Summary:

- Salesforce's earnings and revenue beat market expectations, showcasing its industry strength.

- Analysts predict a substantial potential upside for Salesforce shares.

- GuruFocus estimates indicate Salesforce is trading below its fair value.

Salesforce (CRM, Financial), a leader in customer relationship management, has once again demonstrated its strong market position. The company reported non-GAAP earnings per share of $2.58, surpassing analyst expectations by $0.03. Additionally, Salesforce's revenue reached an impressive $9.83 billion, exceeding forecasts by $80 million. These robust financial results continue to reinforce Salesforce's dominant position in the tech industry.

Wall Street's Projection for Salesforce

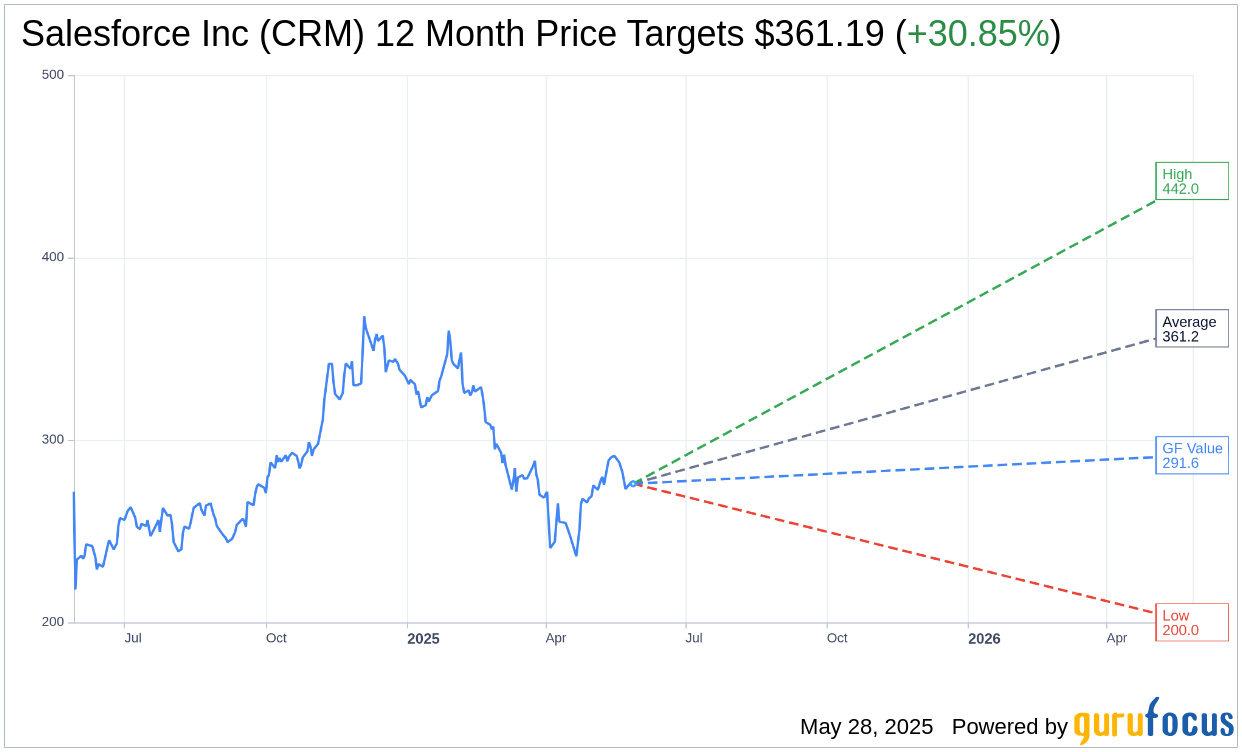

Wall Street analysts remain bullish on Salesforce Inc (CRM, Financial), with 48 analysts offering a one-year price target that averages $361.19. This includes a high estimate of $442.00 and a low estimate of $200.00. The average target suggests a notable upside of 30.85% from its current trading price of $276.03. Detailed analyst estimates can be explored further on the Salesforce Inc (CRM) Forecast page.

The consensus among 54 brokerage firms places Salesforce Inc (CRM, Financial) in the "Outperform" category, with an average brokerage recommendation of 2.0 on a scale where 1 signals a Strong Buy and 5 indicates a Sell.

GuruFocus Valuation Insights

According to GuruFocus estimates, Salesforce Inc's (CRM, Financial) GF Value over the next year is projected to be $291.64. This suggests a potential upside of 5.66% from its current price of $276.03. The GF Value is a proprietary measure reflecting the fair value a stock should trade at, derived from historical trading multiples, past business growth, and future performance projections. Investors looking to dive deeper into Salesforce's valuation data can find extensive information on the Salesforce Inc (CRM) Summary page.