On May 28, 2025, C3.ai Inc (AI, Financial) released its 8-K filing detailing its financial results for the fiscal fourth quarter and full fiscal year ended April 30, 2025. C3.ai Inc, an enterprise artificial intelligence company, provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. The company operates through three divisions: The C3 AI Platform, C3 AI Applications, and C3 Generative AI, serving various regions including North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

Quarterly and Annual Financial Performance

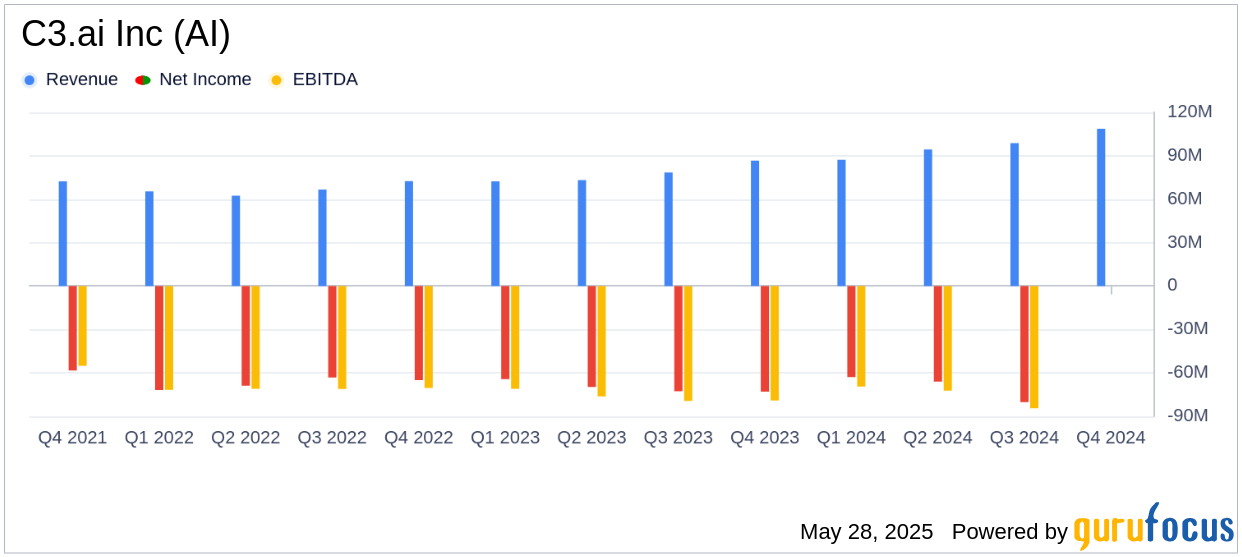

C3.ai Inc reported a total revenue of $108.7 million for the fourth quarter, marking a 26% increase from $86.6 million in the same period last year. This figure exceeded the analyst estimate of $107.73 million. The company's subscription revenue for the quarter was $87.3 million, up 9% from $79.9 million a year ago, constituting 80% of the total revenue. The combined subscription and prioritized engineering services revenue reached $104.4 million, a 22% increase from the previous year, representing 96% of the total revenue.

For the full fiscal year 2025, C3.ai Inc achieved a total revenue of $389.1 million, a 25% increase from $310.6 million in the prior year. Subscription revenue for the year was $327.6 million, an 18% rise from $278.1 million, making up 84% of the total revenue. The company's gross profit for the year was $235.9 million, with a gross margin of 61% on a GAAP basis and 70% on a non-GAAP basis.

Financial Metrics and Challenges

The GAAP net loss per share for the fourth quarter was $(0.60), which is better than the estimated loss of $(0.70) per share. On a non-GAAP basis, the net loss per share was $(0.16). For the full year, the GAAP net loss per share was $(2.24), compared to the estimated loss of $(2.34) per share, while the non-GAAP net loss per share was $(0.41).

Despite the positive revenue growth, C3.ai Inc faces challenges with its operating expenses, which totaled $156.5 million for the quarter, up from $133.9 million in the previous year. The company reported a loss from operations of $(88.9) million for the quarter and $(324.4) million for the full year, highlighting the need for continued focus on cost management.

Strategic Partnerships and Business Expansion

C3.ai Inc continues to strengthen its strategic alliances, renewing and expanding its partnership with Baker Hughes through June 2028. The company also established and expanded alliances with major players like Microsoft, AWS, Google Cloud, and McKinsey QuantumBlack. These partnerships are crucial for broadening market reach and fueling growth, as evidenced by the 68% year-over-year increase in agreements closed through the partner network.

This was a momentum-building year for C3 AI, achieving 25% revenue growth year-over-year. We delivered breakthrough innovations in agentic AI and dramatically expanded our strategic alliances," said Thomas M. Siebel, Chairman and CEO of C3 AI.

Income Statement and Balance Sheet Highlights

The company's gross profit for the fourth quarter was $67.5 million, representing a 62% gross margin on a GAAP basis and a 69% margin on a non-GAAP basis. C3.ai Inc's cash balance, including cash equivalents and marketable securities, stood at $742.7 million at the end of the fiscal year.

| Metric | Q4 2025 | FY 2025 |

|---|---|---|

| Total Revenue | $108.7 million | $389.1 million |

| Subscription Revenue | $87.3 million | $327.6 million |

| Gross Profit (GAAP) | $67.5 million | $235.9 million |

| Net Loss per Share (GAAP) | $(0.60) | $(2.24) |

Analysis and Outlook

C3.ai Inc's strong revenue growth and strategic partnerships position the company well in the competitive AI landscape. However, the ongoing net losses and high operating expenses indicate challenges that need to be addressed to achieve profitability. The company's focus on expanding its partner ecosystem and enhancing its AI offerings, such as C3 Generative AI, is expected to drive future growth and market penetration.

As C3.ai Inc enters fiscal year 2026, the company aims to penetrate new accounts, expand into new verticals, and leverage its alliances to solidify its technological leadership in the AI industry. The financial outlook for the first quarter of fiscal 2026 projects total revenue between $100.0 million and $109.0 million, with a non-GAAP loss from operations ranging from $(23.5) million to $(33.5) million.

Explore the complete 8-K earnings release (here) from C3.ai Inc for further details.