Supernus Pharmaceuticals, known by its ticker SUPN, recently disclosed that it has received Paragraph IV Notice Letters indicating that certain third parties have filed abbreviated new drug applications for generic versions of its viloxazine extended-release capsules, available in 100, 150, and 200 mg dosages. In response, Supernus is rigorously assessing these notices and plans to firmly defend its intellectual property associated with its drug, Qelbree.

Qelbree is currently protected by six U.S. patents registered in the FDA’s Orange Book, with three patents expiring in September 2029, two in February 2033, and another in April 2035. Supernus is committed to maintaining its market position and ensuring that its proprietary rights are upheld against these generic threats.

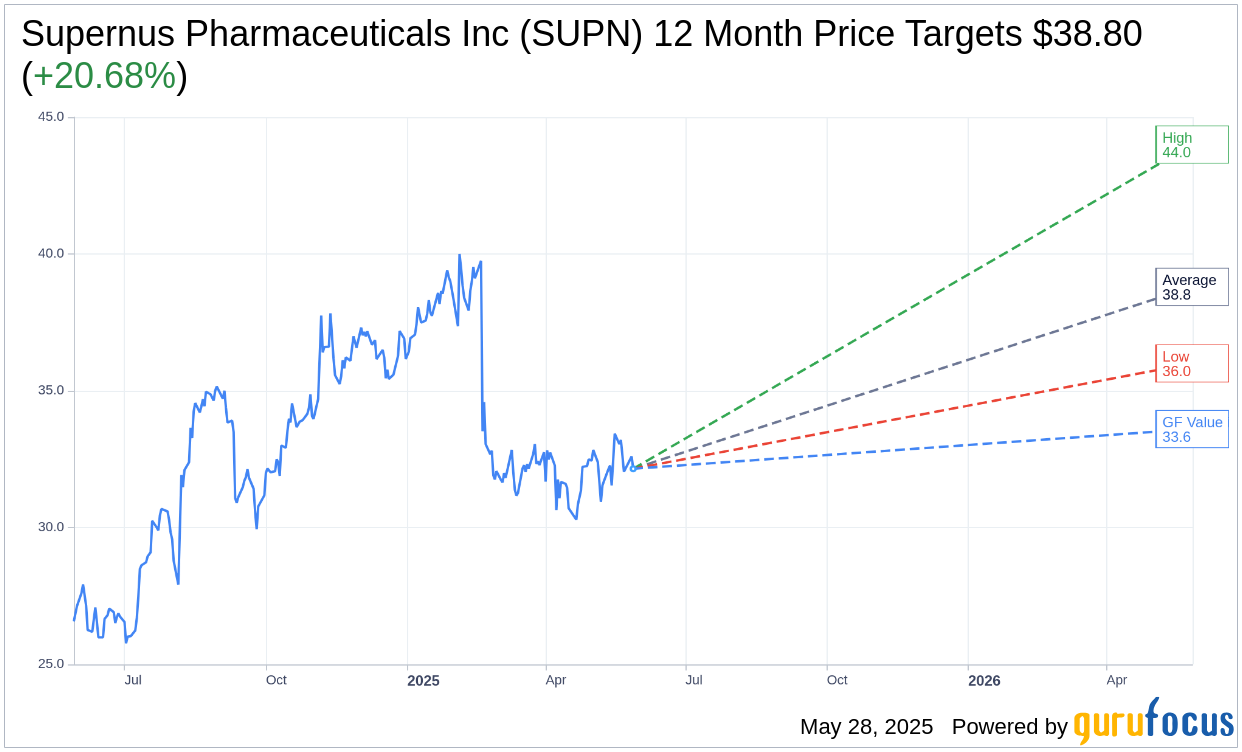

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Supernus Pharmaceuticals Inc (SUPN, Financial) is $38.80 with a high estimate of $44.00 and a low estimate of $36.00. The average target implies an upside of 20.68% from the current price of $32.15. More detailed estimate data can be found on the Supernus Pharmaceuticals Inc (SUPN) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Supernus Pharmaceuticals Inc's (SUPN, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Supernus Pharmaceuticals Inc (SUPN, Financial) in one year is $33.60, suggesting a upside of 4.51% from the current price of $32.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Supernus Pharmaceuticals Inc (SUPN) Summary page.

SUPN Key Business Developments

Release Date: May 06, 2025

- Total Revenue: $149.8 million in Q1 2025, up from $143.6 million in Q1 2024.

- Net Product Sales: $142 million in Q1 2025.

- Royalty Revenues: $7.8 million in Q1 2025.

- Revenue Growth Excluding Trokendi XR and Oxtellar XR: 26% increase in Q1 2025 compared to Q1 2024.

- Qelbree Net Sales Growth: 44% increase in Q1 2025.

- GOCOVRI Medicare Co-pay Reduction: 42% decline in Q1 2025 compared to Q1 2024.

- Combined R&D and SG&A Expenses: $116.9 million in Q1 2025, up from $111.4 million in Q1 2024.

- GAAP Operating Loss: $10.3 million in Q1 2025, compared to $3.2 million in Q1 2024.

- GAAP Net Loss: $11.8 million in Q1 2025, or $0.21 loss per diluted share.

- Adjusted Operating Earnings: $25.9 million in Q1 2025, up from $22.3 million in Q1 2024.

- Cash, Cash Equivalents, and Marketable Securities: $463.6 million as of March 31, 2025.

- 2025 Revenue Guidance: $600 million to $630 million.

- 2025 Combined R&D and SG&A Expenses Guidance: $435 million to $460 million.

- 2025 GAAP Operating Earnings Guidance: Loss of $15 million to earnings of $10 million.

- 2025 Non-GAAP Operating Earnings Guidance: $105 million to $130 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Supernus Pharmaceuticals Inc (SUPN, Financial) reported a 26% increase in total revenues excluding Trokendi XR and Oxtellar XR, driven by strong performance from Qelbree and GOCOVRI.

- Qelbree prescriptions grew by 22% and net sales increased by 44% in the first quarter, with a record high of 75,277 monthly prescriptions in March.

- The launch of ONAPGO, a new growth product for Parkinson's disease, has shown encouraging initial responses from physicians.

- Supernus Pharmaceuticals Inc (SUPN) has a strong balance sheet with $463.6 million in cash, cash equivalents, and marketable securities, providing financial flexibility for potential M&A opportunities.

- The company is advancing its CNS pipeline with plans to initiate a Phase 2b trial for SPN-820 in major depressive disorders, indicating a commitment to R&D and future growth.

Negative Points

- Combined net sales of legacy products Trokendi XR and Oxtellar XR were down 46% in the first quarter, with further erosion expected throughout 2025.

- The company reported a GAAP net loss of $11.8 million for the first quarter of 2025, compared to net earnings in the prior year quarter.

- Operating loss on a GAAP basis increased to $10.3 million, primarily due to higher contingent consideration loss.

- The Medicare Inflation Reduction Act has led to increased mandatory Medicare manufacturer payments, which could impact financial performance despite increased prescriptions.

- Potential import tariffs on products manufactured in Europe or Canada could affect MYOBLOC, XADAGO, or Osmolex ER, introducing uncertainty in cost management.