Key Highlights:

- Synopsys (SNPS, Financial) shares dropped 11% due to U.S. commerce restrictions on China.

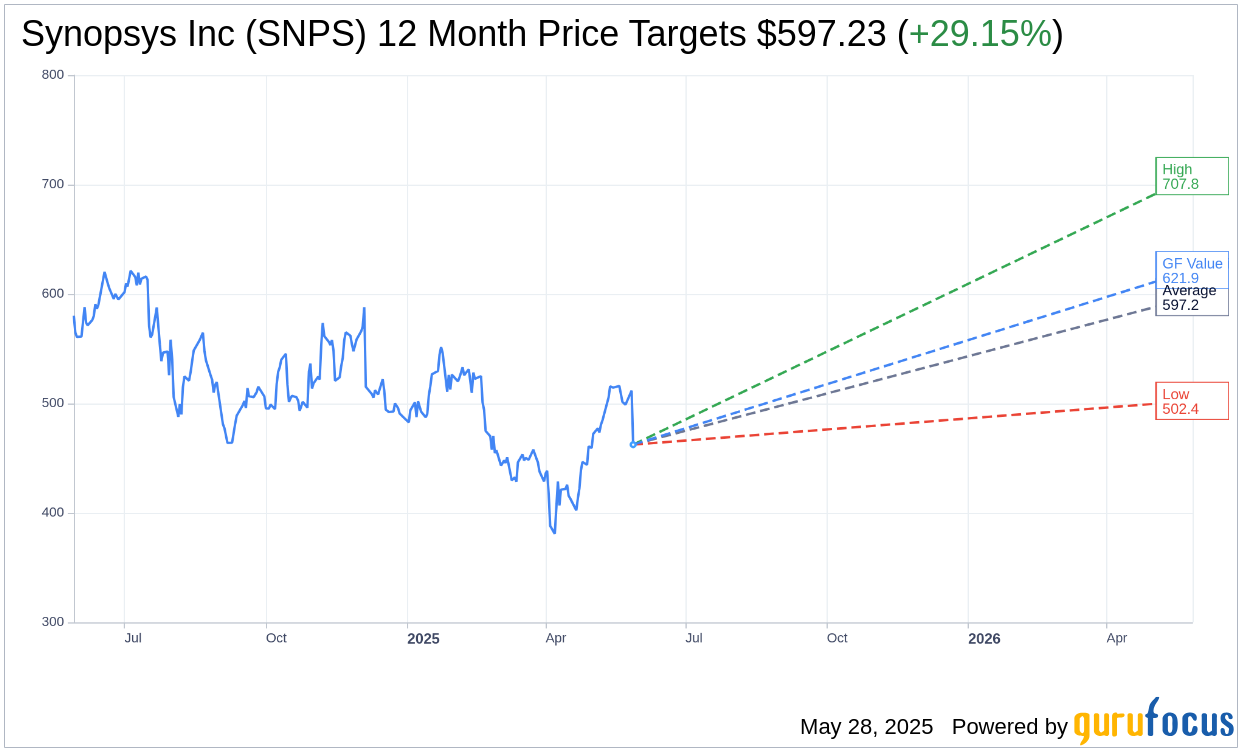

- Analysts predict a potential upside of 29.15% for Synopsys with an average price target of $597.23.

- Consensus recommendation for Synopsys stands at "Outperform" with a GF Value suggesting a 34.47% potential gain.

Impact of U.S. Commerce Restrictions on Synopsys

Synopsys Inc. (SNPS) experienced a sharp decline of 11% in its share price following an announcement from the U.S. Department of Commerce. The directive mandates that electronic design automation companies cease the sale of chipmaking technologies to China. This regulatory move aims to restrict China's progression in the semiconductor sector and has similarly affected prominent firms like Cadence and Ansys.

Analyst Price Predictions for Synopsys

In light of current market conditions, 20 analysts have provided a one-year price forecast for Synopsys. The average target stands at $597.23, with predicted highs of $707.78 and lows of $502.41. This forecast suggests a significant potential upside of 29.15% from the current trading price of $462.43. For more insights, visit the Synopsys Inc (SNPS, Financial) Forecast page.

Brokerage Recommendations and GF Value Insights

Reflecting on the latest brokerage analyses, Synopsys holds a favorable average recommendation score of 1.9, correlating to an "Outperform" status. This rating is based on a scale from 1 (Strong Buy) to 5 (Sell).

Moreover, GuruFocus' GF Value calculation estimates that Synopsys’ fair value in one year should be approximately $621.85. This suggests a compelling upside potential of 34.47% from the current stock price of $462.43. The GF Value metric assesses the stock’s worth based on historical trading multiples and the anticipated business growth trajectory. For further details, please visit the Synopsys Inc (SNPS, Financial) Summary page.