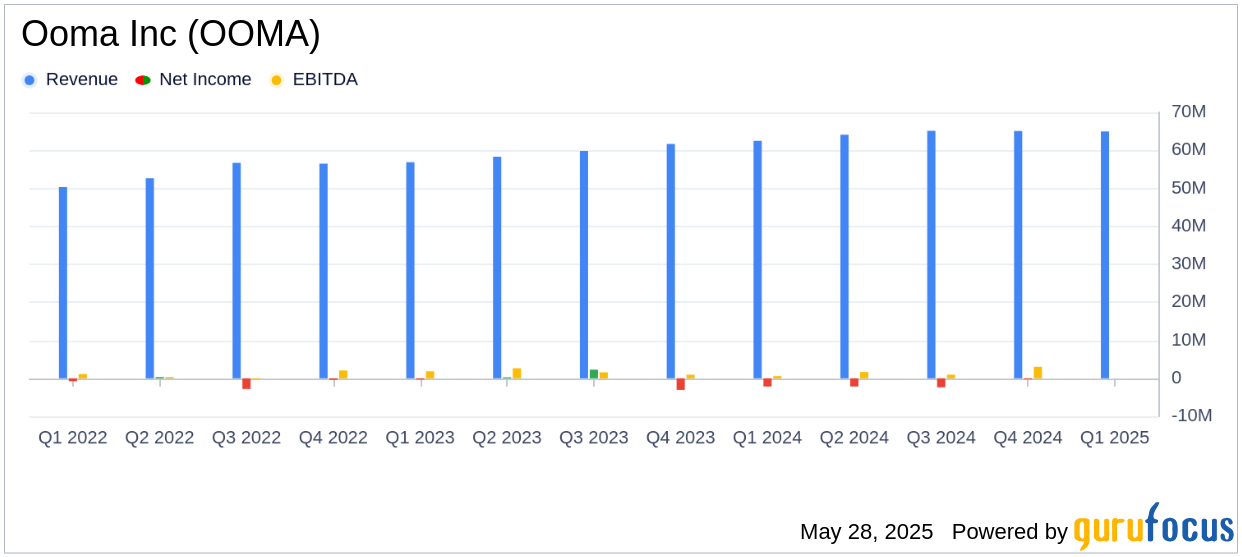

On May 28, 2025, Ooma Inc (OOMA, Financial), a communications services company, released its 8-K filing detailing the financial results for the fiscal first quarter ending April 30, 2025. The company reported a total revenue of $65.0 million, exceeding the analyst estimate of $64.82 million. This represents a 4% increase year-over-year, driven primarily by the growth of Ooma Business.

Company Overview

Ooma Inc is a smart software-as-a-service (SaaS) and unified communications platform provider, offering voice and collaboration features such as messaging, intelligent virtual attendants, video conferencing, and residential phone services. The company generates revenue through subscriptions and other services, leveraging a multi-tenant cloud service, on-premise devices, desktop and mobile applications, and calling platforms.

Financial Performance and Challenges

Ooma Inc reported a GAAP net loss of $0.1 million, or $0.01 per basic and diluted share, which aligns with the estimated earnings per share of -0.01. This is a significant improvement from the GAAP net loss of $2.1 million, or $0.08 per share, in the same quarter of the previous year. The non-GAAP net income was $5.6 million, or $0.20 per diluted share, surpassing the prior year's non-GAAP net income of $3.6 million, or $0.14 per share.

Key Financial Achievements

Ooma Inc's adjusted EBITDA increased to $6.7 million from $5.0 million in the first quarter of fiscal 2025, reflecting a 33% year-over-year growth. The company's focus on expanding its small business UCaaS, AirDial POTS replacement, and 2600Hz wholesale solutions contributed to these results. The addition of new partners and customer wins further strengthened its market position.

Income Statement Highlights

Subscription and services revenue rose to $60.3 million from $58.4 million in the previous year, accounting for 93% of total revenue. The gross profit increased to $40.2 million from $38.1 million, with a GAAP gross margin of 62% and a non-GAAP gross margin of 63%.

Balance Sheet and Cash Flow Insights

Ooma Inc's balance sheet shows total assets of $148.8 million, with cash and cash equivalents of $19.0 million. The company reported a net cash provided by operating activities of $3.7 million, an increase from $3.6 million in the previous year. This reflects effective management of operating assets and liabilities.

Commentary and Future Outlook

“Ooma delivered a solid Q1, with $65.0 million in revenue and $5.6 million of non-GAAP net income,” said Eric Stang, chief executive officer of Ooma. “Our results included 48% year over year growth of non-GAAP EPS and 33% year over year growth of adjusted EBITDA. We achieved these results while continuing to invest in and expand our small business UCaaS, AirDial POTS replacement, and 2600Hz wholesale solutions.”

Analysis and Conclusion

Ooma Inc's performance in the first quarter of fiscal 2026 demonstrates its ability to grow revenue and improve profitability despite challenges. The company's strategic investments in expanding its service offerings and strengthening partnerships have positioned it well for future growth. As Ooma continues to focus on its core business operations and explore new opportunities, it remains a company to watch in the communications services industry.

Explore the complete 8-K earnings release (here) from Ooma Inc for further details.