During a virtual gathering on May 27, shareholders of Customers Bancorp (CUBI, Financial), the parent company of Customers Bank, one of the leading digital-forward banks in the U.S., voted on several important matters. The meeting resulted in the election of three directors to the board.

Additionally, the shareholders ratified the appointment of Deloitte & Touche LLP to serve as the independent registered public accounting firm for the fiscal year ending on December 31, 2025. They also expressed their approval for the company's executive compensation in a nonbinding "say on pay" proposal. These decisions reflect continued support for the bank's strategic direction and management team.

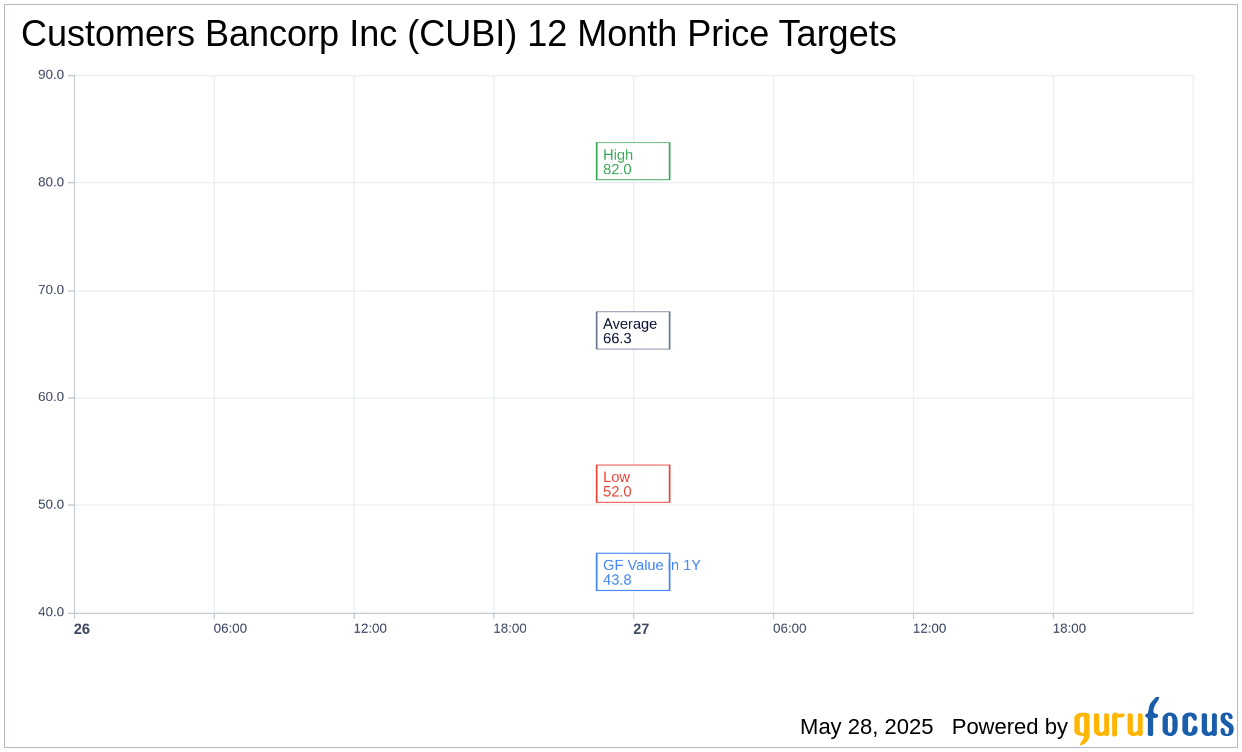

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Customers Bancorp Inc (CUBI, Financial) is $66.25 with a high estimate of $82.00 and a low estimate of $52.00. The average target implies an upside of 29.57% from the current price of $51.13. More detailed estimate data can be found on the Customers Bancorp Inc (CUBI) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Customers Bancorp Inc's (CUBI, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Customers Bancorp Inc (CUBI, Financial) in one year is $43.80, suggesting a downside of 14.34% from the current price of $51.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Customers Bancorp Inc (CUBI) Summary page.

CUBI Key Business Developments

Release Date: April 25, 2025

- Revenue Growth: 15% annual growth rate over the last five years.

- Core Earnings Per Share (EPS): $1.54 for Q1 2025.

- Net Income: $50 million for Q1 2025.

- Net Interest Income: $167.4 million for Q1 2025.

- Net Interest Margin: Increased to 3.13%, up 2 basis points sequentially.

- Loan Growth: 12% annualized pace in Q1 2025.

- Deposit Growth: Total deposits increased to just under $19 billion.

- Average Cost of Deposits: Reduced by 25 basis points in Q1 2025.

- Non-Interest Bearing Deposits: $5.6 billion, nearly 30% of total deposits.

- Core Return on Common Equity (ROCE): 11.7% for Q1 2025.

- Return on Assets (ROA): 97 basis points for Q1 2025.

- Core Efficiency Ratio: Improved to 52.7%.

- Tangible Book Value Per Share: $54.74, up more than $5.50 year over year.

- Common Equity Tier 1 (CET1) Ratio: 11.7%.

- Total Capital Ratio (TCO): Increased to 7.7%.

- Non-Performing Assets (NPA) Ratio: 26 basis points.

- Reserves to Non-Performing Loans (NPLs): 324%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Customers Bancorp Inc (CUBI, Financial) reported strong core performance across its franchise, with significant low-cost granular deposit growth and a 25 basis point reduction in average deposit costs.

- The company achieved a 12% annualized loan growth rate, driven by selective onboarding of credits and leveraging long-standing relationships.

- Net interest margin increased by 2 basis points due to reduced interest expenses, marking the second consecutive quarter of margin expansion.

- Operational excellence initiatives surpassed targets, realizing $30 million in annualized impact, exceeding the original $20 million target.

- Capital and liquidity metrics remain robust, with CET1 at 11.7% and a TCO ratio of 7.7%, providing substantial flexibility for organic growth.

Negative Points

- The macroeconomic landscape remains complex and volatile, posing challenges for the banking industry.

- Despite strong performance, there is uncertainty in the rate trajectory, which could impact net interest income expansion.

- The company undertook a balance sheet optimization process, indicating potential concerns about credit-sensitive securities.

- There is ongoing pressure to maintain low-cost deposits amidst market volatility and competition.

- The company faces challenges in sustaining its high growth rates in deposits and loans, given the evolving economic conditions.