Key Highlights:

- Synopsys (SNPS, Financial) surpasses earnings expectations with second-quarter non-GAAP EPS of $3.67.

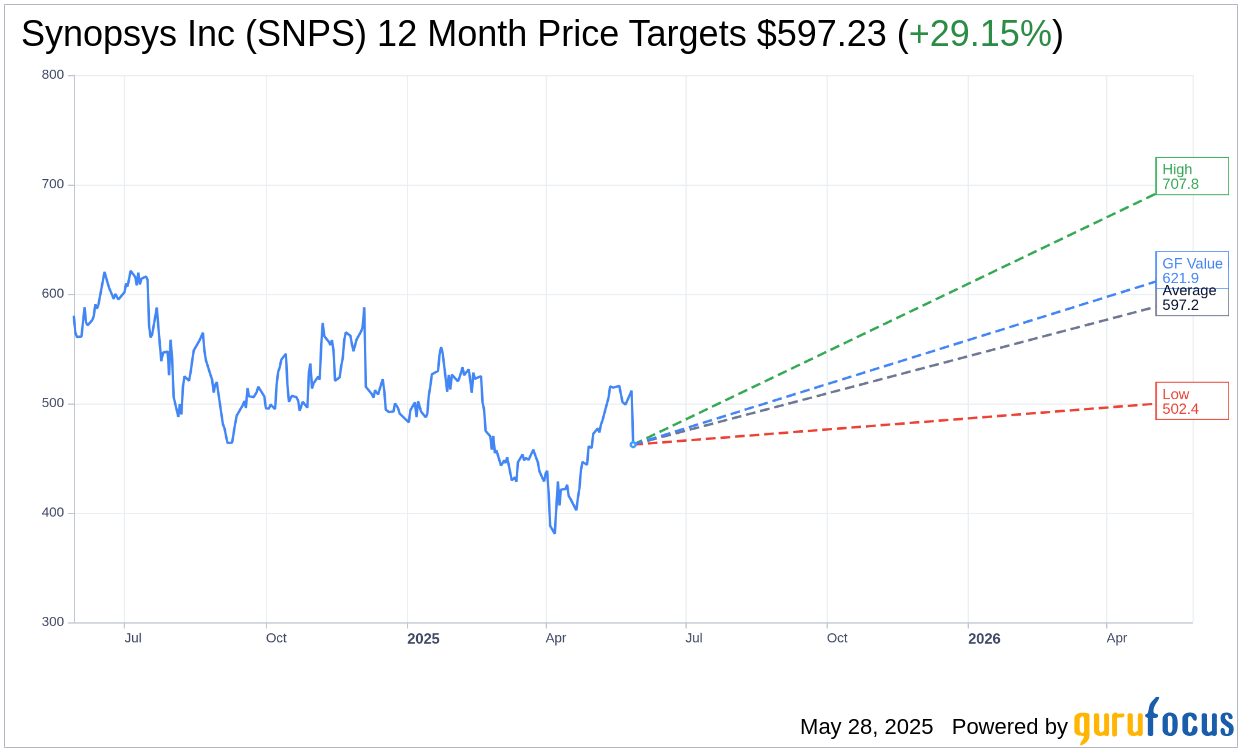

- Analysts project a significant upside potential for SNPS, with price targets averaging $597.23.

- The GF Value estimate reflects a 34.47% upside potential, affirming the stock's growth trajectory.

Synopsys' Stellar Quarter Performance

Synopsys Inc. (SNPS) has exceeded market expectations with its impressive second-quarter results, posting a non-GAAP earnings per share of $3.67, surpassing analysts' consensus estimates by $0.27. The company reported a robust 10.3% increase in year-over-year revenue, reaching $1.6 billion. As Synopsys looks ahead, it maintains solid guidance for fiscal year 2025, with non-GAAP EPS targets set between $15.11 and $15.19.

Analyst Predictions on Synopsys' Growth

Wall Street analysts remain bullish on Synopsys Inc (SNPS, Financial), providing an average one-year price target of $597.23. Their forecasts range from a high of $707.78 to a low of $502.41, suggesting an enticing 29.15% upside from the current trading price of $462.43. For more comprehensive price estimate data, visit the Synopsys Inc (SNPS) Forecast page.

The consensus from 21 brokerage firms assigns Synopsys Inc (SNPS, Financial) an average brokerage recommendation of 1.9, reflecting an "Outperform" status. It's worth noting that the rating scale ranges from 1 to 5, where 1 represents a Strong Buy, while 5 indicates a Sell.

Valuation Insights from GuruFocus

According to GuruFocus estimates, the anticipated GF Value for Synopsys Inc (SNPS, Financial) in one year stands at $621.85, projecting a 34.47% upside from the current price of $462.43. The GF Value represents GuruFocus' assessment of what the stock should ideally trade at, leveraging historical trading multiples, past growth, and forecasts of future business performance. For a more detailed analysis, explore the Synopsys Inc (SNPS) Summary page.